India’s Export Opportunities Along the International North South Transport Corridor

By Naina Bhardwaj, India Briefing

Exploring India’s trade and export opportunities via Iran and the International North-South Transportation Corridor

The International North South Transport Corridor (INSTC) connects India with Central Asia, Russia, and has the potential to expand up to Baltic, Nordic, and Arctic region, increasing the scope of trade multifold. It also has the potential to transform the economies of countries along the corridor into specialized manufacturing, logistics, and transit hubs. In June 2021, INSTC’s western corridor was operationalized to connect India with Europe for the first time. Efforts are underway to operationalize the eastern corridor, which will connect China with Russia and European countries via Central Asian countries. India wants the Chabahar port to be included in this eastern corridor.

Increased physical connectivity via the INSTC’s shortened routes will facilitate access to newer markets. The flow of goods and services will inevitably improve information sharing mechanisms along the corridor, which can reverse the existing demand deficit in the member nations. In terms of potential, the future creation of industrial parks and SEZs to develop specific sectors, such as pharmaceuticals and agriculture, would add commercial and substantive value to this connectivity corridor. As internet connectivity strengthens across INSTC member countries and the overall corridor region, cross border e-commerce is another sector that stands to gain the most.

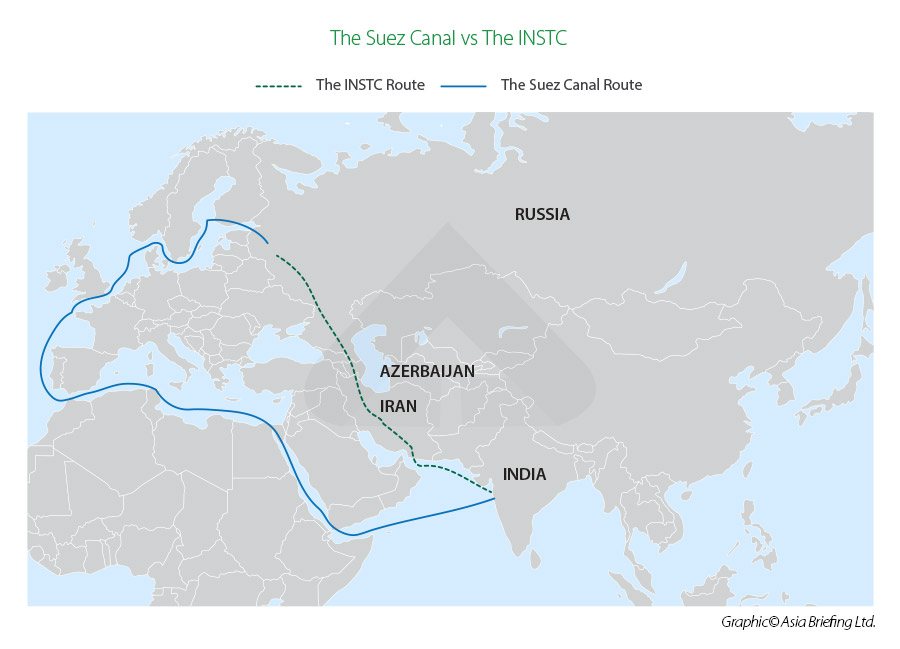

Last year’s Suez Canal blockage, which roughly cost 12 percent of global trade and reportedly held up trade valued at US$9 billion per day, has amplified the optimistic outlook towards the International North South Transport Corridor (INSTC) as a cheaper and faster alternative multimodal transit corridor.

The INSTC connects India with Central Asia, Russia, and has the potential to expand up to Baltic, Nordic, and Arctic region. This connectivity initiative, when viewed with its underlying commercial advantages, can bring about a transformative development in the region, facilitating not just transit but humanitarian assistance as well as overall economic development.

For India, it provides a shorter trade route with Iran, Russia, and beyond to Europe, creating scope for increased economic engagement and direct trade opportunities with untapped markets in Central Asia and the Balkans. When looked at in sync with the Ashgabat Agreement, the INSTC could be the key to India’s “Connect Central Asia’’ policy. In fact, India hosted the first India-Central Asia Summit in virtual format on January 27, 2022, which was attended by Presidents of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. Included in the talks were proposals to further cooperation in areas of trade and connectivity.

What is the International North South Transport Corridor?

The INSTC is a 7,200 km-long multimodal transportation network encompassing sea, road, and rail routes to offer the shortest route of connectivity. It links the Indian Ocean to the Caspian Sea via the Persian Gulf onwards into Russia and Northern Europe. It is aimed at reducing the carriage cost between India and Russia by about 30 percent and bringing down the transit time by more than half.

It was launched in 2000 with India, Russia, and Iran as its founding members and work on actualizing the corridor began in 2002. Since then, INSTC membership has expanded to include 10 more countries – Azerbaijan, Armenia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkey, Ukraine, Syria, Belarus, and Oman. Bulgaria has been included as an observer state. The Baltic countries like Latvia and Estonia have also expressed willingness to join the INSTC.

Architecture of the INSTC: Transport Routes and Modes

The INSTC spirals across the following corridors:

Central corridor: It begins from the Jawaharlal Nehru Port in India’s western state of Maharashtra (in the Indian Ocean Region) and connects to the Bandar Abbas port on the Strait of Hormuz. It then passes through the Iranian territory via Nowshahr, Amirabad, and Bandar-e-Anzali, runs along the Caspian Sea to reach the Olya and Astrakhan Ports in Russia.

Western corridor: This connects the railway network of Azerbaijan to that of Iran via the cross-border nodal points of Baku (Azerbaijan) and Astara (Iran) and further to Jawaharlal Nehru (Mumbai) port in India via the sea route.

Eastern corridor: It connects Russia to India through the Central Asian countries of Kazakhstan, Uzbekistan, and Turkmenistan.

India has proposed the inclusion of the India-invested Chabahar Port in Iran within the scope of the INSTC, which has traction among Central Asian countries as well. India had also backed the extension of membership to Afghanistan and Uzbekistan and envisaged an “eastern corridor” comprising a land route between Kabul (Afghanistan) and Tashkent (Uzbekistan). Chabahar port holds significance for India as it helps India bypass its fractious neighbor Pakistan, which has blocked India’s access to Afghanistan and other landlocked Central Asian Region (CAR) countries. Chabahar is also often pitted against the China-invested Gwadar port in Pakistan. Meanwhile, the Iranian government has invited China and Pakistan to consider the integration of Gwadar into the INSTC, calling it Chabahar’s “twin sister”.

What is the Economic Rationale for the INSTC?

Even though the progress of the corridor has been sluggish in the last two decades, it has recently picked up pace, motivated by several geopolitical and geo-economic developments. While there may be several factors, including rebalancing of power, at work in the conceptualization and steering of the corridor, its sustainability and success mainly rests on its economic viability as well as commercial benefits accrued by the participating nations. The primary reason it may hold solid ground in the future is its equality-based approach, which provides the same level playing field to all the members, juxtaposed with its Chinese counterpart, the patronage-based Belt and Road Initiative.

India has accorded priority to economic integration with the member nations and has accordingly concluded Double Taxation Avoidance Agreements (DTAA) and Bilateral Investment Protection Agreements (BIPA) with some member states.

India has signed DTAAs with Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russian Federation, Turkmenistan, Ukraine, and Uzbekistan. Negotiations are ongoing for signing the same with Azerbaijan and Tajikistan. Steps are being taken for initiating negotiations with Georgia and Moldova.

India has signed BIPAs with Kazakhstan, Kyrgyzstan, Uzbekistan, Turkmenistan, Tajikistan, Ukraine, Russian Federation, Armenia, and Belarus. Steps will be taken for signing BIPAs with the rest of the Commonwealth of Independent States (CIS) countries, that is, Azerbaijan, Georgia, and Moldova.

Potential Transport and Logistics Gains from the INSTC

The INSTC envisages development and simplification of transportation services catering to both goods as well as passengers, while at the same time providing an increased market access to the member nations who can also benefit through various backward and forward linkages.

The member nations can develop themselves as logistics and transit hubs but can also focus on developing themselves as manufacturing hubs through hard and soft infrastructural development. The focus is also on enhancing route security, besides focusing on environmental protection.

Short distances and faster deliveries lead to cost reduction: INSTC boasts of the shortest trade route connecting India with Russia. According to a study conducted by the Federation of Freight Forwarders’ Association of India (FFFAI) in 2014, INSTC was 30 percent cheaper and 40 percent shorter than the traditional Suez route, slashing the transit time to an average of 23 days for Europe-bound shipments from the 45-60 days taken by the Suez Canal route.

Increased market access along with creation of new markets: Cheaper cost of transport will lead to increased competitiveness of Indian exports, opening access to unfulfilled markets.

Facilitation of transit by helping develop regional transit and logistics hubs: Under the agreement, Iran and Azerbaijan are expected to develop into transit hubs. In India, Nagpur and Bhiwandi from Maharashtra state are identified as potential logistics hubs. With an estimated capacity of 20-30 million tons of goods per year, the corridor facilitates transit and trade connectivity.

Creation of regional supply chains across Eurasia: The creation of diverse supply chains across Eurasia might surely alter the stereotype of East as the producer and West as the consumer.

Increased trade volume between member nations: The trade statistics among the member nations of INSTC reveal a dismal picture so far. Exports from India form a mere one percent of total exports in the CIS region. With Russia, India’s trade has so far been restricted to energy and defense. India also has a huge trade deficit with Russia. The most cited reason for negligible trade in other goods is lack of information on Indian markets among the Russian business class. The trade situation in the Central Asian Region is no better with India having a negligible share in the countries’ imports. The main reason for low trade with the landlocked Central Asian countries is lack of connectivity, which has now been taken care of with Iran’s Chabahar Port. The INSTC will not only enhance physical connectivity but will also improve knowledge and information sharing mechanisms.

Creation of backward and forward linkages: The member nations along the INSTC will get the opportunity to transform themselves into specialized transit and manufacturing hubs through infrastructural development. This will also simulate local industry, manufacturing, and trade along the way, thus transforming this transport corridor to a developmental corridor. It will also help in creating further employment and growth opportunities, leading to betterment in overall economy of the bloc.

Supply of energy as a commodity: With India being the fifth largest energy consumer in the world, consuming 4.4 percent of the world’s total, improved connectivity and trade prospects with the energy rich member nations cannot be overlooked. Also, another prospect of an oil pipeline development along INSTC cannot be ruled out.

Synchronization of INSTC with Ashgabat Agreement and Organization of the Black Sea Economic Cooperation (BSEC): Linking INSTC to existing transport initiatives in the Central Asian region like BSEC (Europe-centric) and the Ashgabat Agreement (Central Asia-centric) will expand trade linkages and opportunities in the region.

Potential materialization of free trade agreements (FTAs) in the region: There have been talks of signing an FTA between India and the Eurasian Economic Union (EAEU): It will provide the much-needed impetus to the trade momentum between different countries in the region. Access to the EAEU nations alone will open India to a market of 173 million people.

Possible synchronization with Baltic, Nordic, and Arctic corridors in the future: Alongside the North Sea-Baltic Corridor, INSTC may synchronize with the Scandinavian-Mediterranean (ScanMed) Corridor and the planned Arctic Corridor in the future.

What are India’s export opportunities along the INSTC?

Iran

Indian exports to Iran have substantially reduced by half since 2020, following the harsh economic sanctions placed by former US President Trump on Iran. However, with US President Joe Biden taking office in January 2021, some relief in the sanctions can be expected. India and Iran’s relationship has deepened with India being Iran’s major oil importer. Despite the sanctions, India and Iran have managed to sustain this relationship, with few hiccups.

In the period between April 1996 to March 2015, the cumulative approved Indian FDI in Iran stood at US$183.4 million. Large Indian companies, such as ESSAR, OVL, Tata Steel, Persia Rohit Mines & Industries Company, etc., have a presence in Iran.

India’s exports to Iran include rice, machinery and instruments, metals, primary and semi-finished iron and steel, pharmaceuticals and fine chemicals, processed minerals, manmade yarn and fabrics, tea, organic/inorganic/agro chemicals, rubber manufactured products. Over 80 percent of India’s imports from Iran are comprised of crude oil.

Other potential items that can enhance Indian exports to Iran are machinery and instruments, electrical, electronic equipment, vehicles other than railway, tramway, plastics and plastic articles, optical, photo and technical apparatus, pharmaceutical products, animal vegetable fats and oil, ceramic products and pearls, precious stones.

Meanwhile, it has been reported that Iran and Qatar plan to launch regular shipping lines between the two countries’ ports. A link to Qatar offers further development of the INSTC reach. That will be to Qatar’s new Hamad Port, located south of Doha in the Umm Al-Houl area. Construction of the port began in 2010; it was officially opened in September 2017 and became fully operational in 2020. Hamad is capable of handling up to 7.8 million tons of products annually, the bulk of trade which passes through the port consisting of food and building materials. The shipping distance is 613 nautical miles, and will allow additional connections to the Gulf States from Europe, the Caucasus, Russia and Central Asia, as an alternative to the Suez Canal.

Afghanistan

Although Afghanistan is not yet formally a part of INSTC, India has proposed its inclusion at the recent 2021 maritime summit. India’s exports to Afghanistan have almost doubled in the last five years, touching almost US$1 billion in 2020. India’s imports from Afghanistan have also increased by 72 percent between 2015-16 and 2019-20 to reach around US$530 million in 2020. Lacking a direct border with Afghanistan, India has been denied connectivity by Pakistan. Therefore, India and Afghanistan instituted an Air-Freight Corridor in 2017.

The Chabahar port in Iran is operational, and was used to ship 75,000 MT of wheat as humanitarian food assistance to Afghanistan in September 2020 due to the pandemic.

The top five items that India exports to Afghanistan are textile, sugar, transmission towers, tobacco, and medicines. The import basket from Afghanistan to India is dominated by dried figs, asafoetida, raisin, saffron caraway fennel, and onion.

Russia

The bilateral trade between India and Russia stood at US$11.6 billion in 2019 wherein Indian exports stood at US$3.92 billion and Russian exports, US$7.24 billion. Both countries have agreed to grow bilateral trade to reach US$30 billion by 2025.

Major items of export from India include electrical machinery, pharmaceuticals, organic chemicals, iron and steel, apparels, tea, coffee, and vehicle spare parts. Major items of import from Russia include defense equipment, mineral resources, precious stones and metals, nuclear power equipment, fertilizers, electrical machinery, articles of steel, and inorganic chemicals. India has not supported the recent UN condemnation of Russia concerning the current situation in Ukraine and is actively seeking trade ties despite this. New Delhi is currently negotiating a Free Trade Agreement with the Eurasian Economic Union (EAEU) of which Russia is the dominant trade player.

Turkey

India and Turkey have robust trade ties with trade volume reaching its pinnacle in 2018 at US$8.6 billion. In 2020, the trade volume declined to US$5.7 billion due to political disagreements and possibly the pandemic.

The major Indian exports to Turkey include petroleum products, auto components/parts, man-made yarn, fabrics, made ups, aircraft and spacecraft parts, plastic raw materials, organic chemicals, dyes, industrial machinery, etc. Imports from Turkey include industrial machinery, broken/unbroken poppy seeds, machinery and mechanical appliances, iron and steel articles thereof, inorganic chemicals, pearls and precious/semi-precious stones and metals (including imitation jewelry), granite and marble, etc.

Several major multinational Indian companies like TATA, Mahindra, TAFE, etc. have invested in Turkey. The total Indian FDI in Turkey is US$125 million and Turkey has invested FDI worth US$223 million in India as per data provided by the Embassy of India in Ankara.

Azerbaijan

India’s bilateral trade with Azerbaijan has increased substantially from around US$50 million in 2005 to around US$1,093 million in 2019. However, due to the pandemic, it declined to US$583 million in 2020.

The exports from India to Azerbaijan comprise of rice, mobile phones, drugs/human vaccine, centrifugal liquid pumps, taps and valves, kali and natrium bromide, devices and equipment of automatic regulation and control, meat, mechanical spades and excavators, stones, tiles and granites, etc. The primary import from Azerbaijan to India is crude oil. Other import items from Azerbaijan are iodine, jet fuel, and plants for perfumes. The surge in bilateral trade can be put down to the launching of the Baku-Tbilisi-Chaney (BTC) oil pipeline to the Mediterranean port, from where Indian oil companies have been buying substantive quantities of crude oil.

Potential Indian Export Sectors That Will Benefit from the INSTC

The sector that stands to gain most out of the inherent advantages that INSTC offers in terms of shorter distances, is that of perishable goods, including fruits and vegetables, that comprise more than 50 percent of India’s export basket to the European Union.

Another sector that can gain from the shorter distance and faster delivery time are high value items like ATMs, industrial printers, 3D printers, robotic assembly accessories, etc.

Also, it has been seen that trade between India and the CIS region is inclined towards primary commodities and lower-end manufactured goods. In recent years, though, India is in active pursuit to become a global manufacturing hub, as also indicated by the recently launched production-linked incentive schemes. India aims to establish itself as a leading manufacturer of pharmaceuticals, electronics, aircrafts and accessories, etc. and these Indian manufactured goods can find attractive markets along the INSTC corridor.

Another sector poised to benefit the most out of this corridor is cross-border e-commerce. Domestic e-commerce has been growing at an exponential pace and with the internet connectivity of the region strengthening, the scope for global e-commerce has also widened. High freight and shipping charges have always been a roadblock but with the INSTC logistics network, especially rail connectivity, these shipping and freight charges will be substantially cut. In India, Aurangabad in Maharashtra state has been identified as having the potential to emerge as a hub catering to e-commerce firms.

Other important sectors that can expect a surge in exports are:

Agriculture and allied products (coffee, tea, spices, edible fruits, fish)

Articles of apparel (not knitwear)

Engineering – aircrafts and parts thereof

Organic chemicals

Rubber and articles

Optical, photo, and medical instruments

Project exports pertaining to petroleum, heavy engineering, and hydrocarbon sectors

What is the progress of the INSTC?

Often hailed as a game changer in India’s Eurasian and Central Asia policy, the pace of INSTC development was unfortunately slow. However, with connectivity prospects improving after India’s accession to the Shanghai Cooperation Organization (SCO) in 2017 and Ashgabat Agreement in 2018, developments along the corridor have picked up pace.

In 2020, the state-owned Container Corporation of India (Concor) and Russian Railways Logistics Joint Stock Company (RZD) signed an MoU to transport cargo via the INSTC. Now with US President Biden displaying a more progressive approach, the outlook for full operationalization of the corridor looks promising, as other countries can hopefully grow their economic partnership with Iran without worrying about US sanctions.

From April 2021, under the Biden administration, the US has been working towards reversing Trump’s abrupt move of pulling out of the Joint Comprehensive Plan of Action (JCPOA) concerning Iran and renegotiating US entry into it, thereby easing economic sanctions on Iran. With the recent 2021 Iran elections and Ebrahim Raisi’s accession to power as Iranian President, hopes have been renewed as Raisi has backed talks between Iran and six world powers (China, France, Germany, Russia, UK, and the US) to revive the JCPOA deal.

On June 21, 2021, INSTC’s western corridor was operationalized to connect India with Europe; a Finnish logistics company was the first to use the multimodal corridor to dispatch consignments from Vuosaari in Finland to Mumbai in India. A consignment of 30 containers of 40ft each were sent via train from Vuosaari in Finland, which crossed Russia and Azerbaijan to reach Astara (Azerbaijan) in approximately eight days. From Astara, the containers were transported to the Bandar Abbas port in Iran and further shipped to the Nava Sheva port in Mumbai, India. The route travel time is around 22 days, as compared to the 40 days’ time earlier taken via the traditional Suez canal and western European port routes.

In February 2022, The Economic Times reported that the United Nations Economic and Social Commission for Asia and the Pacific has been pursuing the eastern corridor, which will connect China with Russia and European countries via Central Asian nations.

Funding

While India has backed the development of the port, free trade zone, and railway line at Chabahar, Azerbaijan has loaned a sum of US$500 million to Iran for the completion of the 167-kilometer standard gauge rail line connecting Rasht and Astara. The Asian Development Bank (ADB) has increased the line of credit to Azerbaijan from US$200 million to US$400 million for the development of the 441-kilometer Baku-Yalama railway line – connecting the capital of Azerbaijan with the Yalama border at Russia. This railway line comes within the framework of INSTC.

Both ADB and Islamic Development Bank have provided loan financing to the Kazakhstan-Turkmenistan-Iran railway link that is also being funded by the governments of Kazakhstan, Turkmenistan, and Iran.

Iran has also invited China to invest in the corridor. Japan, through the Japan International Cooperation Agency (JICA), Japan Bank for International Cooperation (JICA), and other banks has also expressed interest in financing INSTC projects and investing in the Chabahar Free Trade-Industrial Zone.

The Path Forward

Although the INSTC, if realized in full, can open massive opportunities for all the stakeholders, the actualization of all its potential advantages will require a lot more in terms of finance, cooperation, political will, as well as strategic planning. The ambitious INSTC needs a regular, dedicated, and planned source of funding to bring its objectives to fruition, which is unfortunately absent. In fact, lack of proper funding and a single large investor has been widest bottleneck till date. It also lacks private sector funding mainly because of certain security threats like spread of the Islamic State (IS) in the region, domestic political instabilities etc. Another issue which needs to be looked at is differential tariffs and customs in the region. Although many countries in the region are in talks for harmonization of duties along the corridor.

For the trade volume to increase, a more important step is to increase informational connectivity to create demand. A look at the export of goods from South Asia and Southeast Asia to Europe via the Suez Canal route presents a disappointing picture. Unless an effort is made to correct this demand deficit, a project as huge and ambitious as INSTC will lay under-tapped and unfulfilled.

However, the INSTC provides the opportunity to member countries to collaborate in a manner that fosters increased economic integration. Creation of industrial parks and special economic zones (SEZs) to develop sectors of mutual interest, such as pharmaceuticals and agriculture, will also add commercial and substantive value to this connectivity corridor.

Related Reading

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The firm assists British and Foreign Investment into Asia and has 28 offices throughout China, India, the ASEAN nations and Russia. For strategic and business intelligence concerning China’s Belt & Road Initiative please email silkroad@dezshira.com or visit us at www.dezshira.com