Whose Funding Who? And Where? The Belt And Road Nations Sending & Receiving The Most Money From Overseas

Op/Ed by Chris Devonshire-Ellis

Compare the Market have just released a report on which nations send the most money overseas in the form of personal money transfers. It’s big business – amounting to hundreds of billions of dollars per annum.

Whether they’re supporting family in another country, paying an international worker or investing overseas, many people around the globe rely on money transfers or remittances to send and receive money. In terms of the Belt & Road Initiative, the nations that sent the highest amount of funds through money transfers and the nations that received personal remittances in 2019, based on World Bank sending and receiving data are as follows.

The Generous Benefactors: Who Sent The Most Money?

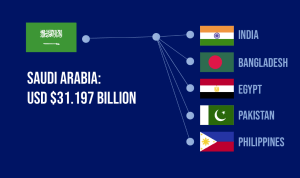

1) Saudi Arabia

Saudi Arabia sends the second-largest amount of money transfers worldwide after the United States and were the largest global financier among the Belt & Road nations.

In 2019, Saudi Arabia sent USD $31.197 billion. The biggest receivers of transfers from Saudi Arabia in 2018 were:

India: USD $11.668 billion

Egypt: USD $6.376 billion

Pakistan: USD $5.123 billion

It’s relatively cheap to send money out of Saudi Arabia compared to other countries around the world. For example, recent World Bank data shows it would cost an average of 5.5%, while it can be higher than 27% for other countries such as Angola. Saudi Arabia has recently increased market competitiveness around money transfers, has made it safer for people to send and receive money and has implemented new technologies around transfers.

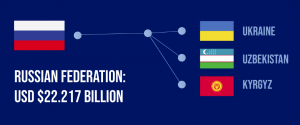

2) Russia

Russia transfers the second largest amount of money overseas from the BRI nations, and the fifth-highest amount of money worldwide, sending USD $22.217 billion in 2019. In 2018, Russia sent the most money to nations within its immediate proximity, including:

Ukraine: USD $7.870 billion

Uzbekistan: USD $2.801 billion

Kyrgyzstan: USD $2.002 billion

When it comes to sending money overseas, Russia has some of the lowest money transfer rates in the world. The average cost is only 1.7%, opposed to the worldwide average of 6.8%.

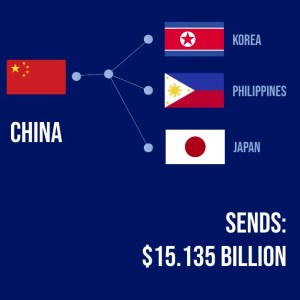

3) China

China is only in third place in terms of sending personal remittances among BRI nations, and the sixth-highest sender of funds globally (USD $15.135 billion) in 2019. It tends to send smaller amounts but to many recipient countries, reflecting the size and spread of the Chinese diaspora.

In 2018, Chinese nationals sent the most money to:

North Korea: USD $597 million

Philippines: USD $567 million

Japan: USD $273 million

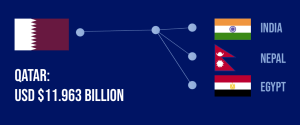

4) Qatar

Sending a total of USD $11.963 billion overseas in 2019, Qatar was the fourth largest financier among the BRI nations and is the 10th highest sender of funds in the world. According to the latest data from the World Bank, Qatar sends the most money to:

India: USD $4.341 billion

Nepal: USD $2.227 billion

Egypt: USD $1.472 billion

The nation’s cost to transfer money internationally is 5.3%, compared to the global average of 6.8%. This may make it easier for people to invest in overseas projects or simply transfer money overseas.

The Grateful Recipients – Who Received The Most Money?

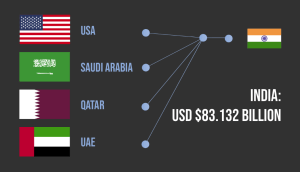

1) India

India is not a Belt & Road Initiative nation but is heavily involved in regional infrastructure that links to it and is included to provide a more complete regional overview. In 2019, India received a total of USD $83.132 billion in money transfers, making it the world’s highest receiver of money transfers. While many countries send money to India, recent World Bank data shows the most of it came from:

United Arab Emirates: USD $18.529 billion

United States: USD $12.737 billion

Saudi Arabia: USD $11.668 billion

The World Bank predicts that South Asian countries will experience an average 22.1% drop in money transfers due to COVID-19, meaning India’s flow could reduce by USD $18.37 billion.

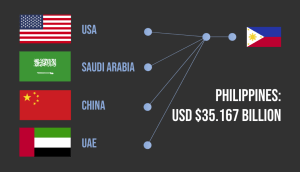

2) The Philippines

The Philippines is the third highest receiver of funds through money transfers in the world and was sent USD $35.167 billion in 2019 alone. The biggest sender of money to the Philippines were:

United States: USD $11.426 billion

Saudi Arabia: USD $3.273 billion

United Arab Emirates: USD $3.230 billion

The region is predicted to be hit with a 13% reduction in money transfers due to the COVID-19 pandemic, meaning the Philippines could see their 2020 inbound funds slashed by USD $4.57 billion.

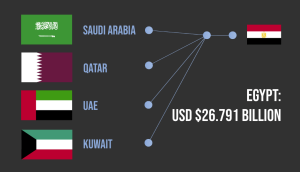

3) Egypt

Egypt received USD $26.791 billion worth of money transfers in 2019, making it the fourth highest receiver of money globally. World Bank data shows that in 2018, the most significant senders of funds to Egypt were:

United Arab Emirates: USD $6.680 billion

Saudi Arabia: USD $6.376 billion

Kuwait: USD $3.369 billion

The World Bank is anticipating a 19.6% drop in money transfers to Egypt’s world region due to COVID-19, which could see funds coming into the country reduced by USD $5.251 billion.

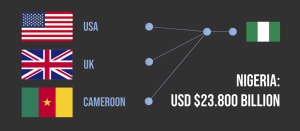

4) Nigeria

Nigeria received the four highest amount of inbound money transfers among BRI nations and the sixth-highest amount of global money transfers in 2019 with around USD $23.8 billion coming into the country. Recent World Bank data shows the biggest senders to Nigeria in 2018 were:

United States: USD $7.275 billion

United Kingdom: USD $3.865 billion

Cameroon: USD $1.571 billion

The World Bank predicts Sub-Saharan Africa will see a 23.1% reduction of money transfers into the region, which could see Nigeria’s 2020 received funds slashed by USD $5.497 billion. A large decline in money transfers to Sub-Saharan African countries like Nigeria is expected due to migrants living in countries such as China, the US and countries in the EU being impacted by the COVID-19 pandemic.

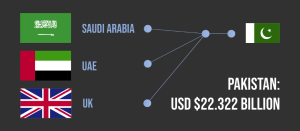

5) Pakistan

Pakistan received USD $22.322 billion through money transfers in 2019, making it the seventh-largest receiver of money transfers in the world and fifth largest BRI recipient. 2018 data from the World Bank shows that the countries that send the most money to Pakistan include:

United Arab Emirates: USD $5.663 billion

Saudi Arabia: USD $5.123 billion

United Kingdom: USD $1.882 billion

South Asian countries are predicted to see a 22.1% drop in received money transfers due to COVID-19, which could see Pakistan’s annual inflows of money transfers reduced by USD $4.933 billion.

The COVID-19 pandemic is impacting key sending countries such as the United States and United Kingdom – which is expected to contribute to this significant drop in money transfers.

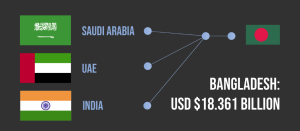

6) Bangladesh

Bangladesh received USD $18.361 billion through money transfers in 2019, making it the eighth highest recipient of money transfers globally and sixth in terms of the BRI. 2018 data from the World Bank shows that the following countries send the most money to Bangladesh:

India: USD $4.593 billion

Saudi Arabia: USD $2.707 billion

United Arab Emirates: USD $2.732 billion

With South Asian countries predicted to see a 22.1% decline in incoming transfers due to COVID-19,7 Bangladesh’s 2020 total may reduce by USD $4.057 billion. It costs less in money transfer fees to send money to South Asian countries such as Bangladesh, which could be why it receives a high volume of money transfers.

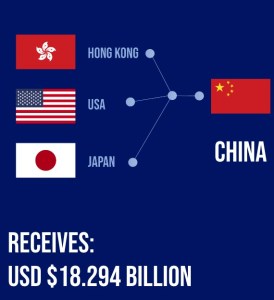

7) China

China was the seventh highest recipient of money transfers (USD $18.294 billion). In 2019, China received the highest number of money transfers from:

Hong Kong: USD $16.340 billion

United States: USD $14.252 billion

Japan: USD $4.872 billion

Due to COVID-19, the World Bank predicts China will receive USD $2.378 billion less in 2020, which reflects a 13% decline anticipated for the Eastern Asia region.

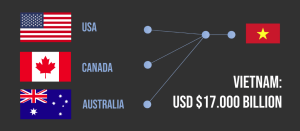

8) Vietnam

Rounding out the top 10 recipients of global money transfers, and eighth amongst BRI nations is Vietnam. The nation received USD $17 billion in 2019. World Bank data from 2018 shows that these countries send Vietnam the most money through money transfers:

United States: USD $8.333 billion

Australia: USD $1.421 billion

Canada: USD $1.136 billion

Vietnam is expected to see a 13% reduction in money transferred due to COVID-19, with its 2020 total projected to reduce by USD $2.21 billion.

Why do people send money overseas?

Money for family back home

According to the United States Congressional Budget Office, it’s common for migrants to regularly send money to their home country through banks, by sending it directly to family members, or by making financial investments in their birth country. For example, the top three countries that receive the United States’ top money transfers are Mexico, China and India.

The USA has high migration numbers from these countries, with US Homeland Security data showing that the most lawful permanent residents are from Mexico and China, while India ranks as the sixth-highest.

Meanwhile, in India, which received the highest amount of transfers worldwide, close to 60% of money transfers are intended to help family directly. In contrast, just over eight per cent of money transfers are for investment purposes.

The payment of wages

Money transferred between countries is also used to pay employees who once carried out work in a particular country. The World Bank states that personal remittances paid can include payments to employees who worked seasonally or for a short period before returning home. This is especially true of countries such as Qatar, where preparations for the upcoming World Cup soccer finals have seen a large number of Pakistani workers receive their wages back in Pakistan rather than being paid onsite in Qatar. China’s massive army of overseas workers by contrast tend to be paid back in China directly by their Chinese employer, with just a small stipend paid locally from amounts often loaned by China in the first place. Consequently Chinese remittances are far lower from overseas than the size of the actual labor force would suggest.

Meanwhile, the Congressional Budget Office in the US believes many people return to their home country but retain bank accounts and other financial assets in the US. They then continue to transfer funds from their US accounts to other nations around the world. This is especially true of expatriates or even naturalised US citizens who continue to remit money back to their relatives in India, Russia and so on.

The impact of COVID-19 on money transfers

The World Bank predicts that the COVID-19 pandemic will hugely impact the world’s money transfer habits, with the largest decline in recent history anticipated. The impact will be felt differently across the globe. For example, money transfers to Europe and Central Asia are anticipating drops of around 28%. On average, they’re expected to drop by an average of 20% due to the economic crisis and loss of wages caused by shutdown procedures around the world.

Many developing nations rely on money transfers for healthcare, food, education and other basic necessities and a sharp drop could significantly impact these countries.

The complete Compare the Market report can be viewed here.

Related Reading

- Obtaining Chinese Funding For International Development Projects

- 84% Of China’s BRI Investments Are In Medium-High Risk Countries

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com