United Kingdom To Request Membership Of The Comprehensive and Progressive Trans-Pacific Partnership

Op/Ed by Chris Devonshire-Ellis

- UK qualifies as Asia-Pac nation via the Pitcairn Islands

- Access to markets in the world’s fastest growing consumer market

- Dynamic changes expected in CPTPP global engagement and standards

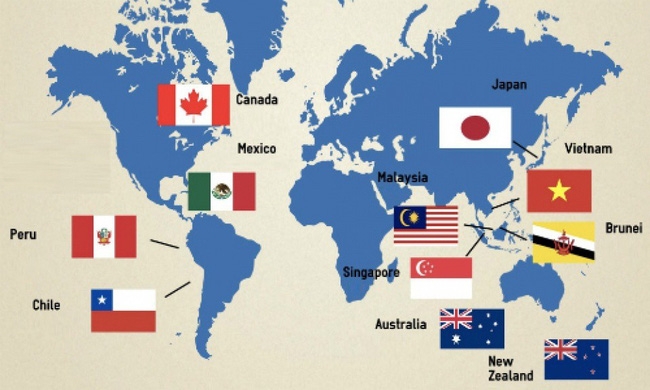

The United Kingdom is set to formally request membership of the eleven nation Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) Free Trade Agreement tomorrow (Monday February 1) at a meeting between Liz Truss, the British Trade Secretary and Ministers of the participating nations.

The CPTPP includes Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. The UK signed Free Trade Agreements with Singapore and Vietnam earlier this year, in what has been a busy start to post-Brexit life. We broke the news of an impending CPTPP deal last week.

Pitcairn Islands Flag

The UK has a small territory in the Asia-Pacific, in the form of the Pitcairn Islands, while Australia, Brunei, Canada, Malaysia, New Zealand and Singapore are all members of the British-led Commonwealth of Nations.

The CPTPP is the successor to the Trans-Pacific Partnership,which was originally to have included the United States, however then-President Trump pulled out of the deal at the last moment back in 2016, shortly after being elected. The remaining countries went ahead with the agreement anyway.

In June last year, the UK issued a Policy Paper stating the UK’s position on accession to the CPTPP. There were three reasons given:

- Securing increased trade and investment opportunities that will help the UK economy overcome the unprecedented challenge posed by Covid-19. Joining CPTPP would open new opportunities for UK exporters in strategically important sectors and help to support an industrial revival in the UK.

- Helping the United Kingdom diversify trading links and supply chains, and in doing so increasing economic security at a time of heightened uncertainty and disruption in the world.

- Assisting the UK’s future place in the world and advancing the UK’s longer-term interests. CPTPP membership is an important part of our strategy to place the UK at the centre of a modern, progressive network of free trade agreements with dynamic economies. Doing so would turn the UK into a global hub for businesses and investors wanting to trade with the rest of the world.

The UK government also stated that in 2019, each region and nation of the UK exported at least £1 billion ($1.25 billion) worth of goods to CPTPP member countries. The UK government also highlighted that UK companies held about £98 billion worth of investments in CPTPP countries in 2018, and that in 2019, the UK conducted more than £110 billion ($137 billion) worth of trade with countries in the CPTPP free trade area.

British Prime Minister Boris Johnson said last week: “One year after our departure from the EU, we are forging new partnerships that will bring enormous economic benefits for the people of Britain. Applying to be the first new country to join the CPTPP demonstrates our ambition to do business on the best terms with our friends and partners all over the world and be an enthusiastic champion of global free trade.”

British businesses have reacted warmly to the plans, with the Federation of Small Businesses (FSB) saying the move would help firms “thrive and succeed more than ever”. Truss said joining the pact would “create enormous opportunities for UK businesses that simply weren’t there as part of the EU”, while Lord Bilimoria, President of The Confederation of British Industry said: “Membership of the bloc has the potential to deliver new opportunities for UK business across different sectors.”

There has been criticism – it is understood that China is also eying membership of the CPTPP, although it has recently signed off the similar Regional Comprehensive Partnership Agreement (RCEP) making a China-CPTPP deal less likely. Were China to join a CPTPP bloc with the UK, it could cause political problems in addition to dampening expectations of any trade deal with the United States. Both the UK and US are experiencing political, human rights and trade problems with China at this present time.

Nonetheless, the deal should prove advantageous for the UK should it go ahead. The Asia-Pacific region overall is one of the world’s most dynamic and fastest growing consumer markets, while the CPTPP bloc recently issued a statement concerning taking the CPTPP ‘to the next level’ at their more recent annual meeting, held in Mexico last August. Following that event, the CPTPP issued an memorandum outlining the blocs intentions, titled ‘Expand, Rebrand, Engage’ which included:

- Expanding the agreement’s scope to cover emerging issues such as digital governance, supply chain resilience, and foreign investment reviews.

- Rebranding the pact as the “Comprehensive Agreement for International Partnership” or CAIP to appropriately reflect its expanded scope.

- Engaging a broad group of like-minded, market-oriented countries to join in the effort to establish a new framework with a set of rules approved by all participants as a preferred alternative to the state capitalist model.

The CPTPP further elaborated on this by stating their intentions to:

- Address new challenges to maintaining an open global trading system;

- Foster sustainable, balanced, and inclusive global growth in the years ahead, as governments seek to address the long-term damage wrought by COVID-19;

- Fill the gap left by the collapse of the negotiating function of the World Trade Organization (WTO) while creating pressure to reinvigorate it;

- Build consensus around an alternative to China’s state capitalist model; and

- Ensure that the CPTPP remains the centerpiece of any future US reengagement and is not supplanted by a wholly new framework.

Bring into CPTPP the Best Practices for Key Disciplines, addressing the post-COVID-19 world

CPTPP already incorporates advanced WTO-plus disciplines on state-owned enterprises, e-commerce, and a host of other cutting-edge issues, as well as ambitious gains on industrial, services, and agricultural market access. Yet economic and technological developments have rapidly emerged over the past few years. The challenge now is to build on CPTPP’s breakthroughs to ensure that it remains at the forefront of global trade developments. As the WTO shows, failure to continually update an agreement risks a loss of relevance as members and traders look elsewhere for new opportunities.

Digital governance.

The best practices emerging from recent accords could inform a new initiative to enhance the norms established by CPTPP. In particular, Japan has been a leader in championing international initiatives to promote high standards of digital governance through its Data Free Flows with Trust (DFFT) concept launched during its G20 presidential year of 2019. CPTPP incorporates principles and rules governing digital trade, and Singapore has taken a leading role to forge subsequent regional and bilateral agreements (Australia-Singapore, Singapore-New-Zealand-Chile digital economy agreements) that have refined and expanded the framework established by CPTPP.

Supply chain resilience.

The border closures, quarantines, shutdowns of markets, food production facilities, and key transportation and storage infrastructure, and loss of access to critical drugs, materials, and parts that have resulted from the COVID-19 pandemic dramatically underscore the need to improve the resilience of supply chains and address overreliance on Chinese production. Already, countries have begun efforts that could become building blocks for greater cooperation.

High-level plurilateral approach to investment reviews.

Concerted, often state-backed foreign investment by entities of state capitalist countries in strategic sectors is compelling like-minded countries to coordinate their investment screening regimes. A number of countries are increasingly working to enhance coordination and create common standards that incorporate and align recent trends in the United States and its allies.

REBRAND: Rename the pact to reflect a broader than regional, global and thematic scope

To reflect its truly global nature, the agreement should be rebranded with a new name, for example, the “Comprehensive Agreement for International Partnership” or CAIP. A new name would allow participating countries such as the United States to avoid any negative perceptions associated with the Trans-Pacific Partnership or “TPP” and help to promote the initiative as part of recovery efforts to rebuild from the COVID-19 crisis.

ENGAGE: Work to expand the pact to like-minded, market-oriented countries

Opening the pact to more countries that can meet its standards.

Consistent with CPTPP’s history as an inclusive, open-architecture arrangement, this expansion into the CAIP should not be limited by geography. Eligibility should reflect the membership’s common commitment to market principles and recognition that accession to harmonized, high-standard “software” for trade can play a major role in driving shared prosperity, bolstering competitiveness and setting global rules and standards on key issues. Such an inclusive approach could expand membership, including to fast-growing economies such as India and China, should they demonstrate their readiness to commit to the agreement’s disciplines.

The United States potentially open to reengaging.

President-elect Joseph Biden has called for a “pause” in trade deals but has also called for reestablishing US leadership in the world and rebuilding US relationships with allies. Getting the United States into a transformed CPTPP—i.e., CAIP—framework is likely to involve US demands for significant changes. It would also require rebuilding congressional support and an extension of Trade Promotion Authority, which expires on July 1, 2021.

We will bring you more details of any UK-CPTPP agreement as they become available. For a complimentary subscription to Asia Briefing publications, including weekly updates and access to over 25 Asian trade and investment magazines each year, please click here.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com