The Abraham Accords Are Attracting Chinese & Western Investment In The Middle East

Dubai is repositioning itself as a Gateway to billions of dollars of Asian investment

Op/Ed by Chris Devonshire-Ellis

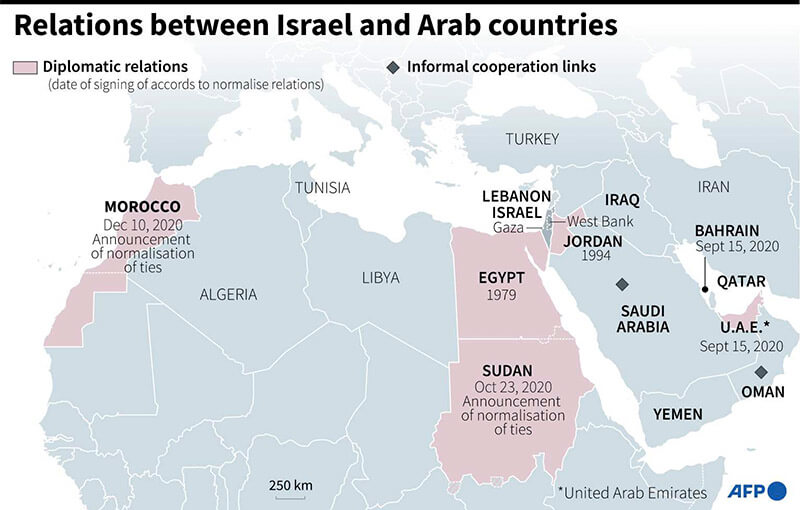

They’ve tended to be under the radar for many, however the Abraham Accords (AA), a series of treaties normalizing diplomatic relations between Israel, the United Arab Emirates (UAE), Bahrain, Sudan, and Morocco are already having a sizeable regional impact. Facilitated by the U.S. Administration between August and December, 2020, these four Arab states joined Egypt and Jordan in making peace with Israel. The agreements were called “The Abraham Accords” in honor of Abraham – the patriarch of Judaism, Christianity, and Islam. Egypt and Saudi Arabia are expected to join at a later stage.

Although on face value there are still issues between the Arabic nations and Israel, including visa travel problems between them, underlying this as a positive current have seen significant financial and investment flows already taking place.

All countries are interested in diversifying their economies and engaging with each other to achieve that goal, with Israel agreeing to freeze its plans for annexation/application of sovereignty in the West Bank as part of the deal. The AA has led not only to diplomatic ties, but also cultural exchanges and grassroots cooperation between people in both countries. Since the accords were signed in September 2020, 130,000 Israelis have visited Dubai, the four Arabic states and Israel have been cooperating as concerns healthcare and covid vaccines, and trade between Israel and the UAE has reached 1 billion AED (US$272 million).

This is having the impact of further developing Dubai as a regional platform from which investors, both from China, Asia, Russia and globally, can reach out to Israel and other Arabic partners as a trade hub. That has particular resonance for China as it is currently negotiating a Free Trade Agreement with the Gulf Cooperation Council (GCC) which includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

Annual Investment Meeting (AIM), the Dubai based investment platform, and China Venture Capital Research Institute (CVCRI) signed an MoU in 2019 for a long-term strategic partnership to share resources and to boost investment opportunities within the Belt and Road Initiative. China has pledged to spend US$400 billion in Muslim countries over the next decade as part of its BRI plans.

Multilateral investment has been swift.

Chinese bilateral trade just with the UAE grew by 38% last year to touch US$65 billion, while in terms of AA regional trade, just this year, in January, Mubadala (UAE) agreed to invest US$100 million in Israeli tech. Previously it invested $20 million in 6 Israeli VC firms, while in February Synaptech Capital (UAE) and Avnon Group (Israel) announced a new US$100 million tech fund focussed on start-ups. In June, Al Waha (Bahrain) invested US$85 million in LionBird (Israel) a healthcare provider.

AA Multilateral Investment Funds & Corporate Financing

VC/PE funds are also under consideration, including in December last year a UAE announcement it was setting up a US$10 billion investment fund aimed at strategic sectors in Israel, with a Joint Israeli-UAE investment fund for high-tech at NIS300 million (US$87 million). The UAE and Bahrain Sovereign Wealth Funds have also announced plans to establish a joint fund to invest in both countries.

There have also been AA related corporate investments, in late 2021 these included the UAE’s Mubadala agreeing to acquire a 22% stake in Delek Drilling’s (Israel) Tamar Oil Field for US$1 billion, while Bahrain secured US$500 million in tourism capital investment in 2020, led by Emaar of Dubai.

In August last year, Etisalat (UAE state telco) acquired an 8.5% stake in Maroc Telecom, (Morocco) lifting it to 53% ownership, for US$505 million, while in May this year, Packaging leader Hotpak Group (UAE) announced a partnership with Retail Holding, Morocco’s largest retail firm, and Waste management firm Averda (UAE) announced that it had secured US$30 million from the World Bank’s IFC to fund expansion into Morocco, Oman and South Africa.

Indonesia An AA Investment Target

There are also significant investments being made into other South Asian countries by AA member states. These tend to gravitate to Malaysia and Indonesia especially due to the Islamic connections. In Indonesia, the UAE reaffirmed its commitment to Nusantara, the new capital city, with a US$1 billion pledged investment; some of this amount is to be allocated to the new capital with the rest invested in infrastructure, food security, logistics, healthcare, and the digital economy.

The UAE has been busy in Indonesia in other sectors as well, in January 2020, the UAE and Indonesia signed US$23 billion of deals during the Crown Prince’s visit, led by energy but also including education, health, agriculture and counter-terrorism, following that up in March 2021 by announcing it would invest US$10 billion in Indonesia’s sovereign wealth fund.

In March 2021, the UAE’s ADIA was announced as the lead investor (US$400 million) in the US$1.3 billion pre-IPO in GoToGroup, Indonesia’s largest tech company (and ASEAN unicorn) while in November 2021 the two countries signed deals worth $32.7 billion, focused on tech, biotech, infrastructure and renewables, following President Widodo’s visit.

Also in March, Saudi Arabia’s Crown Prince expressed his interest in investing in Nusantara, leading to a potential capital infusion of up to US$600 billion by the Saudi Public Investment Fund (PIF). It is leading similar domestic giga-projects, concentrated on NEOM – a US$500 billion high-tech economic zone, central to Saudi’s Vision 2030 economic diversification program and could serve as a model for Nusantara.

Dubai As The AA Financial Hub

Dubai’s involvement is key to its development as well, as it is the regional investment hub with a low tax regime and an extensive free trade and double tax network in its own right. It is also more liberal in KYC protocols, meaning it is easier for Russian investors to establish operations and banking facilities in the UAE. As such, Dubai will be attracting some investment away from Singapore and Hong Kong, and especially that looking to participate in infrastructure and hi-tech investment in the Middle East and back into Southeast Asia.

Businesses looking to discuss operations in Dubai, the Middle East and South Asia may contact Dezan Shira & Associates regional office at dubai@dezshira.com

Related Reading

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The firm assists British and Foreign Investment into Asia and has 28 offices throughout China, India, the ASEAN nations and Russia. For strategic and business intelligence concerning China’s Belt & Road Initiative please email silkroad@dezshira.com or visit us at www.dezshira.com