ICBCS Bank Launches Belt Road Indexes and OBOR Economic Health Reports

The London based ICBC Standard Bank (ICBCS), a partnership between China’s ICBC and South Africa’s Standard Bank, have just launched two Belt and Road economic indices, designed to capture the dynamics as well as broader economic benefits of the Belt Road initiative. Assisted by Oxford Economics, ICBCS say these indexes have been created to address the lack of an existing standardized framework for comparing the Belt and Road countries, bridging the informational gap for investors.

These Indexes are:

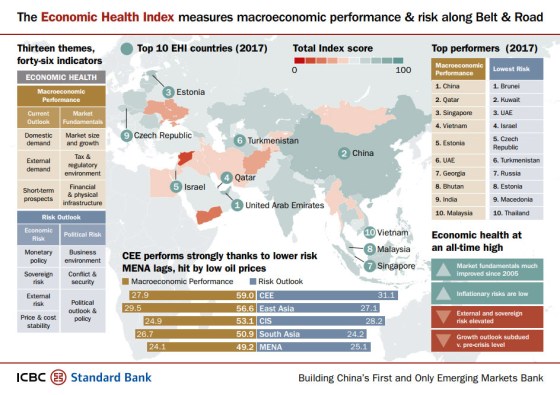

The ICBCS Belt and Road Economic Health Index

This is a monthly index designed to provide a broad overview of the relative attractiveness across each of the Belt Road economies. It provides over 45 individual country indicators within a comparable analytical framework that can be used for tailored analysis, helping investors to make informed decisions. At the high-level, overall economic health is tracked across the dimensions of macroeconomic performance and risk outlook.

The inaugural Economic Health Index found that, despite sovereign and external risk being at multi-year highs, the overall economic health among OBOR nations is at a decade high driven by an improvement in market fundamentals. The top macro-performers fall into two categories. The “Big Three” of China, India, and Vietnam – large emerging markets with strong growth prospects; and the “Nimble Four” of Qatar, Singapore, Estonia and the United Arab Emirates – smaller markets with good quality investment climates. Estonia for example has been making waves with its e-commerce platform, and is increasingly involved in handling Alibaba trade with the EU, which now accounts for 5% of all China Post volume.

The Central and Eastern Europe (CEE) region currently enjoys the highest average economic health score across the Belt and Road regions.

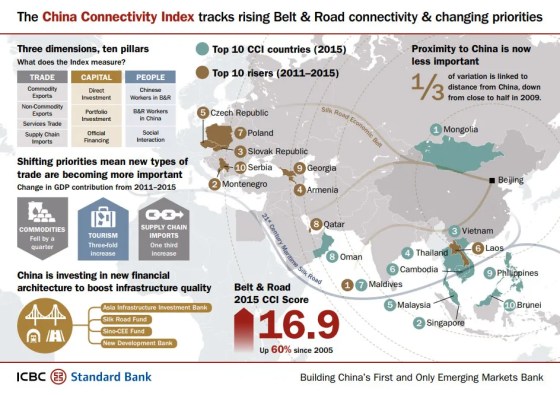

The ICBCS Belt and Road China Connectivity Index

This is a bi-annual index designed to provide investors, businesses, policymakers and other stakeholders with an evidence based metric to track broad-based economic connectivity between China and the Belt and Road economies. This is achieved by tracking bilateral activity across the three dimensions of trade, capital and human resources.

The Connectivity Index found that overall economic connectivity between China and the median Belt and Road economy is around twice that in 2015 as it was a decade ago, and as China’s economic activity has shifted to trade in services and human capital, connectivity has become less tied by proximity – good news for OBOR nations, and especially in Central and Eastern Europe. The rising stars of the Connectivity Index are dominated by countries in the CEE region, reflecting China’s structural shift to re-balance towards more sophisticated economies. As China shifts to become a more consumer-driven economy, the role of commodities as a driver of economic growth and connectivity has fallen. There is clear positive correlation between the capacity of an economy to facilitate trade, the strength of its infrastructure and, in turn, between trade and growth.

The Belt Road initiative has led to a vast mobilization of resources to over 60 frontier and emerging economies, as covered and explained on Silk Road Briefing. These Indices however “shed new lights on thought leadership establishment, and will offer unique and meaningful contributions to future policy debates and dialogues in the coming years.” stated Liu Xiaoming, the Chinese Ambassador to the United Kingdom at the Index launch last Thursday.

Jinny Yan, chief China economist at ICBC Standard Bank, said: “As a result of our research we can see a clear link between investment in infrastructure and overall economic prosperity in Belt and Road countries. This explains why infrastructure is a central part of China’s Belt Road effort and why it is so crucial to unlock alternative infrastructure financing to ensure the initiative delivers on its goal of inclusive economic growth.”

These reports can be downloaded from the ICBCS website.

Chris Devonshire-Ellis of Dezan Shira & Associates comments “The ICBCS initiative is timely and welcome and will make life far easier for analysts involved in the complete spectrum of Chinese, Asian and Eurasian trade. The outlook for the region remains positive and on an upward trend. Smaller nations with innovative hi-tech ideas such as Estonia and Singapore can now use these independent indexes to demonstrate to international investors their own OBOR resources and preparation for involvement, making foreign inbound capital flows much more likely to invest in local economies that are preparing the way ahead as part of the Belt Road Eurasian integration.”

About Us

Silk Road Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & Vietnam. For editorial matters please contact us here and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Asian and Eurasian region. We maintain offices throughout China, South-East Asia, India and Russia. For assistance with OBOR issues or investments into any of the featured countries, please contact us at silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

Silk Road and OBOR Business Intelligence

Dezan Shira & Associates´ Silk Road and OBOR investment brochure offers an introduction to the region and an overview of the services provided by the firm. It is Dezan Shira´s mission to guide investors through the Silk Road´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.

China Targets, Funds & Incentivizes Eastern Europe As Bilateral Trade Potential Intensifies