Asia & Emerging Economies The Way Out Of Covid GDP Slump

Belt & Road Initiative GDP Forecasts 2020-2021

Op/Ed by Chris Devonshire-Ellis

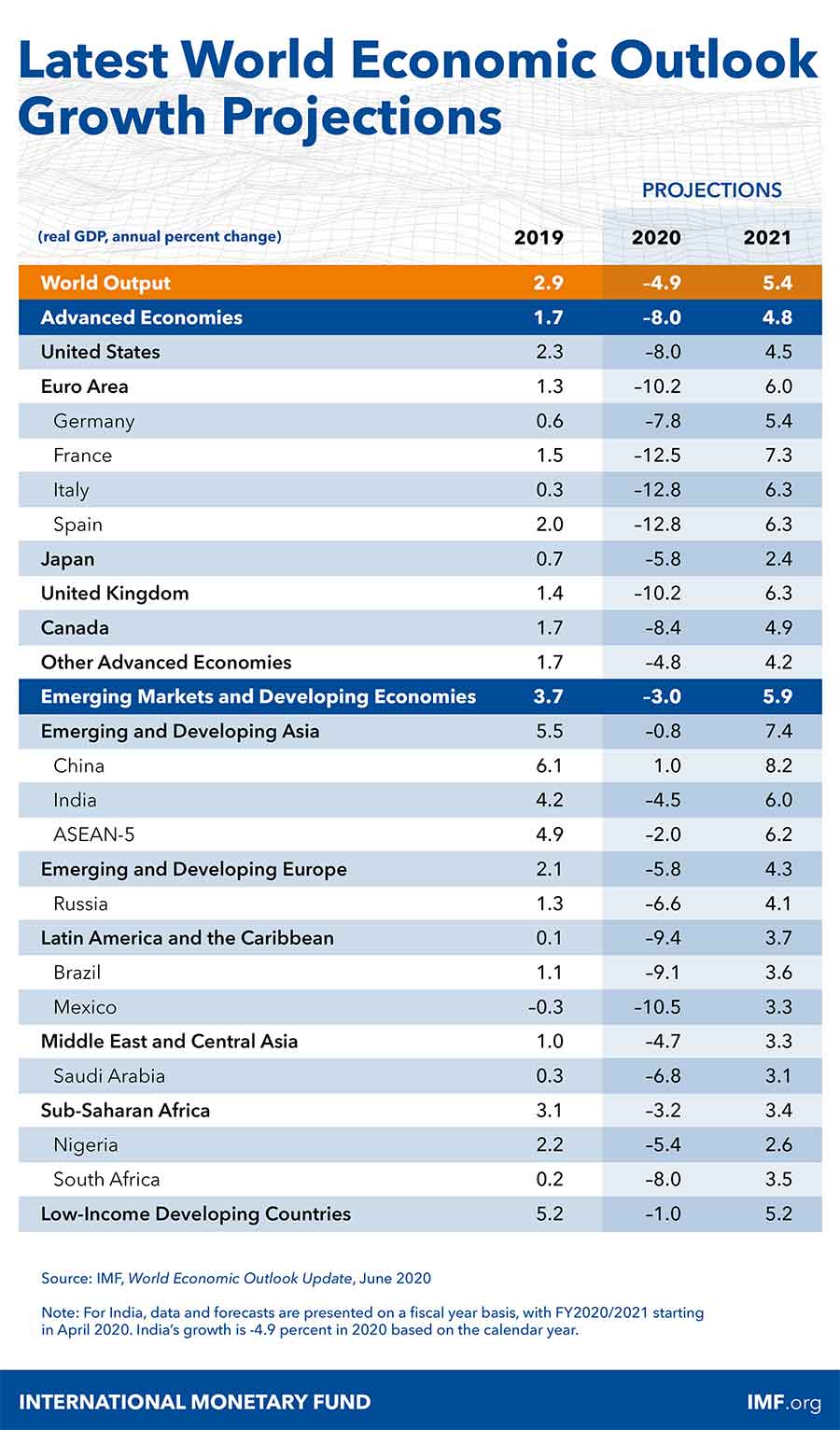

The International Monetary Fund has released updates for how it sees economic developments both this year and next in the wake of the Covid-19 global pandemic.

Global growth overall is projected at –4.9 percent for 2020, 1.9 percentage points below the April 2020 World Economic Outlook (WEO) forecast. The COVID-19 pandemic has had a more negative impact on activity in the first half of 2020 than anticipated, and the recovery is projected to be more gradual than previously forecast. In 2021 global growth is projected at 5.4 percent. Overall, this would leave 2021 GDP some 6½ percentage points lower than in the pre-COVID-19 projections of January 2020.

We can examine the impact of this and where investments are likely to go next year in the following IMF projections:

As can be seen, the Advanced economies of the United States, much of the European Union, the UK, Japan, Canada and related economies are expected to retract this year, between -5 and -14 percent over 2019. This is a serious recession. However, a bounce-back is expected next year, with an average return to growth averaging about 5%. However, figures just in from the United States show US contraction at a huge -32.9% – far worse than the IMF forecast above. Markets in the US and EU closed significantly down amidst a huge stock sell-off and things can not unexpectedly be presumed to worsen further.

I should caution though that there appears to be no provision in this data for any second wave of Covid-19 spurring additional lockdowns and the essential shuttering of economies should the pandemic return in force during the winter and spring of 2020/21. The IMF forecasts for 2020 and 2021 may yet prove optimistic, as were the original forecasts for 2020 issued by the IMF in January, and April.

Even so, it appears that the Emerging Economies are the place to be in order to realize a stronger rate of return on investment. We can see China returning to growth in 2021 at 8.2% against the United States 4.5%, with India and the ASEAN5 economies looking at 6% plus. Russia, Brazil and South Africa, which together with China and India make up the BRICS, are expected to return to growth at rates of about 3.5 to 4% – higher than Japan.

BRI reach into the Middle East, Sub-Saharan Africa and smaller emerging economies is also looking a sound investment as all again are set to return to growth at higher rates.

There are a number of conclusions that can be drawn from these predictions:

- China’s Belt & Road Initiative Investments look to have been resilient in the wake of Covid-19;

- Foreign Direct Investment remains a good bet in China, India, the ASEAN5 of Indonesia, Malaysia, Singapore, Thailand and Vietnam;

- Emerging BRI economies in Latin America, Middle East and Africa are also expected to perform well.

In essence then, after a deep dip in 2020, nothing in terms of the investment fundamentals in the emerging economies of the world – and especially Asia, Africa and Latin America will have changed that much. Asia especially remains attractive.

There remains however a large question of the sustainability of the position of the United States versus China. With American GDP growth expected to reach 4.5% next year, China will significantly over-perform against the US with an expected 8.2% performance. How long political motives will continue to influence American investors looking for larger and faster returns of their investments may show signs of waning. US elections meanwhile will be out of the way by the year end, meaning 2021 can at least have some degree of certainty as concerns China trade and investment for the year. But for now, the International Monetary Funds statistics appear to show just why China has invested in the Belt & Road Initiative, and point to why investors in the advanced economies of the United States and Europe should continue their investment stance when it comes to China, India and ASEAN, and perhaps look at jumping into some of the BRI markets as well. That is a stance also taken by China’s Central Banks, who view BRI investments as sustainable compared with other forms of external debt, particularly given it is often proportionally less significant. Despite growing global trade tensions, protectionist policies have yet to impact BRI membership and investments.

There are other reasons to consider BRI. Although some analysts have pointed to a slow-down of Chinese investment in the BRI this year, the reason is not to do with any failures. Instead, it is a natural progression – despite Covid-19, many BRI investment projects intended to create supply chains and facilities to and from China have reached the end of their initial investment phase – the building is slowing down and there is not so much need now for investment capital.

The second phase of BRI investment is instead underway, and that is the soft investment, often in technologies, at a time when the world is going through a revolution in the way in which business is conducted. Investments into digital technologies are part of this second wave, as are the people required to operate them. A.I, Fintech and Blockchain are all part of this, and China and other BRI nations such as Russia are very much at the global forefront of this.

In June, China announced the launch of the Digital RMB Yuan, an event missed by much of the Advanced Economy media. Yet this will make China the first major economy to take such a step. Other signs are in China actively recruiting and incentivizing new technology talent.

For foreign investors, the issue with the BRI is that the ability to finance the routes has already been taken; and mainly by Chinese banks. Yet the infrastructure exists, has been funded and is now nearly all operational. Smart investment funds and businesses should be looking at where BRI interconnectivity is going to spur increased trade, footfall and need for additional infrastructures. China has been savvy in investing in route and trade security. Now that is done, the opportunities to invest in the soft technologies and builds – anything from shopping centres, to car parks to all types of trade utilization machinery and software is the new opportunity.

Covid-19 has shown this is sustainable. The IMF appear to concur. The signals could not really be much clearer as where 2021 foreign investment should be conducting research with a view to enhanced growth at rates often superior and less competitive than can be gained at home.

This article was updated on July 31 to reflect new United States GDP figures for the April-June period which differ considerably from the IMF data depicted.

Related Reading

- COVID-19’s Grim Milestones: Impact on Business is Real but Opens Up New Growth Areas

- Impact Of Covid-19 On China’s Global Belt & Road Project Financing – Q&A

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com