AIIB Partners With Amundi To Provide Asia Climate Bonds

Asia Climate Change Portfolio To Provide Climate Change Financing Among AIIB Members

The Beijing backed Asian Infrastructure Investment Bank (AIIB) and Amundi, Europe’s largest asset manager, have announced a US$500 million Asia Climate Bond Portfolio, which aims to accelerate climate action changes with the bank’s members and develop the climate bond market. The “Asia Climate Bond Portfolio” will invest in labeled green bonds and unlabeled climate bonds and engage with issuing companies to help them transition their business models to facilitate climate resilience and green leadership.

The Asia Climate Bond Portfolio will begin investing in January 2020. The emerging market corporate debt strategy will be managed by Amundi’s Global Emerging Market Debt portfolio management team, based in London. This team is part of the broader Emerging Markets Investment platform, which manages US$50.5 billion in dedicated EM Equity, Fixed-Income and Cross-Assets strategies.

AIB and Amundi have developed a Climate Change Investment framework, which takes into account three variables – portion of green business activities, climate mitigation and resilience to climate change – to analyze issuers’ ability to cope with climate change.

In July, AIIB announced a US$500 million portfolio that aims to develop debt capital markets for infrastructure, drive responsible investing in fixed income, and build a sustainable ESG ecosystem in emerging markets in Asia.

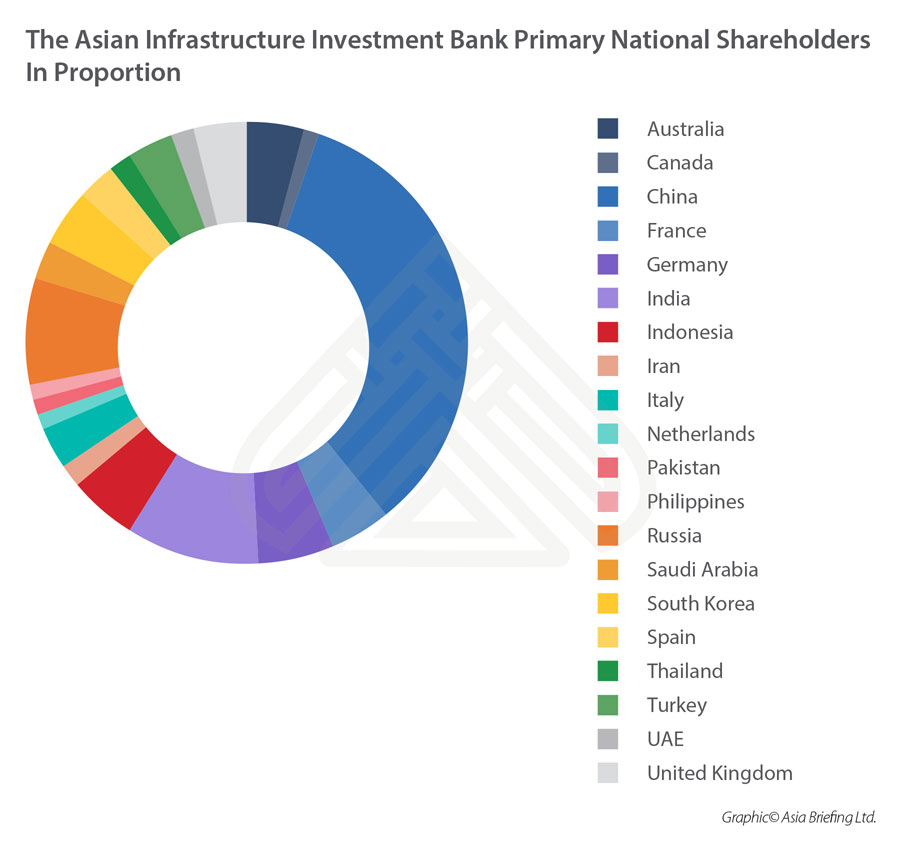

The AIIB is a multilateral development bank that aims to support the building of infrastructure in the Asia-Pacific region. The bank currently has 74 members as well as 26 prospective members from around the world, and was launched, at China’s initiative, in 2015. The starting capital of the bank was US$100 billion, equivalent to 2⁄3 of the capital of the Asian Development Bank and and about half that of the World Bank. The largest shareholders are China, Russia and India.

Amundi is Europe’s largest asset manager by assets under management and ranks in the top ten globally. It manages 1.49 trillion euros (US$1.64 trillion) in assets. Headquartered in Paris, Amundi has been listed on the Paris Stock Exchange since November 2015.

An UNESCO/IPDC booklet entitled “Getting The Message Across” published in 2018, concerning Climate Change and Sustainable Development in Asia and the Pacific can be downloaded on a complimentary basis here

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm assists foreign investors and advises Governments throughout Asia in facilitating trade and investment into the region, and maintains 28 offices throughout China, India, ASEAN and Russia. We also provide Belt & Road advisory and intelligence services. Please email us at silkroad@dezshira.com for enquiries or visit us at www.dezshira.com