Search Silk Road Briefing News

-

Silk Road Development Weekly

Our Weekly Round Up Of Infrastructure Development News across the Silk Road Routes Silk Road Bonds – The Next Big Thing? (Global Finance) Is Russia’s Asia Outreach Bearing Fruit (Asia Maritime) UK Eyes Opportunities in Belt & Road Construction (OBOR Portal)

-

BRICS New Development Bank Considering Ruble Bonds

The BRICS New Development Bank President Kundapur Vaman Kamath said late last week that the bank is considering raising funds through issuing Ruble denominated bonds. Kamath stated “We are looking with great interest at the local Russian currency. Last year, our team held negotiations in Russia with financial regulators. We discussed the possibilities of raising[…..]

-

India’s Silk Road Ambitions and China’s OBOR Intentions

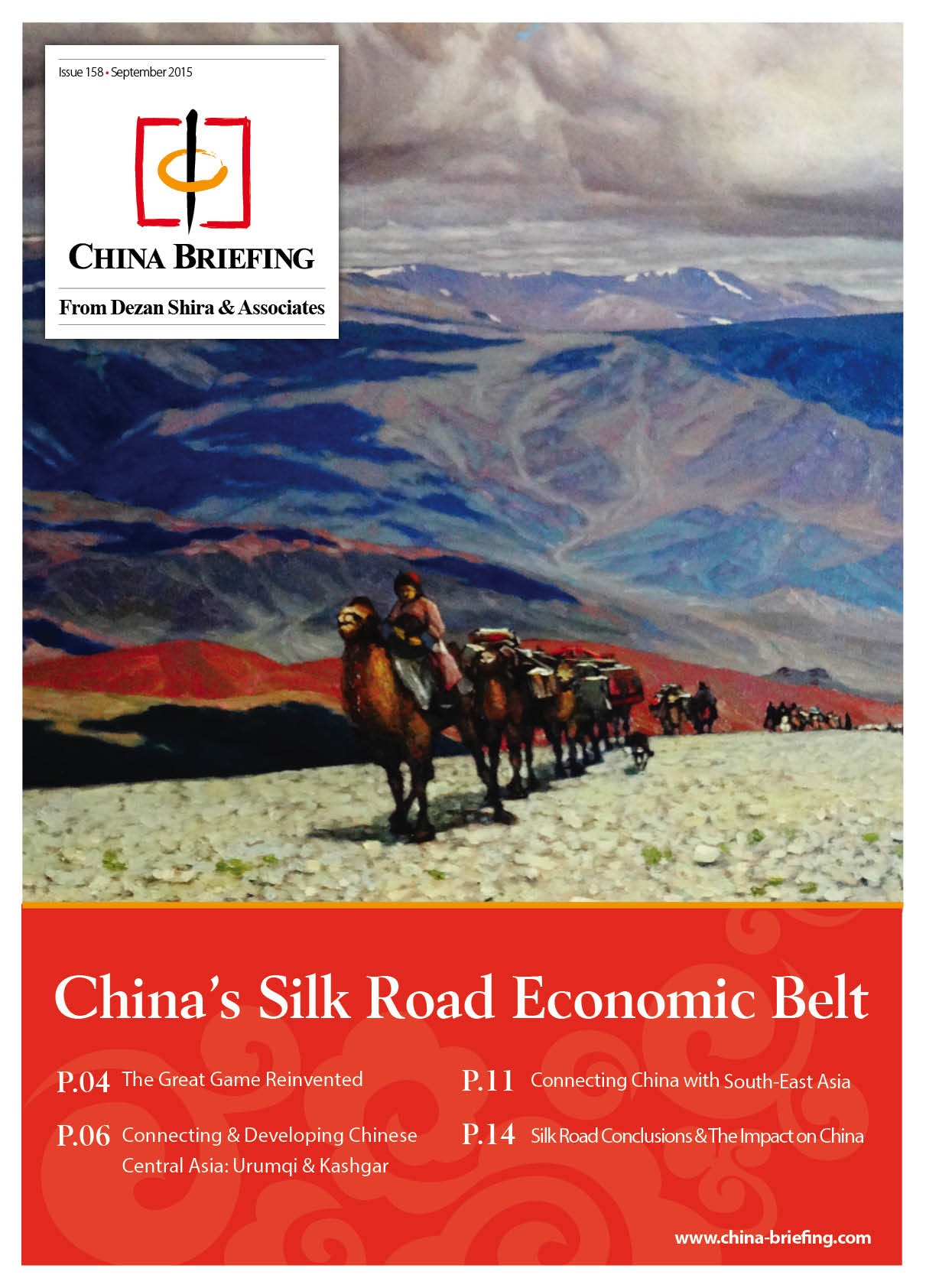

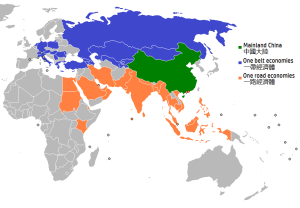

China’s OBOR initiative has taken the limelight, but expanding and developing the Silk Road is not purely a Chinese play. India had sixteen key Silk Road trading sites in ancient times, more than any other country excepting China, and is currently developing its own Silk Road ambitions.

-

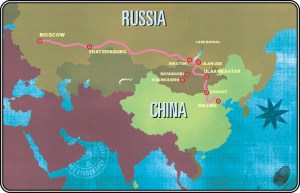

China, Mongolia, and Russia Increase Trans-National Rail Traffic by 150 percent

The Mongolian Embassy in Beijing has held a transportation forum with Chinese and Russian authorities to discuss cooperation on freight train transportation. Mongolia, in specific, is seeking to enact reforms that will allow for more trans-national rail traffic.

-

Silk Road Development Weekly

Our weekly round up of infrastructure development news across Silk Road routes.

-

Central Asian Ministers Agree on Trade, Economic Reforms

Various regional and trade initiatives are being taken up in a series of ministerial meetings among the Commonwealth of Independent States (Central Asia). In this article, we highlight the agreements under discussion that seek to improve the role of the CIS in international and regional affairs.

-

What Currency Will be Used Along the OBOR?

With much discussion over the trade along, and participation in projects aligned to the One Belt, One Road scheme, there has been little examination of which currencies will fund such activities. This article discusses the role of the Chinese RMB and Russian ruble.

-

Brexit Britain, the Commonwealth, China’s OBOR and the Eurasian Economic Union

With the UK now set to exit the European Union, it appears all bets are off as to how the future trade development of the UK pans out. Freed of the political implications with what appears an EU uncertain on how to proceed without the UK, the reality is that Britain is now free to[…..]

-

China Needs to Solve Disputed Territorial Claims if OBOR is to be Effective

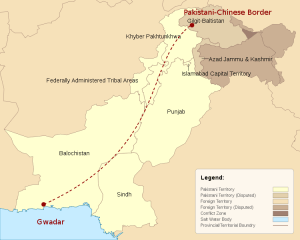

China’s plans for a large scale inauguration of President Xi Jinping’s One Belt, One Road dreams lie in tatters after India pulled out of next month’s “Belt Road Forum” to be held in Beijing. The first OBOR summit has been snubbed by Indian Prime Minister Modi due to concerns that attending it would give China India’s approval over the disputed territories of Kashmir promoted by China as part of its China-Pakistan Economic Corridor.

-

Financing China’s One Belt, One Road: US$8 Trillion in Capital Requirements

A common question when it comes to financial assessments of China’s huge Silk Road plans is how to finance the entire initiative. The anticipated expenditure estimates suggest a cumulative investment over an indefinite timescale variously put at between US$4 trillion to US$8 trillion.