China’s Health Silk Road – Analysis, Covid, Financing & Global Implications

Henry Tillman of China Investment Research was interviewed by the Beijing Examiner for an exclusive article released during last week’s Boao forum. This followed on from the firms recently released “The Health Silk Road Bridge”. Not all of Henry’s interview was published, however with kind permission of the author we reproduce the interview in full as follows:

Why did you name your new report “The Health Silk Road 2020: A Bridge to the Future of Health for All?”

After gaining control of COVID on a domestic basis, from a period of early March until late October last year, a period of only 7 months, China provided medical assistance to over 150 countries. This is extraordinary. In addition to medical assistance, it also provided financing to numerous countries adversely effected by the virus, both directly by the Chinese government and its policy banks and via multi-lateral banks, in addition to the World Health Organization and Covax. Throughout 2020, Chinese biotech companies subsequently developed, tested, and began distributing vaccines by year end.

These global partnerships/relationships extended beyond the circa 140 countries which had previously signed the BRI MoU, including to selected EU and North Asian countries. North American based pharma companies which had partnered with Chinese biotech companies previously played a key role to help them develop in strength and scope to the point of producing the first Chinese vaccine less than one month after Pfizer. As such, we saw this 2020 China led effort as extending beyond the BRI to all mankind, globally.

Why is the Health Silk Road important to global public health governance?

In 2020, China demonstrated global leadership in being the first country to control the virus, then rapidly changing course to provide time sensitive medical aid focused on countries which had already signed the BRI as well as to selected EU and North Asian countries. While China effectively became a benefactor to these countries in several ways, strengthening their prior relationships, they also became much more linked with global healthcare organizations cemented with a total of US$50 million investments into the WHO during H1 2020 (194 member states) and by joining Covax (180 countries) in H2 2020.

The combination of this global coalition as well as what we perceive as being the development of several hub and spoke hubs along the 140 country BRI, can provide updated medical data as well as base of identifying possible future pandemics – which most observers expect to occur.

COVID-19 prompted China to participate more positively in global health cooperation, with measures such as sending medical teams to foreign countries for assistance, providing vaccines and pandemic-fighting loans to developing countries, participating international cooperation. Is there any new data you can share with us in the above-mentioned regards?

After we finalized the Q3 data for our report, Q4 saw additional AIIB COVID-19 loans to the Cook Islands (US$20 million), Cambodia (US$60 million), Ecuador (US$50 million), Turkey (US$200 million), Uzbekistan (US$200 million) as well as committing US$30 million to Legend Capital Co. Ltd fund (China) for enhancing healthcare digitization. Also in Q4, NDB extended COVID-19 related loan facilities to India (US$1 billion) and to Brazil (US$1 billion), both in December 2020.

In Q1 2021, AIIB approved COVID -19 related facilities to Philippines (US$300 million), Sri Lanka (US$180 million), and Bangladesh, two facilities, one for US$260 million and one for US$300 million. NDB approved a US$1 billion COVID-19 credit facility for China in Q1. While both aggregate amounts and volume both have declined from Q2/3 2020, both of these institutions remain active in COVID-19 related loan assistance. China owns minority stakes only in these banks: 26% of AIIB and 20% of NBD.

How do you interpret the growth of mutual-investment between China and foreign countries in the health and pharmaceutical field?

As you have seen from our study outbound healthcare investments, partnerships joint venture (JV) and licensing agreements gained pace through Q3, which is when our study concluded. We can now confirm this trend continued in Q4. Our numbers are in line with Gordon Orr, a global consultant, who mentioned in March 2021 that over 250 partnerships launched just in 2020 between Chinese and non-Chinese pharmaceutical companies. Many were to license China developed innovative drugs for sale globally – a reflection of advances in Chinese pharma and biotech R&D.

Financing of China’s capital market in the country’s health and pharmaceutical enterprises has increased, how do you think this will contribute to the global health?

According to Pitchbook, VC investment in biotech & pharma saw US$28.5 billion invested across 1,073 deals up 60.5% driven in part by the importance of vaccine development. The IPO market for VC-backed biotech companies saw US$11.5 billion raised across 73 biotech public listings in 2020. This led to a global #2 ranking for HKEX (US$51.2 billion IPO proceeds), #3 for Shanghai Stock Exchange (US$51.0 billion IPO proceeds) and #5 for Shenzhen Stock Exchange (US$18.8 billion IPO proceeds).

According to KPMG, in Q1 2021, HKEX ranked #3 (US$13.9 billion IPO proceeds) and Shanghai Stock Exchange (US$6.9 billion IPO proceeds). Healthcare/life sciences ranked #3 among sectors in both 2020 and 2021 (with 13% and 12% of the A-Share Market). Biotech and healthcare/life sciences are expected to be one of the driving forces of the A-share IPO market.

This new capital raised via public markets as well as from VC investors can be expected to continue to fuel the growth of existing vaccine groups as well as new groups being formed (AIM in Beijing) and new vaccines being tested.

In March, China approved a 5th vaccine, produced by Anhui Zhifei Longcom Biopharmaceutical and the Chinese Academy of Sciences. It joins the two vaccines made by Sinopharm, one by Sinovac and one by CanSino Biologics, in partnership with the military.

We have heard reports of up to 15 Chinese vaccines which are now being tested.

China provided vaccines through the Health Silk Road, which is different from the method of U.S. and EU. How do you view this difference?

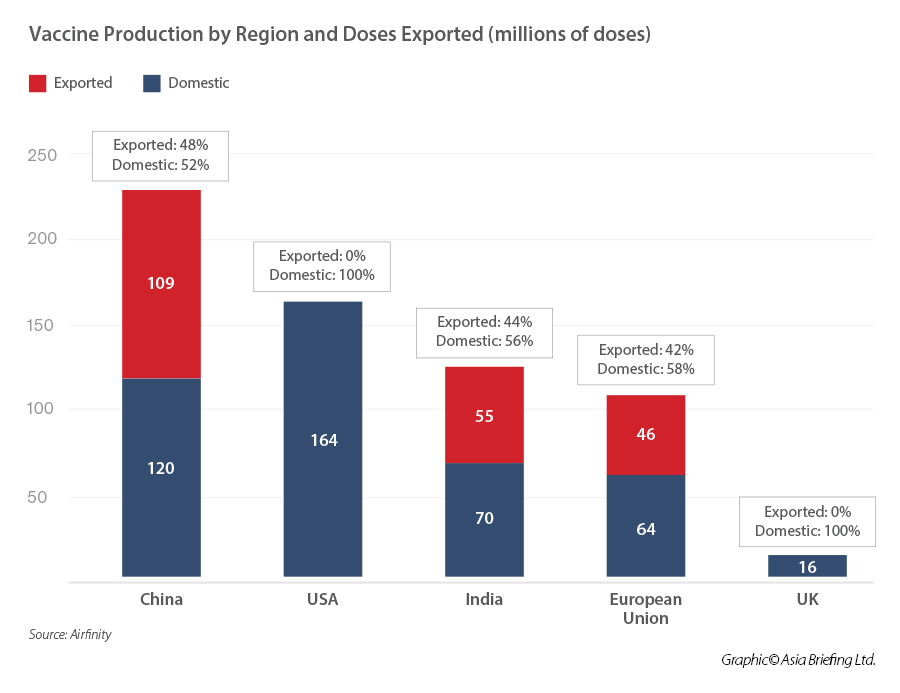

Included are two tables with data as of mid-March 2021; the first on vaccine production by region and doses exported (by millions) and one by country. You will note that as of that date, China led on both overall production and amounts exported. As regards distribution by countries, clearly this is dominated by countries previously signing the BRI MoU.

Russia (Sputnik V was authorized in 57 countries as of 29 March) and India (which has exported 60 million doses by end of Q1) are expected to continue export to several countries but considering the global needs, which we see extending well beyond 2021, there is ample room for various country’s strategies.

What are the main deficiencies in the health sector of the Belt and Road countries? How can they work together to address them?

Unlike some countries which have purely shown a domestic Covid focus, China has shown an interest in providing global health from almost the founding of New China. Initially, it was keen to share its Traditional Chinese Medicine (TCM) with many countries. This effort started in Algeria in the early 1960s and spread from there. In the 1970s, China built a major hospital in Afghanistan which is still in use today. In the 21st century, China played a major role in the Ebola crisis in Liberia. So it has shown commitment to global healthcare for decades.

The official launch of the BRI Health Silk Road in 2015 declared China’s commitment to global healthcare. The HSR was relatively slow to develop and initially focused on specific diseases. The 2020 rapid spread of the virus throughout the world led to a need for China to respond and to reach out to cooperate with global healthcare providers, the WHO and Covax as well as multilateral financial organizations to address the pressing needs.

It is not possible to predict future responses from various governments; however, China’s developing of several healthcare hubs along the BRI, which contain local manufacturing JVs/PPP of masks/equipment, vaccines, and logistics – led by Alibaba’s Cainaio Global Tracking – is a start. Recently, China’s Foreign Minister Wang Yi mentioned a similar structure for the UAE. We can see a series of these being put into position along the BRI, which are attracting international capital and being built on a PPP basis.

We are grateful to Henry Tillman for allowing us to reproduce this interview. China Investment Research may be contacted here

Related Viewing

- Health Silk Road 2020: A Bridge to the Future of Health for All

- Pakistan Opens Special Economic Zones For Healthcare Manufacturing In North Punjab

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com