Could the Pitcairn Islands Become the New Asia-Pacific Hong Kong?

Pitcairn Island

Op/Ed by Chris Devonshire-Ellis

The United Kingdom has put into place a mechanism to join the Comprehensive & Progressive Trans-Pacific Partnership (CPTPP) in a Free Trade Agreement. The CPTPP currently includes Australia, Canada, Japan, New Zealand, Brunei, Chile, Malaysia, Mexico, Peru, Singapore, and Vietnam, and is seen as an Asian-Pacific bloc.

The UK’s ability to claim membership of such a trade body comes from two sources – the recognition of the CPTPP members that it may be advantageous for them to have a trade agreement with a non-Asian state, and the UK’s claim to be an Asia-Pacific nation through sovereignty of the Pitcairn Islands, a small, four island group sited some 5,500km east from New Zealand.

The Pitcairn Islands were famously colonised by nine British mutineers from HMS Bounty, and a handful of Tahitian natives in 1790. Their descendants live on, and the Islands have had the status of a British colony since 1838. Today, some 43 islanders inhabit Pitcairn, which comprises some 47 km2.

The British claim to be an Asia-Pacific nation is tenuous, but nonetheless there. What is interesting is the combination of British trade needs in the Asia-Pacific, which among the CPTPP nations accounted for 8.4% of British exports in 2019, and Britain’s history and experience of further developing this. Most notably, Hong Kong Island became a British possession in 1842. With a land mass when occupied by the British of some 70km2, Pitcairn Island is 67% the size of Hong Kong Island – more than enough to turn into an Asia-Pacific financial and offshore hub, and with the benefit of no large neighbours nearby wanting to take it back again. Pitcairn is 15,000 km distant from China.

Hong Kong in the 1840’s when the British first arrived had a population of some 6,000, rather larger than contemporary Pitcairn’s 43. But today, Hong Kong Island is home to about 1.3 million, meaning that Pitcairn given its size could support about 870,000 people. That means now, as then that a process of repatriation could take place, bringing in the required talents to develop Pitcairn as an Asia-Pacific regional trade and services hub. Some with Hong Kong backgrounds may wish to relocate.

Infrastructure would need to be put into place, such as an international airport, as currently Pitcairn is served by just one supply ship weekly from French Polynesia. However British engineers and contractors already have experience of building the Chep Lak Kok airport on Hong Kong’s Lantau Island, partially using reclaimed land so this should not be an issue. Pitcairn’s capital, Adamstown, would greatly benefit from an MTR system with links to the Islands main bays and possibly connecting underground with the three other islands in the group, Henderson, Ducie and Oeno. Doing so would undoubtedly spur regional development with advantages in land prices and accessibility, not to mention assist with tourism development – the Islands are regarded as being spectacular in their beauty.

Pitcairn also has an exclusive economic zone extending 370km offshore with an area of 880,000 km2. Manganese, iron, copper, gold, silver, and zinc have been discovered, while the seas are rich in lobster and a wide variety of fish such as Nanwee, White fish, Moi, and Opapa can be caught in shallow water. Snapper, Big eye, and Cod are caught in deep water, and Yellow tail and Wahoo are caught by trawling.

Onshore, Pitcairn is fertile and produces a wide variety of fruits including bananas, papaya, pineapples, mangoes, watermelons, passion fruit, breadfruit, coconuts, avocados, and several varieties of citrus. Vegetable production includes sweet potato, carrots, sweet corn, tomatoes, yams, peas, and beans, while sugarcane is also grown meaning there is potential for a Rum distillery. Pitcairn Island is remarkably productive, and its benign climate supports a wide range of tropical and temperate crops.

It would understandably be a major task to transform what is essentially an agricultural and fishing community into a world class financial centre, however again, this is exactly what happened with Hong Kong.

The need for an Asia-Pacific offshore financial centre is undoubtedly there. Should the UK join the CPTPP, the effective GDP of the Free Trade bloc would be some US$14.25 trillion. Singapore would be the financial centre for the bloc’s Asian trade, with Mexico, a trillion-dollar economy, the South American hub. Pitcairn as a financial services centre would consolidate both, offering tax haven and reinvest facilities.

There are other advantages. As a British Overseas Territory, Pitcairn is governed by the British legal system, with ultimate jurisdiction the High Court in London. The Queen is the Head of State. Pitcairn is a tax-free zone, with no income or corporate taxes, or VAT. Pitcairn registered businesses therefore can park earnings there without additional duties, while the local Government also has a free land scheme in place for expatriates and businesses wishing to relocate, in addition to free residency. There are caveats however, immigrants to Pitcairn are required to have at least US$22,000 savings and build their own house at an average cost of US$100,000.

Wages are low, with a current per capita income of about US$2,667.

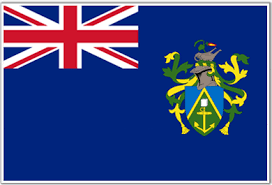

Pitcairn Islands Flag

Applicants interested in Pitcairn and developing it as a new ‘Hong Kong’ for the Asia-Pacific are advised to contact the Pitcairn Government development agency here.

Related Reading

About Us

This article is factual however is also intended as a tongue-in-cheek response to the UK’s claims to be an Ásia-Pacific nation. However, Queen Victoria was once reportedly ”amused” to be told she was sovereign of a small island in the South China Sea.