Brazil’s Da Silva Proposes A Latin American Currency ‘To Be Free Of The US Dollar’

Brazil’s left wing leader and previous President, Lula Da Silva is due to fight the national Presidential elections in October this year and has stated that as part of the manifesto, “We are going to create a currency in Latin America, because we can’t keep depending on the dollar.”

Da Silva, popularly known as ‘Lula’ stated that it would be used for LatAm trade, instead of having to use US dollars in cross-border trade. Countries in Latin America would still keep their sovereign domestic currency. He stated that the currency would be called the Sur, which means “South” in Spanish, and that the goal of the currency would be to deepen Latin American integration and strengthen the region’s economic sovereignty, weakening its dependence on the United States.

Under Brazil’s current government, led by far-right leader Jair Bolsonaro, the South American giant has subordinated itself to Washington, although there have been signs of stress in Brazil’s relations as well. Bolsonaro agreed a trade deal with Russian President Putin in February, just weeks before the Ukrainian conflict blew up.

If he returns to the presidency, Lula pledged that Brazil “will strengthen its relations with Latin America” and also vowed to revive the BRICS system, integrating Brazil, Russia, India, China, and South Africa in an independent economic architecture to challenge Western financial hegemony. The BRICS have also been discussed the development of a BRICS Pay multilateral wallet and currency.

In 2020, Lula published a call “For a Multipolar World.” He explained his goal is “the creation of a multipolar world, free from unilateral hegemony and from sterile bipolar confrontation,” that “would permit a true re-founding of the multilateral order, based on principles of real multilateralism, in which international cooperation can truly flourish.”

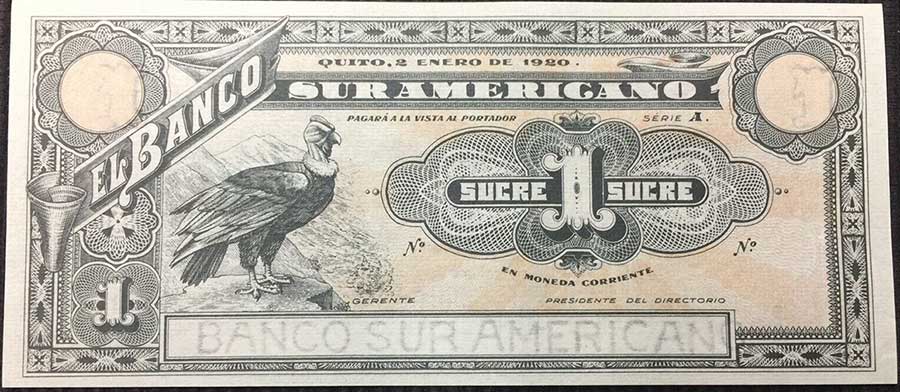

It is not the first time a pan-Latin American currency has been proposed or traded. Venezuela’s former president Hugo Chávez developed an international currency as part of the Bolivarian Alliance (ALBA), an economic coalition of left-wing governments in Latin America and the Caribbean.

This currency was called the Sucre, and was adopted in 2009 by Venezuela, Nicaragua, Cuba, Bolivia, and Ecuador. At its peak in 2012, the Sucre was used for more than US$1 billion in bilateral annual trade in the region. However, the Sucre fell out of use by 2016, following Chávez’s death in 2013, a massive drop in commodity prices in 2014, the imposition of US sanctions on Venezuela in 2015, and violent coup attempts against Chávez’s successor Nicolás Maduro.

Global criticism of the current monetary system has become especially strong in the wake of the Russia-Ukraine conflict with numerous significant economies highly wary of the use of what were originally planned to be global trade systems now being used by the United States to impose its will according to its own foreign policy rather than abiding by global institutions and other nation’s needs. This has led to accusations of the US dollar deviating from its use as an intended global currency to that of a US trade weapon, and the SWIFT global banking network also being used by the US to cut off countries who challenge it.

It has taken time, but aggressive US trade and sanctions policies have resulted in a realization elsewhere amongst other major world economies that when using any national currency as a global currency, six types of instability rise to the surface: environmental, economic, social, financial, political, and ideological. Excessive use of the US dollar to impose Washington’s unilateral will is likely to result, combined with new technologies such as Fintech, into a fracturing global economic system with a variety of digital and asset backed currencies being used in multilateral trade.

Both China and Russia have made inroads into Latin America in recent years. Ecuador and Cuba have signed Trade Agreements with the Eurasian Economic Union, while Brazil and Chile are holding negotiations. Twenty regional LatAm and Caribbean nations are members of the Belt and Road Initiative, signaling a desire to follow alternative paths to US trade agreements which have tended to exploit LatAm resources and low cost labor without leaving much on the ground for the regional economies.

Related Reading

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The firm assists British and Foreign Investment into Asia and has 28 offices throughout China, India, the ASEAN nations and Russia. For strategic and business intelligence concerning China’s Belt & Road Initiative please email silkroad@dezshira.com or visit us at www.dezshira.com