China’s Belt & Road Initiative In Russia’s Far East

Op/Ed by Chris Devonshire-Ellis

Foreign Investment Opportunities Now Extend Far Into North-East Russia

With Chinese President Xi Jinping effectively taking on the mantle of regional “Chairman” and Russia’s Vladimir Putin now the “President”, it is clear who is now the senior partner in the China-Russia axis. That titular shift, announced at SPIEF just last month, not only cements China-Russia relations, but largely puts them in the driving seat too. Is not entirely a situation to Moscow’s liking – China wants the resources and to some extent the land that Russia has, but it has been asking a high price, aware that Moscow .is under pressure from the United States. Large tracts of land in Russia’s Siberia and Far East have been leased to the Chinese with no apparent hardcore evidence that it will ever be returned. Indeed, should the Chinese refuse to leave, Moscow would be faced with either backing down or drawn into a regional war. This might be 50 years off, but time passes quickly. Washington’s foreign policy might have inadvertently gifted China a massive part of territory. There are maps which purport to show parts of the Russian Far East under “Chinese management” – but these appear to have been scrubbed from the internet. It’s hard to separate the facts from fiction in this regional debate.

For now though, at least on the surface, things appear sweetness and light. China needs Russia’s oil and gas, as well as much of Siberia’s currently fallow agricultural lands, with millions of acres lying dormant since the breakup of the Soviet Union. Russia is desperate for foreign trade given sanctions imposed upon it. At present then, it is a match of more or less, equal partners. The two countries have agreed a “China-Russia Regional RMB Fund” (RDIF) which is designed to support infrastructure investment projects in the Russian Far East and North Eastern China and is financed by Russian and Chinese investment banks. The Far Eastern region of Russia as a whole has also been generating a great deal of FDI as a result – 32% of Russia’s total foreign investment goes into the region. The Russian Far East however is a different Federal District from Siberia, which lies further to the West and which I will discuss in a later article. We can look at the massive Far East region of Russia as follows:

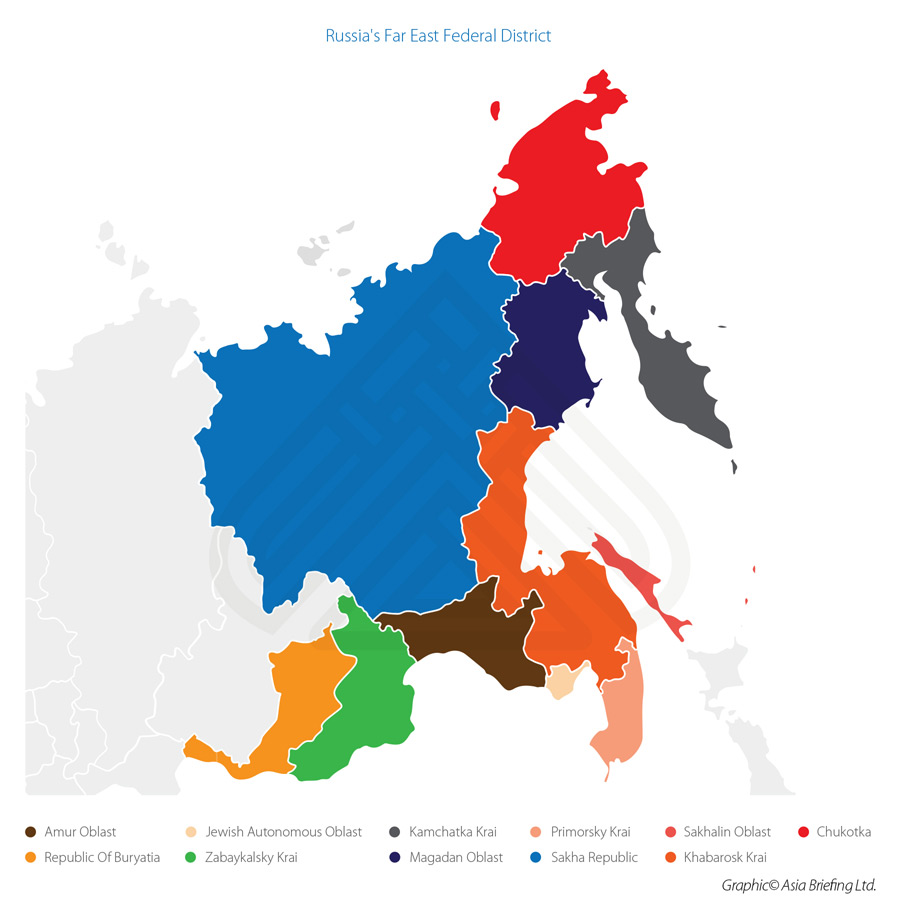

Russia’s Far East

Today, and especially with a more concentrated effort from Moscow and Beijing to develop the region, Far East Russia is experiencing something of a boom. Yury Trutnev, the Russian Deputy Prime Minister made the comments concerning FDI into the region earlier this week at a conference in Mumbai, where he is preparing for the visit of Indian Prime Minister Modi to the Far Eastern Economic Forum which will be held in Vladivostok in early September. Prime Minister Modi will be one of the principal speakers at the event – which Dezan Shira & Associates will also be attending. India, where our firm also has a presence – is in fact a large investor in the Russian Far East, both in securing gas supplies and in the diamond processing trade. The initial shipment of LNG gas to India from the Russia arctic was one of the first deals financed by China’s Silk Road Fund, while both China and India, with huge domestic consumer demand for gold and a state policy of strengthening national gold reserves have been investing in the Far East’s Klyuchevskoye Gold Mines. Vladovostok is also the home to the Eurasian Diamond Exchange, with investors from around the world. The Yakutia region of the Russian Far East carries the worlds largest diamond deposits, for both machinery and jewellery applications. Yakutia diamonds are a Russian girls best friend.

Russia’s Far East is divided up into eleven Federal subjects, with a reorganization in December last year. The regional centre was moved to Vladivostok, while the Federal subjects of Buryatia and Zabaykalsky Krai were moved to the Far Eastern Federal District from the Siberia District. We can examine each of these areas in more detail as follows:

The Republic of Buryatia

An important strategic region, Buryatia borders Mongolia to the south and rubs up against the eastern shores of Lake Baikal. Ulan-Ude is the regional capital. The republic’s economy is composed of agricultural and commercial products including wheat, vegetables, potatoes, timber, leather, graphite, and textiles. Fishing, hunting, furs, sheep and cattle farming, mining. stock raising, engineering, and food processing are also important economic generators. Ulan-Ude sits on the Trans-Siberian Rail network.

The population of the Republic of Buryatia is 1 million.

A Guide to Foreign Investment In the Buryatia Republic can be found here

Yakutia (Sakha Republic)

Comprising half the Far East Federal District, Yakutia covers 3,083,523 square kilometers. Its capital city is Yakutsk. The region is well endowed with raw materials, with large reserves of oil, gas, coal, diamonds, gold, silver, tin, tungsten and many other precious and semi-precious materials and rare earths. Yakutia produces 99% of all Russian diamonds and over 25% of the diamonds mined in the world.

The population of Yakutia is 1 million

A Guide to Foreign Investment In Yakutia can be found here

Amur Oblast

Amur Oblast is located on the banks of the Amur and Zeya Rivers, while the capital is Blagoveshchensk, one of the oldest settlements in the Russian Far East, founded in 1856. It is a traditional center of the fur trade and gold mining. The territory is accessed by both the Trans-Siberian and Baikal-Amur railways. The most important industrial sectors are manufacturing, dominated by food products and beverages, while machine building includes shipbuilding, lifting and transport vehicles, mining equipment, agricultural machinery, metal assemblies and goods, electrical appliances and electrical machines and tools. Mining and quarrying are also important, Amur Oblast ranks sixth in Russia for gold mining, and has the largest gold reserves in Russia, while there are large uranium deposits and processing facilities in Oktyabrsky near the Russia–China border. There are plans to develop other mineral deposits as well, such as titanium, iron, copper, nickel, apatite and so on.

The population of Amur Oblast is just under 1 million.

A Guide to Foreign Investment In Amur Oblast can be found here

Jewish Autonomous Oblast

This is the most enigmatic region of the Russian Far East. The southern part of the territory borders on China through the Amur River. The Jewish religion here maintain their own culture and laws. The administrative center is Birobidzhan. It has well-developed industrial and agricultural base and an excellent transportation network. Its status as a Special Economic Zone offering low taxes have made it a popular destination for Chinese and other Asian traders, while the oblast’s rich mineral and building and finishing material resources are in great demand elsewhere in Russia. Nonferrous metallurgy, engineering, metalworking, building materials, forestry, woodworking, and food processing are among the most developed industrial sectors.

The population of the Jewish Autonomous Oblast is about 200,000.

A Guide to Foreign Investment in the Jewish Autonomous Oblast can be found here

Zabaykalsky Krai

Zabaykalsky Krai borders Mongolia to the South and China to the North-East, while its capital city is Chita, on the Trans-Siberia Railway. The territory is a major conduit for goods passing through into China for processing, with forestry, agriculture, fisheries and other products all being produced here. There is also a sizeable coal and minerals mining industry. The population is 1.1 million.

A Guide to Foreign Investment In Zabaykalsky Krai can be found here

Primorsky Krai

The territory is located in the southern part of the Far East and shares borders with North Korea, Mongolia and China, and has a coastline onto the Sea of Japan. Vladivostok is the regional capital, and is developing as a major eastern city in its own right with a huge sea port, free trade and special economic zones. Vladivostok is the end of the trans-Siberian express train – a 6 day journey to Moscow, or a 9 hour flight. Flights from Shanghai are 3 hours. Vladivostok enjoys a low tax regime and fast track 8 day visas upon arrival as it looks to become the primary city for administering Far East Russian regional development. The city includes a Free Trade Zone, Export Processing Zone and is home to the Eurasian Diamond Exchange where buyers and gem stones processors globally do business. The region as a whole is also an important fisheries area and supports related industries in machinery, processing, refrigeration and shipping.The population of Primorsky Krai is 2 million.

A Guide to Foreign Investment In Primorsky Krai can be found here

Khabarovsky Krai

Khabarovsky Krai borders the Sea of Okhotsk, and the Sea of Japan, and much is area of special scientific natural interest. Tourism here amounts to permits costing US$700 a day. Khabarovsk is the main city and has an international airport as well as being connected to the Trans-Siberian Rail. The main industries in Kamchatka include fishing, forestry, while some coal and other mining is carried out. It is also developing as a coastal centre for Arctic standards shipbuilding, ship repair, and related services. There are oil and mineral resources which are yet to be fully developed.

The population of Khabarovsky Krai is 1.5 million.

A Guide to Foreign Investment In Khabarovsky Krai can be found here

Sakhalin Oblast

Sakhalin is located on 59 islands to the north of Japan and separated from the Japanese mainland by the sea of Japan. It also borders the Sea of Okhotsk and Pacific Ocean. The administrative center of the territory is Yuzhno-Sakhalinsk. Sakhalin has experienced an oil boom with extensive petroleum exploration and mining by most large oil corporations. The oil and natural gas reserves contain an estimated 14 billion barrels of oil and 2,700 km of gas and are being developed under production-sharing agreement contracts involving international oil companies.

The population of Sakhalin is 500,000.

A Guide to Foreign Investment In Sakhakin Oblast can be found here

Magadan Oblast

Magadan is in the Extreme North and borders the Arctic Sea of Okhotsk. Magadan city has an international airport. It is an important fishing and gold mining region, and is also being developed for servicing offshore LNG blocks sited off the coast. Its immediate future will be as an offshore drilling centre for oil and gas exploration in the Russian Arctic. The population of Magadan Oblast is 160,000.

A Guide to Foreign Investment In Magadan Oblast can be found here

Kamchatka Krai

The Kamchatka peninsula is the north-eastern part of Russia and opens out onto the Okhotsk and Bering Seas, in addition to the Pacific Ocean. The region is famous for the quality of its seafoods and this makes up the majority of its industrial base. The administrative center of Kamchatka Krai is Petropavlovsk-Kamchatsky. The population of Kamchatka Krai is 320,000.

A Guide to Foreign Investment In Kamchatka Krai can be found here

Chukotka

Chukotka is one of the least populated federal subjects of Russia and the least densely populated. Anadyr is the capital city. Chukotka is bordered in the north by the Chukchi and East Siberian Seas, which are part of the Arctic Ocean, to the Bering Strait and Bering Sea, part of the Pacific Ocean. The Chukchi Peninsula juts eastward forming the Bering Strait between Russia and the United States. The peninsula’s easternmost point, Cape Dezhnev, is the easternmost point of mainland Russia. Chukotka has large reserves of oil, natural gas, coal, gold, and tungsten, which are slowly being exploited, but much of the rural population survives on subsistence reindeer herding, whaling and fishing. The urban population is employed in mining, administration, construction, cultural work, education, medicine, and other occupations. The population of Chukotka is 50,000.

A Guide to Foreign Investment in Chukotka can be found here

Russian Far East Connectivity Is Key To Foreign Investment

It is significant that Russian President Putin moved the Regional Administrative Centre for the entire Far Eastern Region to Vladivostok six months ago. The city is very close to China and Japan, and is developing as Russia’s main port to the Pacific. It is also the last terminal on the Trans-Siberian Rail.

This is significant as transport nodes are springing up around the region, taking advantage of the upgraded and expanded Trans-Siberian network. The so-called “Trans-Siberian Land Bridge” has begun services from Ports in Japan to Vladivostok, then crossing Russia and the Eurasian continent to Europe. This new route cuts 50% off the normal shipping time, saving time and money. While the various cities of the Russian Far East have seen their fortunes fluctuate over the years, development of the Trans-Siberian will see cities along the route such as Khabarovsk, Chita and Ulan-Ude once again become more affluent as they develop into Far Eastern regional logistics hubs.

These developments open up Far East Russia’s plentiful resources to consumers throughout Asia and Europe. This includes the excellent sea foods, in addition to a wealth of agricultural produce including dairy. As logistics improve, trade will continue to develop.

| Far East Russia Fast Facts | |

|---|---|

| Key Regional Cities: | Vladivostok, Khabarovsk, Chita, Ulan-Ude |

| Flight times | |

| Vladivostok-Tokyo: | 2 hours 15 minutes |

| Vladivostok-Shanghai: | 4 hours |

| Vladivostok-Moscow: | 9 hours |

| Train Times | |

| Beijing- Ulan-Ude: | 20 hours (most trains from China to Russia’s Far East travel via Ulan-Ude) |

Although the Russian Far East may seem remote to many – even in Asia, the fact that one of its cities is a key port on Asia’s East Coast should not be unnoticed. At present, the region provides a still-remote, yet increasingly accessible new commercial frontier. This is linked strongly to the upgrading and expansion of certain sections of the Trans-Siberian Rail, which passes though many of the cities mentioned in this article. That will undoubtedly lead to spin off benefits for local traders, who equipped with local transportation knowledge will be able to use part of that routing for their own consumer needs and export potential, transporting goods and products further into the Russian Far East, in addition to local products heading the opposite direction.

That also includes markets as far away as Japan and Korea as well as deep into China, where Heilongjiang Province and its regional capital of Harbin will be connected via the Primorye 1 Corridor, which creates a land bridge from the landlocked Heilongjiang Province to Vladivostok.

Spill over benefits will carry over right across Far Eastern Russia and Siberia. There has also been talk of upgrading the entire length of the Trans-Siberian to include high-speed trains from Moscow to Kazan and then onto Beijing. China Rail have also identified the Russian Far East as a primary investment target. That will mean additional spurs being created from the Trans-Siberian rail, including to more Northern destinations such as Magadan and Yakutsk and up to Russia’s Arctic Ports.

China has already identified the Russian Arctic as a key strategic area – the development of the Northern Sea Passage and the shipping of containers through this cuts the journey time between China and Europe considerably. It also helps open up the Russian oil and gas fields in the Arctic. I wrote about the Russian Arctic in the article “The Northern Sea Passage Between Europe and Asia – Russia’s Developing Arctic Ports”

Russia’s Arctic GDP is also increasing as a result of trade and exploitation. It is scheduled to reach US$500 billion by 2030. Some of that reach will be conducted through the Russian Far East territories of Kamchatka, Chukotka and Yakutia.

This will ultimately lead to existing Far Eastern regional hubs such as Khabarovsk, Chita and Ulan Ude developing further as major transportation hubs in their own right, with all the implications that carries. In turn, that will lead to greater demand for regional air capacity – which is already being put in place. Russia’s Ministry of Transport has announced it is upgrading over 60 Russian regional airports and increasing their capacity, with the full development expected to last until 2025. That coincides with the development of the major regional S7 airline, which has orders for 25 Sukhoi superjets and became Russia’s first buyer of the Boeing 737 Max. While there remain unfortunate short-term issues with both aircraft, the demand is there, and S7 will buy alternatives if the Sukhoi or 737 Max prove unpopular. S7 currently runs a fleet of 100 passenger aircraft, mainly Airbus and Boeing, flying to over 150 destinations. In 2017, it carried over 9 million passengers, with consistent growth rates of about 10% per annum over the past eight years. Clearly, the demand is there and improved rail connectivity will only see that develop.

There may also be spin offs concerning North Korea should the situation with the country start to ease. Russia shares a border and a rail crossing with the DPRK which will be of immense use should reconstruction start to take place in the country.

Energy supplies are also being upgraded in order to meet this new production and supply demand. Chinese Power companies are all over the Russian Far East at present in order to both ensure oil and gas supplies to China are problem free and also to further develop the region.

There are additional positive trade factors coming down the development pipeline as well. China and Russia are negotiating products to be included in the existing Eurasian Economic Union Free Trade Agreement. Those discussions are now underway. When that is concluded, development in Siberia will also heat up as the FTA will have the effect of reducing tariffs on included products. The reunification – indeed recognition – of Far Eastern Russia as part of Asia is underway.

*This article was adapted and expanded from the Russia Briefing article “32% Of All Foreign Investment Into Russia Now Heads To The Far East” published on 19th June 2019.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, legal advisory, tax advisory and on-going legal, financial and business operational support to investors throughout China, India, ASEAN and Russia, and has 28 offices throughout the region. We also provide advice for Belt & Road project facilitation. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() China’s Siberian, Russian Far East Belt and Road Starts to Take Shape

China’s Siberian, Russian Far East Belt and Road Starts to Take Shape