Eurasian Economic Union FTA the Hot Ticket to Participating in China’s OBOR Trade

Recognition is finally dawning that having a Free Trade Agreement with the Russian backed Eurasian Economic Union is fast becoming the motorway to participating in and profiting from China’s Belt & Road ambitions. The Eurasian Economic Union (EAEU) is a trade bloc that extends from Kazakhstan – which borders China – and includes Krygystan and Armenia, and brushes directly up against the European Union at its borders with Russia and Belarus. It includes the main rail networks crossing Eurasia, including the Korgos land bridge and much of the trans-Siberian rail through to Moscow, which then provides onward connections through to EU nations, such as Poland, Estonia, and Finland, progressing to Germany and beyond.

Closer geophysical examination reveals the true impact – the EAEU includes an entire land mass that sits between China and the European Union. The bloc came into effect on January 1, 2015, with member states still coming into compliance over agreed issues, such as harmonization of tariffs and customs procedures. This is normal; ASEAN has done the same with the smaller nations of Cambodia, Laos, and Myanmar in its own union, allowing time for internal reform. However, the internal trade impact of uniting these countries into a free trade area has produced an immediate upswing in trade between them. The 2017 trade among members is up 38 percent YTD, with exports also surging. That is significant; the EAEU’s annual GDP in 2016 was US$4.2 trillion, with its residents showing an average per capita income of US$13,151 in purchasing power parity (PPP) terms – higher than China.

It is that purchasing power, coupled with the ability to produce relatively inexpensive consumables, that is making the EAEU a sought after partner in terms of other countries wishing to trade with it.

These include China, who is “very close” to signing a Free Trade Agreement with the EAEU, according to Russia’s First Deputy Prime Minister Igor Shuvalov, quoted earlier in the week on Russia TV.

Vietnam already has an EAEU FTA, while other ASEAN nations, such as Singapore and Thailand are also in the stages of negotiation. India’s application for an EAEU FTA is also well underway and has been fast-tracked.

Russia’s Foreign Minister Sergey Lavrov said on Monday, while addressing students of Azerbaijan’s Diplomatic Academy: “There is a multitude of countries willing to make agreements on the free trade zone.”

The impact of this is likely to be immense and will place pressure on the European Union to both open up to more trade with Asia – its own proposed FTA with China has been under discussion since 2012 with little sign of progress. However, it has become apparent that if Europe does not come to China, then China will come to Europe – and has already targeted Northern European countries, such as Finland and the Baltics, to make this happen. When China’s FTA with the EAEU is ratified, it will bring Chinese products, duty free, right across Eurasia and to the borders of the European Union. That means significant opportunities in two areas – European service providers familiar with Asia can provide re-packaging, customs advisory, warehousing, transshipment, and other logistics services – to allow these goods to enter the EU. Investing in facilities based on the Western borders of Russia would be a sound bet in targeting such work.

However, China is also keen to have its own citizens serviced and supplied by EU and other producers. It has cleverly subsidized the rail containers currently bringing Chinese products to Europe to the tune of US$2,000 per container, one reason a plethora of routes have opened up. Not all will survive as being economically viable. However, what this really indicates is China’s need not just to sell products to Europe, but also to purchase products from it. China has a population of 500 million consumers who are already buying products online outside of China and having it shipped to their homes within their own country. Yet, few European producers have cottoned onto this – the vast majority are not familiar with how to organize an online portal suitable for Chinese consumers to use. Even less have considered employing staff with Chinese language capabilities. Yet, Chinese online consumer spending is double that of the United States. and grew at a rate of nearly 40 percent last year alone. European manufacturers need to get into gear fast to learn how to access this market – the Chinese government’s attempt to motivate EU buyers to look at supplying China via providing freight subsidies expires in four years.

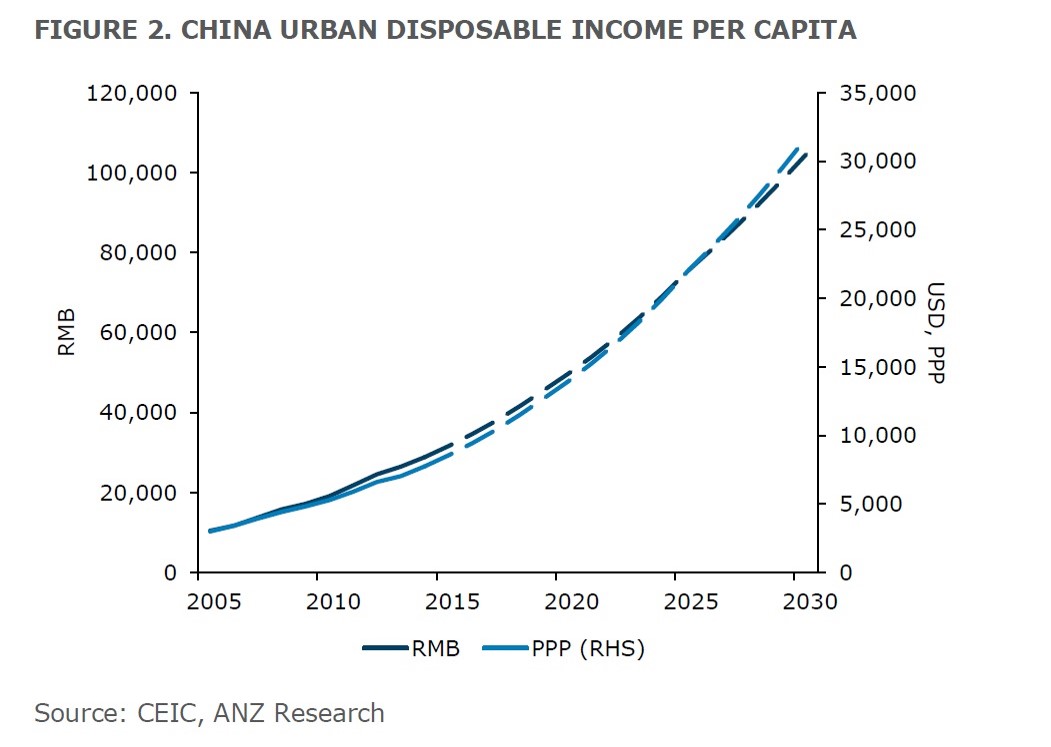

Chinese consumers certainly have the need. The country has 20 percent of the world’s population, yet just 5 percent of global arable land. Chinese consumers are spending increasing sums of money and will continue to do so.

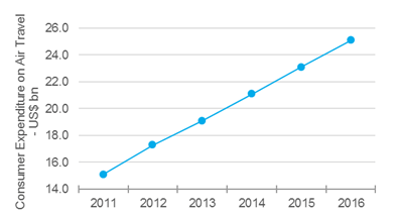

Meanwhile, Chinese tourists travelling everywhere have hugely impacted air travel statistics.

These consumers will bring their experience of those travels, including a preference for quality European goods, back to China.

I often get asked: “How can I get involved in China’s Belt & Road and make money from it?” The answer is simple. Trade. The Eurasian Economic Union, and China’s upcoming FTA with it, in addition to those pending with many other countries, both present a way for China to sell its products overseas but also for other countries to sell to it. Doing so requires the acquisition and understanding of Chinese consumer trends and habits. In today’s new digital silk road, even setting up a physical presence in China is no longer necessarily required. But, establishing an online portal capable of selling your product, to Chinese consumers in China is. Free Trade Agreements with the EAEU, the development of new rail routes, and the new digital economy are all coming together to provide businesses in the countries that have the foresight to engage with these new trends with huge opportunities. It is time for Export Managers to examine how this can be done.

About Us

Silk Road Briefing is produced and written by Dezan Shira & Associates. The firm provides governments and corporate businesses worldwide with strategic, legal, tax and operational advisory services to their SMEs and MNCs investing throughout Eurasia and has 28 offices across China, India, Russia and the ASEAN nations, and partner firms in Central Asia. We have specific and long term experience in China and the OBOR countries. For assistance with OBOR related issues, please contact the firm at silkroad@dezshira.com or visit the practice at www.dezshira.com

Related Reading:

![]() Prospects for UK FTA with China, Revitalization of Commonwealth

Prospects for UK FTA with China, Revitalization of Commonwealth

![]() IKEA Shipping China Made Furniture Via Rail To Estonia For European Markets

IKEA Shipping China Made Furniture Via Rail To Estonia For European Markets

Dezan Shira & Associates’ Service Brochure

Dezan Shira & Associates´ brochure offers a comprehensive overview of the services provided by the firm. With its team of lawyers, tax experts, auditors and consultants, it is Dezan Shira´s mission to guide investors through Asia´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

China Investment Roadmap: the e-Commerce Industry

In this edition of China Briefing magazine, we present a roadmap for investing in China’s e-commerce industry. We provide a consumer analysis of the Chinese market, take a look at the main industry players, and examine the various investment models that are available to foreign companies. Finally, we discuss one of the most crucial due diligence issues that underpins e-commerce in China: ensuring brand protection.