Inbound FDI into China from BRI Countries Rises 58.2% How and Why Did This Happen?

Op/Ed by Chris Devonshire-Ellis

- Increase of inbound FDI the result of numerous State policies

- FDI relaxations, improved market access and tax structures all having an impact

- China on track to be the world’s largest consumer market by 2025

China’s Belt and Road Initiative is paying dividends for China inbound investment, with a rise of 58.2% of actual (not projected) Foreign Investment into the country coming from Belt and Road Initiative signatory nations in Q1 this year. China received a total of US$46.7 billion of FDI during the first three months of the year, according to the Ministry of Commerce. China has now supplanted the United States as the world’s largest recipient of FDI.

Why Invest in China? Why Now?

There are reasons for this. To go hand in hand with the Belt & Road Initiative, China has been extremely active in putting into place a variety of trade agreements with nations part of its BRI. I explained this in my new (complimentary) book ”Identifying Opportunities Within the Belt & Road Initiative”. (Download here)

Bilateral Investment Treaties

These include Bilateral Investment Treaties (BIT) that provide legal security and protection mechanisms for businesses in one country or region to invest in the other. The China-EU CAI is an example, although that now looks in some jeopardy. BIT however provide a regulatory assurance, especially for investors from emerging nations with relatively immature tax laws and regulatory environments. Such treaties also help to underpin the bilateral investment conditions between China and other developed nations.

BIT agreements as a rule of thumb provide a useful mechanism for understanding the legal, tax and dispute resolution mechanisms for investors into the country. As such, BITs are a useful starting point to clarify legal and tax treatments under bilaterally agreed conditions and should be understood as a bilateral document of first resort when understanding the investment environment, and protection mechanisms that China offers its many trading partners. These tend to be of particular importance for understanding the rights of companies investing from or into emerging markets throughout Asia, Africa, Latin America, and the Middle East.

China has 107 BITs in force, with another 17 under negotiation, while Hong Kong has an additional 20.

Double Tax Treaties (DTA)

DTAs are mostly of a bilateral nature and, while DTA-signing countries are not all members of the Organization for Economic Cooperation and Development (OECD), DTAs are generally based on model conventions developed by the OECD or (less commonly) the United Nations. And while about 75 percent of the actual words of any given DTA are identical with the words of any other DTA, the applicability and specific provisions of each treaty can vary substantially.

From an investor’s perspective, confusion about international taxation can arise when investors are subject to two different and potentially conflicting tax systems. For example, Hong Kong and Singapore adopt a “territorial source” principle of taxation, which means that only profits sourced locally are taxable. Meanwhile, other countries such as China and the United States are on the worldwide tax system, and resident enterprises can be required to pay tax on income sourced both inside and outside of the country. DTAs not only provide certainty to investors regarding their potential tax liabilities, but also act as a tool to create tax-efficient international investments.

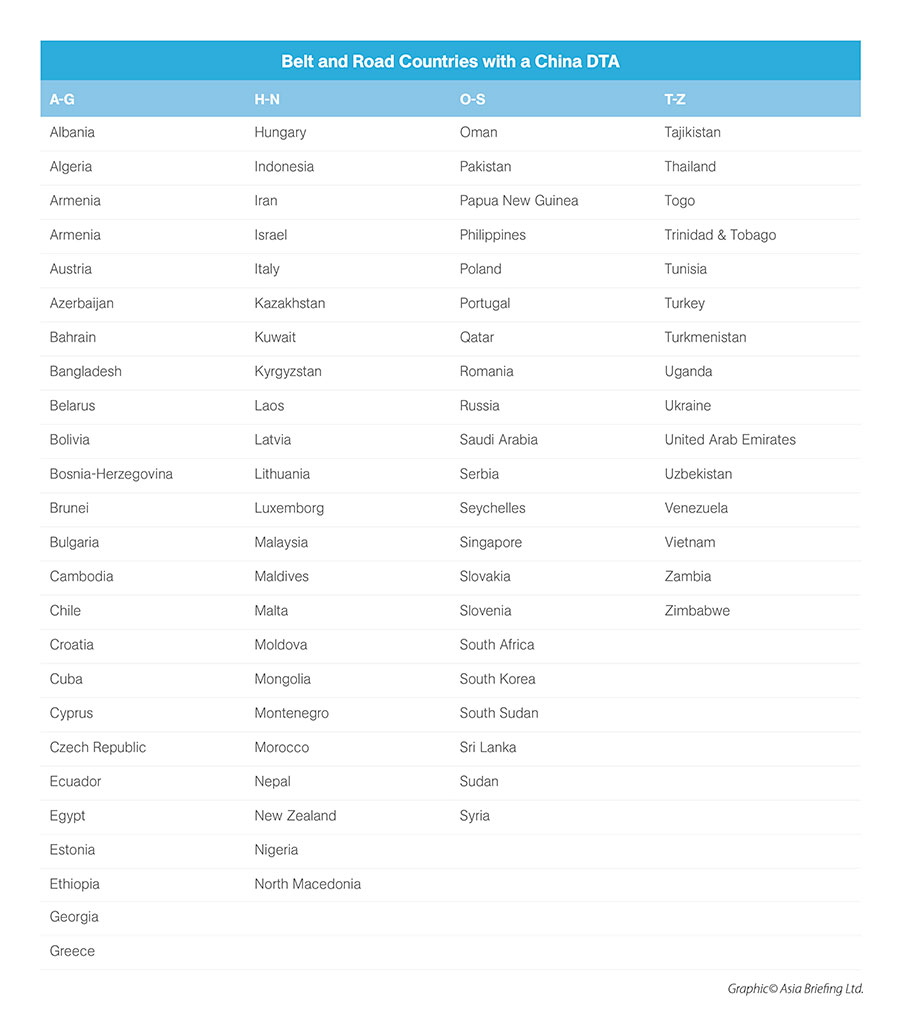

China has signed of DTA with 84 countries along its Belt & Road Initiative as follows:

Free Trade Agreements

China has developed a strategic position when it comes to entering into free trade agreements – the policy of allowing dutiable and tax reduction on certain products and services being one of the main cornerstones that has projected the nation to be the world’s manufacturing hub over more recent years.

Without doubt, the signing of the China-ASEAN FTA, followed by the recent RCEP agreement, will continue to have a huge impact on China, its development in global sourcing and the foreign investment related to this.

China also has a Free Trade Agreement with Switzerland, which as a result has become one of the few European nations not to have a China trade surplus. In total, China has signed off FTAs impacting 26 countries or regions countries (including the 10 ASEAN nations), has another 13 under negotiation, and a further eight under consideration.

Beneficial Changes to China’s Foreign Investment Law

China also relaxed its foreign investment laws at the end of 2019, including two primary concessions:

- Government officials are prohibited from using administrative means to force foreign businesses to transfer their technology.

- Foreign investors enjoy equal treatment and market access with domestic counterparts in China, except in excluded sectors specified in the government’s negative list.

At the same time, China also introduced changes to its patent laws, enhancing security for foreign investors. We wrote about these changes here.

Relaxation of China’s Foreign Investment Negative List

China relaxed restrictions within its foreign investment ‘negative list’ and opened additional market sectors to foreign investment at the end of last year. China had also introduced relaxations at the end of 2019. These include improved market access and investment in sectors such as oil and gas, resource management, and trading and financial services.

The most recent version list decreased off limits sectors by 18 percent and is less than half of the 328 items that were included in the Negative List in 2016. We identified these newly opened sectors here.

The Dual Circulation Strategy

China’s dual circulation strategy was adopted as State development policy in mid 2020 and was introduced at the May 2020 meeting of the Politburo. It seeks to spur China’s domestic demand on one hand and simultaneously develop conditions to facilitate foreign investment and boost production for exports on the other.

This two-pronged strategy refers to the parallel emphasis on an ‘internal circulation’ and an ‘international circulation’ and a shift towards becoming a demand and innovation-driven economy.

While on its own merit, the DCS is not an inwards-looking strategy, the focus on tapping into China’s internal consumption patterns and domestic markets aims to buffer the impact of global economic headwinds and unpredictable external events on China’s economic and financial stability. The strategy is also, in more simpler terms, a culmination of China’s intentions to become more self-reliant as well as increase its export market exposure. We discussed the implications of the DCS and the impact on foreign investment into China in this article.

Summary

Having been advising foreign investors in China for nearly 30 years, I have to say that the current FDI environment in China is the best it has ever been. That has now been verified by the extraordinary overall leap of FDI into the country: increases of 58% from China’s Belt and Road partners, and a 60% increase from businesses in ASEAN.

However, much of the Western media has commented on the negative aspects of China and of investing in the country. Incoming FDI from the EU during Q1 increased by just 7%. Political negativity is impacting on opportunity. A political de-coupling by the West is occurring. Time will tell how much of a mistake or not this is.

That said, the large variety of policies – many of which are designed to shift the Chinese economy from an export manufacturing to a consumer economy should be of profound interest to foreign investors, regardless of where they come from. China’s relaxation of its market sectors permitting foreign investment are not determined by nationality.

China has also been extremely active and successful in its development of a variety of free trade, double tax, and investment treaties, all designed to spur trade growth. Western nations who are not signatories to these are also diminishing the ability of their own domestic companies to export to China. Q1 2021 data also showed that China’s imports rose by 38% – the strategies are working. In fact, China is poised to become the world’s largest importer and consumer market around 2025 – which is why those inbound FDI figures are the size they are.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com