The Belt & Road Initiative: Investments in 2021 and Future Outlook

Op/Ed by Sofia Baruzzi

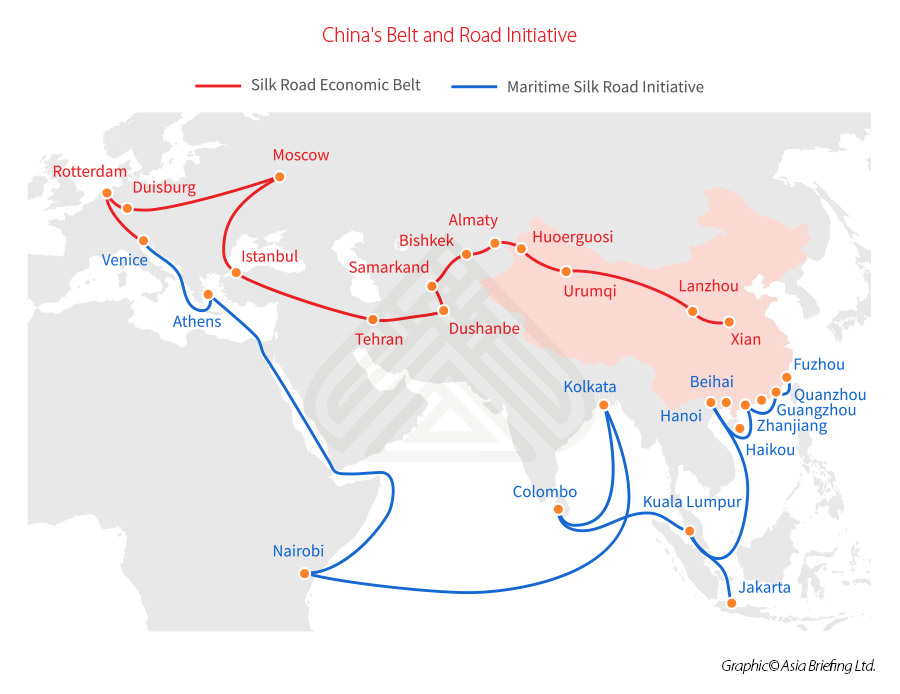

The Belt and Road Initiative (“BRI”) comprises a Silk Road Economic Belt – a trans-continental passage that links China with South East Asia, South Asia, Central Asia, Russia, and Europe by land – and a 21st century Maritime Silk Road, a sea route connecting China’s coastal regions with South East and South Asia, the South Pacific, the Middle East and Eastern Africa, all the way to Europe.

As of February 2021, the number of countries that have joined the BRI by signing a Memorandum of Understanding (MoU) with China is 140.

The BRI aims at creating and strengthening policy coordination, infrastructure connectivity, unimpeded trade, financial integration, and connecting people across the countries involved in the initiative.

The BRI is also flexible and dynamic – able to serve cross-sectional needs that appear from time to time at the global level: an example is the idea of a Health Silk Road, a project dating back to 2015 that revealed its value amid the COVID-19 pandemic.

Another example is the Digital Silk Road, initially a loose proposition within the BRI, aims to improve recipients’ telecommunications networks, AI capabilities, cloud computing, e-commerce and mobile payment systems, surveillance technology, smart cities, and other high-tech areas. Countries in Africa, the Middle East, and parts of Eastern Europe, Latin America, and South East Asia require inexpensive, high-quality technology to build up their wireless phone networks and improve broadband internet coverage.

China’s Outbound Direct Investments in the BRI

As highlighted above, one of the main purposes of BRI is to enhance cooperation and facilitate commercial linkages across geographies, from the Eurasian continent to Africa, the Americas and Oceania, thus producing new platforms for international trade and investment and offering new ways for improving global economic governance. The COVID-19 pandemic has undeniably affected the global economy, but China was the only major economy to post growth in the pandemic-ravaged year.

On February 2, 2021, the Ministry of Commerce released China’s Outbound Investment, Cooperation and Development Report 2020, summarizing the characteristics and experience of China’s outbound investment and cooperation, relevant policy measures, and stressing China’s intention to look forward to future development opportunities.

While China’s outbound investment dropped from US$222 billion in 2016 to around US$50 billion in 2020 – as we explained here – China has spent some US$4 trillion on the BRI over the past seven years, and many BRI projects are now coming to completion.

Moreover, according to the data provided by the Ministry of Commerce, as of May 2020, China has signed 200 cooperation documents for the joint construction of the “Belt and Road” with 138 countries and 30 international organizations, and the interconnection framework of “six corridors, six routes, multiple countries and multiple ports” has taken shape.

In 2020, Chinese enterprises invested US$17.79 billion in non-financial direct investment in 58 countries along the BRI, an increase of 18.3 percent year-on-year, accounting for 16.2 percent of the total in the same period, an increase of 2.6 percentage points from the previous year.

The contract value of newly signed projects in the countries along the route was US$141.46 billion, and the completed turnover was US$91.12 billion, accounting for 55.4 percent and 58.4 percent of the total in the same period.

Investment in the fields of leasing and business services, wholesale and retail, scientific research and professional technical services, power production and supply has grown rapidly. In 2020, investment in the leasing and business services industry was US$41.79 billion, an increase of 17.5 percent year-on-year; US$16.07 billion in wholesale and retail, an increase of 27.8 percent year-on-year; investment in power production and supply, scientific research, and professional technical services increased respectively 10.3 percent and 18.1 percent.

Such data confirm a steady growth and development of China’s economy, despite the global crisis and the pandemic.

Perspective on the BRI’s future

International FDI trends and repercussions on BRI’s investments According to the UNCTAD Investment Trends Monitor’s report, global Foreign Direct Investments (“FDI”) collapsed in 2020, slowing down by 42 percent to an estimated US$859 billion, from US$1.5 trillion in 2019, while China became the largest FDI recipient, attracting an estimated US$163 billion in inflows.

The data showed that the decline was concentrated in developed countries, where FDI flows fell by 69 percent to an estimated US$229 billion, the lowest level in 25 years.

Pursuant to the UNCTAD report, an FDI recovery is not expected to start before 2022, and any increase in global FDI flows is more likely to come not from new investments in productive assets but from cross-border M&As, especially in technology and healthcare – two industries affected differently by the pandemic and on whose growth, China is focusing its national development goals.

The economic crisis brought on by the COVID-19 pandemic will affect FDI movement in the near term. Less projects will be able to be completed due to closure of sites, there could be slowdown in cross-border M&A transactions, and non-starter of new projects, thus leading to tightening margins for reinvesting earnings. Other factors include possible global investment restrictions and lower available budget in several countries as spending for economic stabilization will be prioritized.

These factors and potential outcomes must be considered while assessing the BRI’s investment outlook. But these are also short-term pain points, and the connectivity and infrastructure established under BRI routes will be important for many countries seeking industrial innovation, access to critical resources, and to promote trade enterprise.

Meanwhile, the COVID-19 context and ongoing high-tech revolution, indicates that the BRI’s future investments will be focused on the healthcare and digital sectors, more than others. These two industries are key areas for investment growth for China and most other countries. The BRI demonstrates capacity to ensure connectivity across the world to facilitate movement of knowledge and products even during a global crisis.

Moreover, it is worth remembering that the BRI is also a tool through which China attracts foreign investments – an encouragement that can be considered within the broader context of the Chinese Dual Circulation Strategy. Indeed, by means of the BRI, China allows foreign capital and knowledge to further flow into its market while also creating the conditions needed for increasing domestic demand and diminishing dependency on foreign countries.

The Health Silk Road

As mentioned at the beginning of this article, one of the BRI’s features is its resiliency and flexible role, allowed by the Chinese government. Around March 2020, China doubled down on its efforts to recast itself as a responsible global health leader, launching a widespread public diplomacy campaign and sending medical aid worldwide.

China provided various countries with medical supplies, not only engaging in direct consultation with foreign embassies but also sending such items to several companies involved in BRI projects. This accelerated the development of the Health Silk Road, an aspect of the BRI that was already planned at the time of the BRI’s inception, but, in connection with the pandemic, assumed importance – furthered by China’s focus on developing its healthcare sector.

The Digital Silk Road

This year, beyond the pandemic, the trend towards digitalization could trigger another reconfiguration of the BRI – through a refocus on developing sectoral capacity to assist technology innovation among participating countries. The technology sector is a key focus area of China’s national development strategy, and will likely have repercussions at the international level, which includes the BRI.

Chinese firms are actively investing in developing countries by establishing training centres as well as research and development programs to boost cooperation between these countries and their Chinese counterparts, and to transfer technical knowledge in areas, such as artificial intelligence, robotics, and clean energy.

Hence, under this perspective, the BRI will work – and is already working – as a channel through which knowledge, people, high-tech products, and technologies in general can flow, to meet the necessities linked to this technology-based era.

Sofia Baruzzi is an Editorial Research Assistant with Dezan Shira & Associates. Originally from Parma she has rich experience in Chinese law with a view to assisting Italian businesses interested in the Belt & Road Initiative. Please contact italy@dezshira.com or visit us at www.dezshira.com

Related Reading

- The Belt And Road Initiative’s First Electric Vehicle

- Italy’s Palermo Set to be a Belt and Road Port

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com