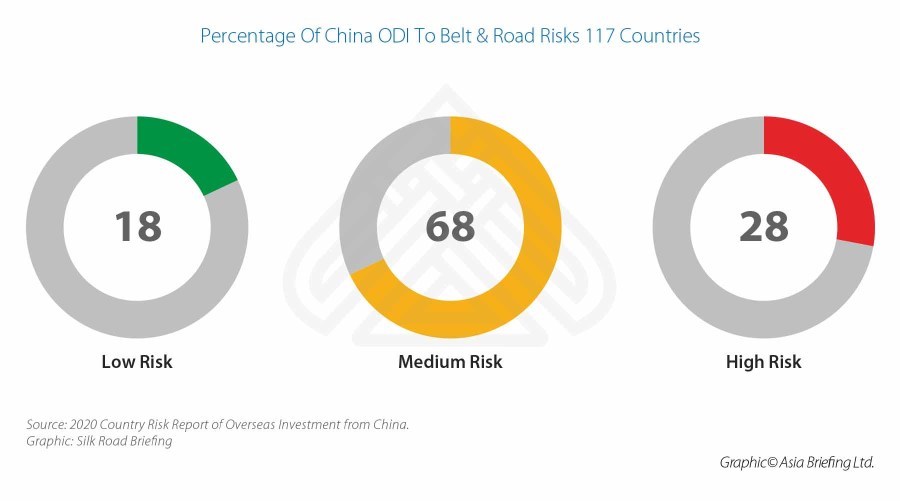

84% Of China’s BRI Investments Are In Medium-High Risk Countries

Op/Ed by Chris Devonshire-Ellis

The 2020 Report of Country Risk of Overseas Investment from China has just been released by the Chinese Academy of Sciences, and provides a useful breakdown of how Chinese Overseas Direct Investment has been diversifying, mainly to Belt & Road Initiative partners. That is a continuing trend we first spotted back in 2013 when I remember numerous Wall Street businesses, law firms and analysts were expecting Chinese money to shore up creaking American infrastructure and invest in the USA. It didn’t happen, just as we showed, and Washington remains peeved about that today in its continual Belt & Road Initiative criticism.

Last year, China’s non-financial direct investment into countries and regions involved in the Belt and Road Initiative reached US$15.04 billion, accounting for 13.6 percent of the total investment, while the brick-and-mortar projects were worth US$154.89 billion, accounting for 59.5 percent of the total, says the report. In terms of the investment risk, among advanced economies, the investment risk in the US, Canada, Australia, EU and the UK increased in 2020 compared to 2019. That is the impact of political, commercial and changing trade dynamics as well as the spread of Covid-19.

In contrast, Singapore maintained a low investment risk profile and also attracted the largest amount of investment from China.

Concerning emerging economies, China classifies these are relatively higher risk than in the advanced economies, but the emerging economies remain the most promising destination for China’s overseas investment. Furthermore, the average investment risk in the countries and regions involved in the Belt and Road Initiative is lower than in the overall risk.

Since 2019, intensifying trade conflict and increasingly tense geopolitical environments have created uncertainty for international direct investment and international cooperation, while the COVID-19 pandemic is leaving many countries facing crises of public health and supporting infrastructure, their domestic economy, external demand, commodity prices and capital flow.

Although some countries have implemented supportive fiscal policies, and put in place monetary policies to ease financial market tensions, moderate risk will continue to dominate the Chinese economic outlook according to Wang Bijun, an associate research fellow at the Institute of World Economics and Politics, Chinese Academy of Social Sciences.

However, China has also been able and prepared to lend at lower rates offered by Western financial institutions, who are more conservative, often link loans to democratic political issues, and charge higher rates of interest. China is currently rated at A+, can borrow at lower rates passing that discount onto poorer nations in much of its Belt & Road Initiative funding. Sri Lanka for example is rated B+ yet is able to borrow money from China at lower rates than the United States is prepared to offer, with the country about to reject a US$500 million facility from USIDFC. China is also more amenable to amending debt repayment terms in times of difficulty.

When examining the breakdown of China’s lending to higher risk countries, the general amount of investment that China is prepared to submit without too many concerns is about US$1 billion, a figure that has cropped up in many smaller island nations that also possess strategic and commercial longer term interests.

In terms of total Chinese investments, at the end of 2018, over 27,000 Chinese domestic investors had set up 43,000 enterprises for overseas investment in 188 countries and regions, while over 80 percent of the world’s countries and regions have Chinese investment.

Related Reading

- China’s Outbound Investment – It’s Going into Asian Infrastructure Development

- Chasing China’s Outbound Direct Investment

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com