European Rail Cargo Operators Reporting 100% Plus Increases For 2020 Belt and Road Freight

Reports carried by Rail Freight indicate that 2020 was a banner year for cargo travelling the Belt and Road railways between Europe and Asia.

Austria’s Rail Cargo Group (RCG) has stated it transported 70,000 TEUs across the Belt and Road routes during 2020, and compared to 2019, it doubled its Eurasian volumes. Additionally, it reached an all-time high number of over 700 trains running on these routes, This year, the company aims to have 1,000 freight trains running on Eurasian tracks.

RCG has been active on the Belt and Road Initiative since 2008. It experienced the first increase of trips by the end of 2016, while in 2017, the company officially entered the Chinese market. Back then, RCG operated only 62 trains with a transport capacity of 3,000 TEUs per year across Eurasia. Demand became higher with time, and until 2020 the company was transporting 35,000 TEUs every year.

“There can be no doubt that the New Silk Road initiative is of enormous importance for Europe as well as for Austria, as it connects the European and Asian economies”, said Austrian Federal Railways CEO Andreas Matthä. Through its European network, RCG also provides opportunities to local customers to gain more visibility and “get out of the crisis”.

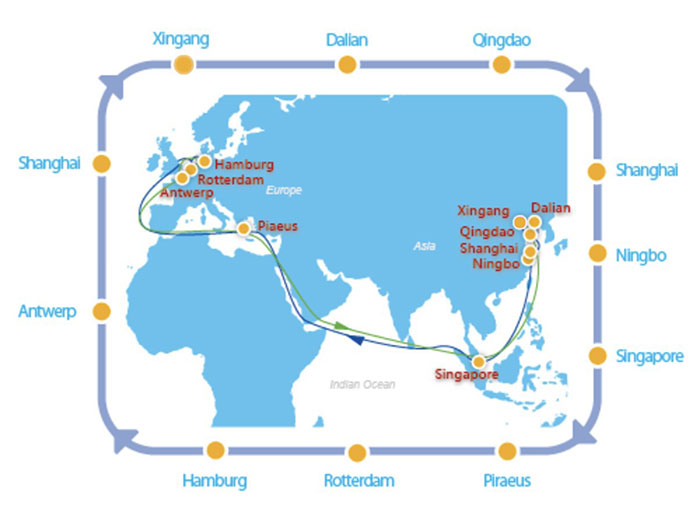

However, for RCG, having access to ports that are part of the Maritime Belt and Road is equally important to a train connection. “We see a wide field of activity along the Belt and Road. Not only along the three rail corridors between Europe and Asia but also as a carrier to the European ports where the maritime Silk Road docks – such as Hamburg, Rotterdam, Trieste, Koper and Piraeus, among others. This is where freight companies like RCG can contribute with its efficient hinterland connections”, added Matthä.

Rail freight operators also contribute to Eurasian transport by providing connectivity between port and hinterland hubs. Quick and efficient cargo distribution is much needed and sometimes more critical than a long train trip between China and Europe. Especially for Mediterranean ports like Piraeus, Koper or Trieste with access to Suez, setting up train services towards central and northern Europe is beneficial for customers and rail companies that see high volumes.

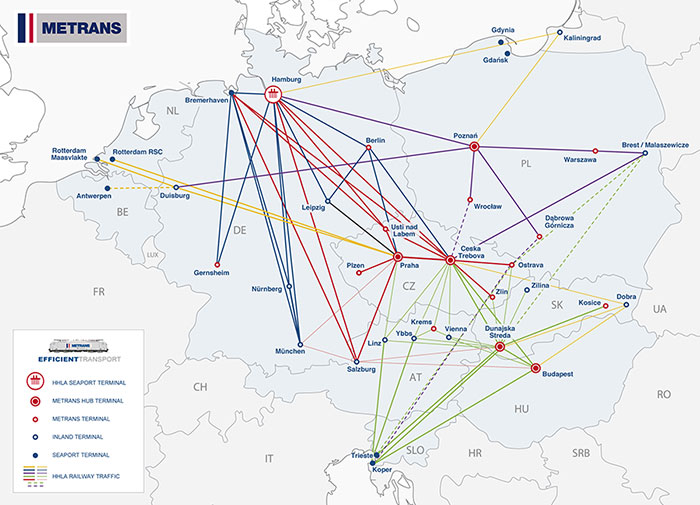

Metrans, one of the main EU intermodal operators along the Belt and Road Initiative has also been able to reap the benefits of this positive trend. Transport volumes of the company along the BRI are about 30,000 TEU’s, with the company operating 913 trains in 2020, in both directions. In comparison, it operated 426 trains in 2019, indicating an increase of 114%. Metrans Westbound traffic to Europe accounted for the largest growth at 131%.

Each month, Metrans operates 60 to 80 trains between China and Europe. Together with partners, it assembles the block trains in Chinese hubs such as Zhengzhou, Xi’an and Jinhua. The trains are then taken over by traction operators at the various hubs of the Eurasian rail corridor. These hubs are the Polish border terminal Malaszewicze (near the Belarusian city of Brest) and the Slovakian terminal in Dobra (near the Ukrainian border). The containers are then distributed throughout the entire Metrans network. The key hubs for the rail cargo flows between Europe and China by Metrans are its hub terminals in Budapest, Prague, Ceska Trebova, Poznań and Dunajska Streda.

These new figures mean that EU-China rail freight volumes are growing at rates of about 100% per annum for the past two years – resulting in what we have identified as 44 key emerging logistics and business hubs throughout the EU.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com