Bangladesh’s Mega Projects Are Projecting The Country To Be A Major Asian 2022 Tiger Economy

Bangladesh is becoming an ASEAN+1

By Chris Devonshire-Ellis & Pathik Hasan

Bangladesh’s ability to both attract and invest capital into its infrastructure needs has massively increased during the past two-three years with global investors looking at the country as a solid investment. The country sits between ASEAN and the India-Centric SAARC, provides Himalayan and China access, which together with a welcoming foreign investment regime are seeing the country develop as a South-Asian supply chain hub. Bangladesh is where South-East Asia meets the Himalaya and the Indian sub-continent. Collectively, these are markets of over 2 billion people.

Consequently, the ability for Bangladesh to both borrow and repay foreign loans has increased. In the meantime, Bangladesh has become the latest addition to South Asia’s middle-income countries.

A large part of this has been a mature academic and Governmental attitude to restructuring and redevelopment. Largely free of the religious divides now creeping back across Indian politics, Bangladesh is showing the South-East Asia way ahead for its largely Muslim community: tolerance, and a business savvy professional class mixed with a firmly set national development agenda. It’s a winning agenda.

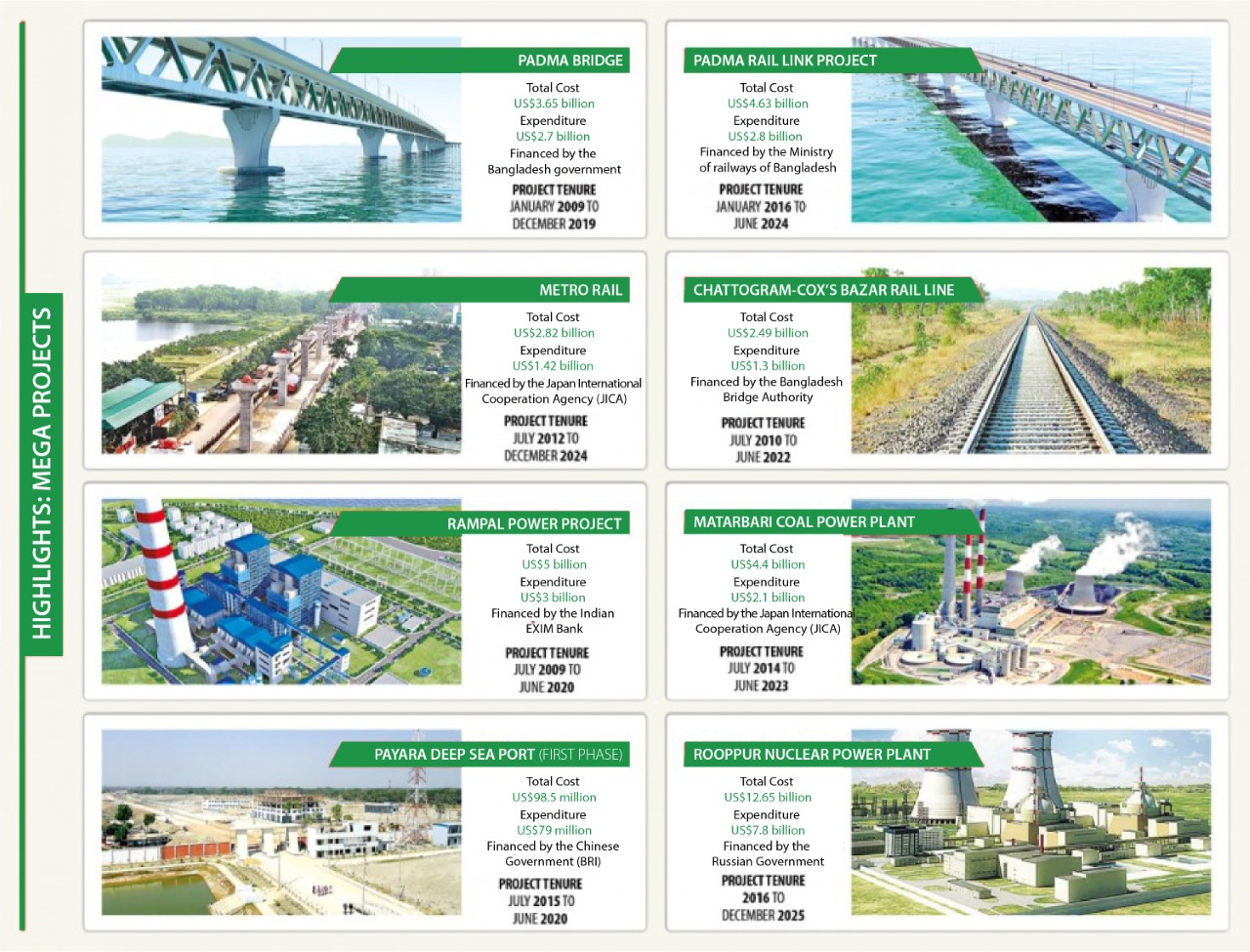

Bangladesh’s development partners agree. Here we can see a graphic (with assistance from Cox Gazette) that show off Bangladesh’s key megaprojects.

This represents the new Bangladesh – even ahead of the United States in its infrastructure build. It is also noticeable how the country has balanced its foreign debt: a BRI member, it has spread its loan repayments across Japan, India, Russia and to a lesser degree, China. All however are serial Asia investors, and see Bangladesh as a prominent, and responsible recipient.

Bangladesh meanwhile is increasingly able to gain access to foreign lending with additional loans from its reserves. The infrastructure developments we depict will only add to its GDP and commercial value as they come online.

Bangladesh is also along the road of changing from being a regional borrower to becoming a responsible regional benefactor. The Bangladesh Central Bank is concluding preparations to lend US$200 million to Buddhist Sri Lanka, a fellow SAARC member badly hit by its 2018 terrorist attacks, then almost immediately followed by the decimation by Covid of its tourism industry. Sri Lanka’s medium-long term fundamentals remain good; but like a lot of Covid affected nations it requires some breathing space. Well-heeled executives from Dhaka and Colombo may in time be afforded direct flights instead of transits via India or Singapore as a result. Both would benefit from the trade, and tourism ties if Sri Lanka can tone down its Muslim rhetoric. It makes economic sense: Bangladesh’s middle class consumer base is about 40 million – double the size of the entire Sri Lankan population. Yet bilateral tourism programs are threadbare.

Meanwhile, for Bangladesh it is a complete turnaround in fortunes. At one time Dhaka only borrowed from foreign companies or countries. That day has changed. The capacity of Bangladesh has increased. Bangladesh is now emulating many in South Asia, and especially in terms of economic potential.

Bangladesh’s economy is also showing sustainable recovery potential while many countries are affected by the Covid pandemic. After managing the first wave, it is now handling the second and third waves. Significant vaccine contributions to Bangladesh have been made by China (Sinopharm), Russia (Sputnik) and the UK (Oxford Astra Zenica). It should be noted that Bangladesh is part of the British Commonwealth and was part of British India under the Raj until 1947. Opportunities for British businesses to expand on the Covid and Commonwealth familial goodwill should not be underestimated.

Back to the so-called “MegaProjects”. Bangladeshi Government officials and its business leaders say that if these can be completed, Bangladesh as a regional and global manufacturing and trade hub will produce a major impact on Asian and Global supply chains and bring radical changes in the regional communications and infrastructure sectors.

Part of this has been due to political stability. After the election of the current (subsequently reelected) Bangladesh government in early 2009, massive development activities began all over the country. As the government remained unchanged in the second term, development activities gained more increasing momentum and national approval in the development and expenditure in important sectors such as roads, infrastructure, power, and energy infrastructure – a key feature incidentally of China’s CPEC infrastructure investment in Pakistan.

It is worth noting Bangladesh’s success in the power and energy sectors, and that these only came after overcoming longstanding obstacles. Certain countries both near and far preferred Bangladesh to remain a ‘client state’ and perpetually in debt. It remains a democratic curio that a long-term government – as preferred by many emerging economies – has managed to deliver. The incumbent Awami League for example has won the 11th national election for the third time in a row.

Bangladesh’s per capita income and GDP growth is increasing rapidly, although like many economies it has been affected by the Covid-19 epidemic, which impacted on planned infrastructure and MegaProject deliverable timeframes. Those have now been adjusted, and development progress restarted.

For example, significant progress has been made in the construction of the much-anticipated Padma Bridge and Metrorail. As of June, this year, the post-Covid (after vaccination) development progress of the Metrorail Line-6 has improved by 67.63 %.

It is a similar story elsewhere. The take-up progress of the Padma Bridge (ten-lane) project has been more than 93% compared to 2020. It is now hoped that the Padma Bridge will be opened to traffic within the stipulated time when the project was first initiated, pre-Covid. That means opening on or around June 2022.

Worker isolation policies also helped. The construction of Bangladesh’s first tunnel under the Karnaphuli River did not stop, despite various obstacles including a labor shortage issue and disruption in the supply of construction materials. Although the pace of work declined, the project participants remain optimistic about making it suitable for traffic within the stipulated time.

Taken together, the overall work progress of the Mega Projects has been 70% of that originally targeted but with improving, optimistic post Covid completion dates.

That does not mean all projects will come in on time, and most will suffer delays. Work is not progressing as usual in the second wave of Covid. Necessary construction materials are still not arriving on time. External contractors involved in the project cannot go on site without one-month strict quarantine. What has changed is that these delays can be better measured, and with that, funding access and cashflow better understood and provided. Risk has reduced, while new completion timescales – many more conservative than before – have been reviewed.

The overall progress of the Bus Rapid Transit (BRT) project for example is at about 35% of where it should have been. However, the Planning Commission of Bangladesh has approved an extension of the project to June 2022. Additional resources have been deployed to assist, such as Bangladesh’s Roads and Highways Department revising the DPP of the project, and deploying additional personnel to complete it.

The construction of the Dhaka-Ashulia Elevated Expressway project has also been delayed, but again additional, not originally planned for deployments of personnel (including military) drafted in to get close to the original completion deadlines.

Further afield, it is a similar situation amongst other Infrastructure projects being undertaken on a global basis including many projects of China’s Belt and Road Initiative. An understanding and risk analysis has been performed, with alternative resources being deployed in many countries to get as close to the original, pre-Covid national infrastructure development plans as possible – as often these are interlinked with other important national and intra-regional projects. For Bangladesh, and one suspects many others affected by the pandemic, infrastructure investments will complete with a BANG! and not a whisper.

At the same time, transportation of goods from North Bengal and elsewhere (such as ASEAN) are becoming easier as Covid subsides. This is starting to reduce the supply cost of transporting goods, leading to positive changes in the Bangladeshi economic situation and its subsequent social wellbeing. The government thinks that this will also make a significant contribution to the overall economy of the country in 2022.

When the MegaProjects are implemented, with most due 2022/23, it will add another 2% growth to the country’s economy – and at expected and sustainable rate of about 8-9% – the highest in emerging Asia.

Therefore, the Bangladesh Ministry of Finance has termed the national ‘Megaprojects’ as ‘Transformational’. When these reach expected usage by 2025, Bangladesh will experience significant GDP growth and investment returns. The time to take Bangladesh seriously as a recipient of international investment funds, global manufacturing hub, and as an ASEAN+1 alternative have arrived.

We are grateful to Pathik Hasan for his assistance with this article. Dr. Hasan is a Dhaka based NGO worker and freelance writer commenting on current affairs and international politics. He can be contacted at pathikhasan1141@gmail.com

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com