European Union Discusses Trade With China Via Kazakhstan, Bypassing Russia

Competition for routes to China heat up with Russia and Geopolitics remaining EU obstacles

Competition for close cooperation with Kazakhstan between Russia and the European Union is intensifying. In a recent study of future transport links with Central Asia, the European Bank for Reconstruction and Development (EBRD) identified the Central Trans-Caspian Network, which runs through the southern Kazakhstan, as the most promising for integration with the Trans-European Transport Network.

Readiness for joint work with European partners was confirmed last week by the President of Kazakhstan, Kassym-Jomart Tokayev. Despite the desire of the European Union to invest in alternative configurations of the China-EU transport corridors, it remains premature to consider the issue resolved: Russia is simultaneously working on the development of the same direction, mastering the transit potential of the Northern Sea Route. Which route is preferable for China will probably depend more on economic rather than political factors.

Kazakhstan, according to President Kassym-Jomart Tokayev, is ready for joint work with the EU on the integration of the Trans-Caspian International Transport Route with the Trans-European Transport Network.

Speaking late last week at the Central Asia-European Union summit, Tokayev referred to the EDRB’s report on sustainable transport links between Europe and Central Asia. A fuller report will be issued next month. The preliminary document linked to above confirms the thesis discussed with several Eurasian Economic Union (EAEU) officials last summer: Kazakhstan will become a competitive arena for projects focused on the influx of Western investment, including in terms of the implementation of Western China-EU transport corridors bypassing Russia.

In this study, the EDRB recognises the Trans-Caspian International Transport Route (TITR), or more commonly, the Middle Corridor as the most sustainable option for developing logistics between China and the EU.

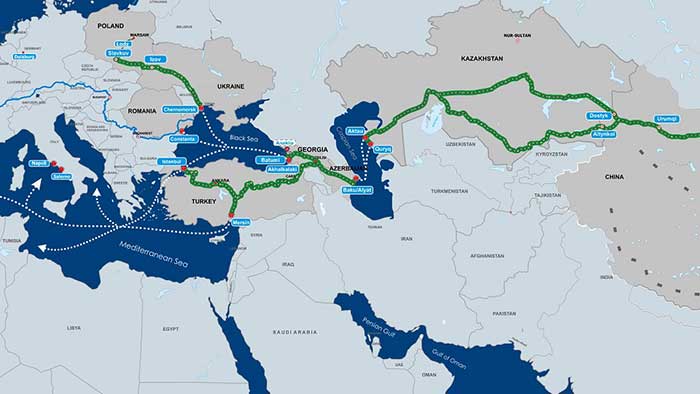

This route runs through China, Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, Turkiye and enters the EU via Bulgaria and Romania, with Ukraine an additional potential future route. According to preliminary estimates, significant improvements along the route, ensuring uninterrupted supplies, require investments of about €18.5 billion. The EU is apparently ready to take on a significant part of this investment.

The funds, as specified in the EBRD report, are needed, among other things, to restore and modernise railway and road corridors, increase port capacity and improve infrastructure at the borders. The investments and policy decisions of the participating countries of the route will be needed in terms of trade facilitation and harmonisation of trade rules, market liberalisation and improvement of tariff regulation these issues will be described in detail in the full report of the EBRD – due next month.

It should be noted that the development of the Middle Corridor is also important for Kazakhstan in the context of diversifying export supplies of oil, 80% of which now uses the Russian-controlled Caspian Pipeline Consortium (CPC).

Astana began looking for alternative routes to the CPC after deliveries through it were stopped several times last year due to repairs in Novorossiysk, Russia’s largest Black Sea Port, but close to the Ukraine.

The reduced role of Russia in oil supplies from Kazakhstan is also beneficial for the European Union, which directly points to the need for this in the context of general political uncertainty. The balance of supply through the CPC and alternative routes will likely depend on the volume of European investment. They can also have political consequences for Kazakhstan in cooperation with Russia, including through the EAEU.

In addition, by expanding the TITR, Astana is being drawn into competition with Moscow for the China-EU transport corridor.

Russia, which is also interested in Kazakh goods passing through its territory, plans to develop the Northern Sea Route (NSR) for these purposes.

The seriousness of intentions can be evidenced by the discussion of this topic at the highest level: in March, Russian President Vladimir Putin, at negotiations with Chinese President Xi Jinping, indicated that the formation of railway and road corridors in the direction of China-Europe and back through Russian territory while improving the transport and logistics infrastructure of the NSR remains an unconditional priority for Moscow.

That fits in with China’s general Belt & Road Initiative strategy – maintaining alternative supply chains.

Despite the EDRB study, and other statements by the EU, it is still too early to say that the choice of a priority supply corridor has been made – and for China supply chain diversification purposes it may not be, although the overland route is more likely to become operational somewhat sooner than the NSR.

The situation is further complicated in that the EU in the near future will have to resolve the issue of reducing the dependence of developed countries on trade with China, and especially following pressure from the United States to do so.

In 2022, China, according to its Ministry of Customs data, sold more to the European Union than it bought from it: Chinese exports reached €525 billion, while imports reached €266.5 billion. The position of China itself remains unclear as the choice of route is more likely to be linked to economic than political factors. The choice from Beijing to target an increase in trade is likely to be made in favour of a cheaper and more efficient option – while options will also remain open as concerns alternatives.

Source: Kommersant with additional commentary by Chris Devonshire-Ellis.

Related Reading