Mongolia, China and Russia At The Centre Of A New Multipolarity

Numerous connectivity infrstructure projects are repositioning Mongolia as an energy and transit hub for Northeast Asia

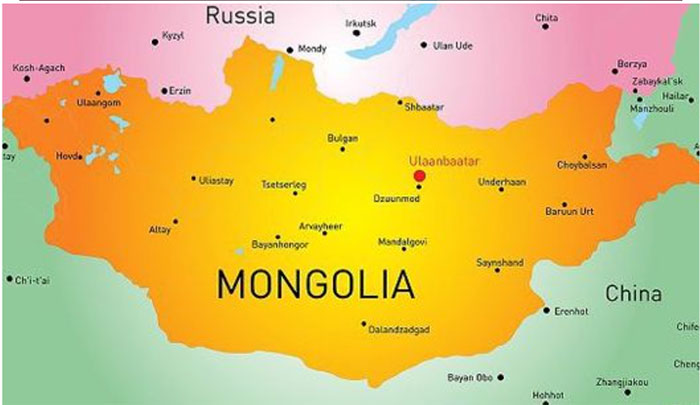

The ongoing transformation of the world order is inevitably affecting the regional subsystems of international relations. Mongolia is the only country in the region that has practically no significant disputes or disagreements with any states. Due to the specifics of its geographical location, its main partners are China and Russia. Ulaan Baatar appreciates the potential for the formation of a multipolar world, free from conflict. Probably, the current geopolitical conditions may both give a new impetus to the development of the country, and, on the contrary, initiate chaos in domestic and foreign policy.

The idea of Mongolia’s vulnerability is however being actively promoted in the West and could lead to some political uncertainty. For example, the UK Guardian stated in May 2022 that due to “Renewed pressure from its authoritarian neighbours, China and Russia, the Mongolian economy is suffering, the standard of living of the population is declining, and the chances of establishing cooperation with the West are decreasing.” However, despite a number of frankly anti-Chinese and Russian articles that have focused on the “nomadic”, freedom-loving spirit of the Mongolian people, which must escape from the “trap”, such ideas have failed to gain traction among locals. Even the protests in December 2022 were caused not by any external factors, but by corruption among the authorities and officials, who together were to blame for both inflation and the everyday difficulties of residents.

Nevertheless, due to the influence of information technologies and the fact that 2/3 of the population is under 35 years old, society willingly adopts liberal values and ideas. One of the most attractive concepts is the so-called third neighbour policy, proposed to Ulaan Baatar by Washington back in the 1990s and aimed at reducing the influence of Moscow and Beijing. The applied proposals of American ideologists include development of the transport industry with the help of Western investment, with co-ownership of the infrastructure built to increase the country’s autonomy and subsequently pressure China and Russia via tariffs impositions and sanctions.

Opening up the mining sector

So far, one of the few examples of this approach being implemented is the project launched by the Australian-British mining corporation Rio Tinto to develop the world’s largest gold and copper deposit, Oyu Tolgoi, in the Gobi desert. The facility is the largest in terms of attracting foreign direct investment and provides several thousand highly paid jobs. Rio Tinto’s investment has already exceeded US$7 billion, which the Mongolian government will not be able to immediately return in case of refusal. Although Ulaan Baatar fears that over-exploitation will cause irreversible damage to nature, the limited extraction of resources will begin in 2023. At the Mongolian Economic Forum 2022, Prime Minister Luvsannamsrain Oyun-Erdene noted the extreme interest in expanding the export of goods, especially copper concentrate and coking coal. The implementation of the government’s plan to privatise some state-owned companies should help attract about US$50 billion in private investment in the energy sector, land-based logistics terminals (“dry ports”), and industrial production. As a result, the volume of exports should grow from US$9 billion to US$20 billion by 2029. It also provides for the establishment of a diversified national wealth fund to stabilise the exchange rate of the Mongolian Tugrik and curb inflation, which will require the assistance of other foreign currencies in addition to the Chinese Yuan and the Ruble.

However, from the Mongolian perspective, these “third neighbours” do not have to be the United States, the European Union or Japan — as India, Iran, Pakistan, the Central Asian nations, ASEAN and South Korea are also showing interest in cooperation with Mongolia.

New transit infrastructure

For several decades, Mongolia only had a railway connection with the USSR, later following the collapse of the Soviet Union with Russia inheriting the route. Almost the entire railway network of the country was created on the basis of the Russian 1520 mm railway gauge, which forced the massive use of trucks in trade with China. However, at present, export opportunities on the Chinese-Mongolian border have reached their limit due to infrastructural restrictions — 13 “dry ports” have already been organised, through which coal, iron ore, and copper concentrate are delivered by road.

The construction of 1435 gauge railways such as those that are widely used in China, according to the plan of the Mongolian authorities, should contribute to the growth of export-import operations throughout the Eurasian space, finally realising their extraction potential and supplying Asian markets with raw materials and finished products.

During the visit of the Mongolian Prime Minister to Beijing in February 2022, agreements were reached on the speedy unification of three routes from the southern Gobi Desert to China. Railways with a capacity of more than 20 million tonnes per year will link natural resource deposits and logistics terminals with China’s Mandal checkpoint in Inner Mongolia. There are even more ambitious plans for laying a trans-Mongolian highway linking the east and west of the country, a plan that would connect Kazakhstan with China via Mongolia.

To increase commercial attractiveness, the Mongolian government permits the transfer of part of the tracks and trans-shipment points in concessions to Chinese and Russian companies. The most important transit links will connect Russia’s Trans-Baikal Territory and Northeast China via eastern Mongolia, and connect the Tuvan Republic in Southern Siberia with China’s Xinjiang Province through western Mongolia. In addition to railways, the construction of high-speed cross-border highways is also under consideration.

Power of Siberia

In 2019, Russia and Mongolia signed a memorandum of understanding on the construction of a trans-Mongolian gas pipeline with a capacity of 50 billion cubic meters per year. The Soyuz Vostok project, part of the Power of Siberia-2 pipeline, is extremely important for Russia in terms of organising an uninterrupted supply of natural gas to Asian markets in the face of difficulties with Europe. Gazprom is currently finalizing the details with the Mongolian and Chinese sides. Beijing is also interested in increasing purchases of fuel from Russia, which, in the face of rivalry with the United States at sea, seeks to strengthen the security of transporting strategically important raw materials through the development of land routes. Similar reasons have stimulated the development of cross-border electricity supplies from Russia to China through Mongolia.

This means that instead of being an isolated land-locked country, Mongolia is developing as a centre of transport communications and the site for the implementation of significant regional multilateral projects.

The Mongolia-China-Russia triumvirate

In July 2022, the Russian Foreign Minister Sergey Lavrov visited Ulaan Baatar. The main topics of discussions were the reconstruction of border checkpoints, the development of free trade economic zones, the supply of petroleum products, as well as the construction of a cross-border gas pipeline as part of the Mongolia-Russia-China economic corridor project. At the Eastern Economic Forum 2022 in Vladivostok, Vladimir Putin discussed the prospects for cooperation with Mongolian Prime Minister Oyun-Erdene, and they confirmed their intention to jointly implement projects in transport, energy and the extraction of natural resources. Also in September 2022, a trilateral meeting of the heads of Russia, China and Mongolia was held in Samarkand. The Russian President emphasised that such a format is of particular importance, as it effectively complements bilateral cooperation and provides high added value for all three countries.

In November 2022, Mongolian President Ukhnaagiin Khürelsükh visited China, where he held talks with President Xi Jinping. Thanks to the removal of Covid restrictions, the volume of bilateral trade in a number of positions, primarily in coal, has tripled. In addition, the Mongolian leader noted that the country’s economic development plans, including the “New Revival Policy” and “Vision 2050” are closely aligned with China’s Belt and Road Initiative and provide for the joint development of cooperation with Beijing in the fields of investment, finance, energy, infrastructure, e-commerce and environmental technologies. The joint statement emphasises commitment to the spirit of the 1994 Treaty of Friendship and Cooperation and the 2014 Joint Declaration on the Establishment of a Comprehensive Strategic Partnership.

The Russian side supports its Mongolian partners in joining the work of the Shanghai Cooperation Organisation, the Eurasian Economic Union and in building mutually beneficial conditions. Beijing has a similar interest. It is worth noting the successful independent initiatives of multilateral formats, such as the Ulaan Baatar Dialogue. Today, a comprehensive and pragmatic approach to issues of cooperation with neighbouring states and a course towards integration into the common Eurasian space are justifiable goals for the Mongolian government.

Source: Andrey Gubin for the Valdai Club

Dezan Shira & Associates have offices in Mongolia, as well as China and Russia. For market and business analysis, corporate establishment, tax advisory and trade compliance issues please contact us at asia@dezshira.com

Related Reading