China’s Belt & Road – The Caribbean & West Indies

Op/Ed by Chris Devonshire-Ellis

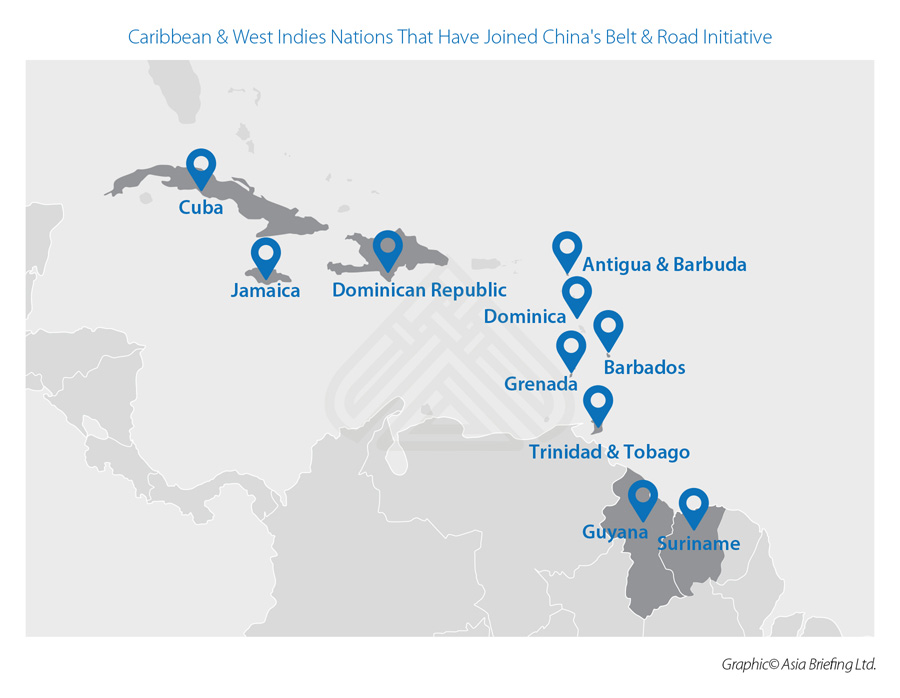

China’s diplomatic and trade reach in pursuit of its Belt & Road Initiative has included the Caribbean and West Indies, and rubs up against both the United States and to a lesser degree the United Kingdom in doing so. At present, about a third of the major island groupings have signed up to join, with China treading carefully so as not to antagonize the US too much.

Of the countries concerned, both Cuba and Jamaica have bilateral investment treaties with China, which permits a basic trade platform to be codified and encourages investment in each others countries. On a more product and tax-specific basis, China has signed Double Tax Treaties with Barbados, Cuba, Jamaica and Trinidad & Tobago. These are important as despite the name, they prevent the taxation of profits twice in both China and the home nations, reduce the amount of taxes and duties payable on specific products and services, and can allow profits tax to be mitigated against by use of withholding taxes rates which are typically lower. As such, these locations in particular are of interest when reaching out to trade between the Caribbean and West Indies and China as their DTA with China provide for lower transactional taxes.

This grouping illustrates not just attempts by China to bring them into the Belt & Road sphere because each of them add another notch to China’s attempts to brand it as a global initiative, but also trade and tourism opportunities. The islands are a mixed bunch, split between well established (and some exclusive) tourist resorts, while others are fairly poor, with infrastructure in need of improvement, and with mainly fishing and aquatic products as industries. What happens next is of critical concern to investors and business planners as these islands will surely evolve along a different path they and their US and European traditional allies have been accustomed too.

The Prime Minister of Antigua & Barbuda, Gaston Browne, signed off their Belt & Road MoU last year and stated “This opening up to unimpeded trade and investment flows also envisages the expansion of the use of local currency in investment and trade and the encouragement to the industry to build industrial parks and special economic and trade zones. We will not let this unique opportunity slip from our grasp. I pledge my Government’s full collaboration with China in the implementation of this ground breaking Initiative.” The MoU has been noted in the Antigua & Barbuda High Commission in London as containing references to building infrastructure connectivity such as roads, bridges, civil aviation, ports, energy and telecommunications.

Barbados has been taking a view to servicing Chinese businesses in the financial services arena. It is one of the top 10 global domiciles for captive insurance, yet is relatively unknown to the Chinese, and the sector has been lobbying the Barbados government to allow development in this area. Improved business relations with China could also increase Barbados’ attractiveness to multinational companies who are re-assessing the growth potential in Asia. One avenue previously explored by Barbados, but ultimately capitalized on by other regional jurisdictions, has been cross-border listing on the Hong Kong Stock Exchange (“HKXE”). That may yet be revisited. Barbados is also positioning itself as a “Gateway to Latin America” for Chinese businesses, as Barbados itself has a number of beneficial tax treaties throughout the region, including with China and is looking to establish itself as a trading centre with beneficial China tax incentives as well as within the Caribbean and Latin America.

Cuba, a long time China ally, also has designs on positioning itself as a Chinese gateway to Latin America. Although it doesn’t have the financial services clout and global recognition of Barbados, it is a major regional trading center. Bilateral trade has been on a steep increase: Chen Xi, the Chinese ambassador to Cuba stated just over a year ago, quoting 2017 trade figures, “That (China customs) data shows that the volume of bilateral trade during the first eight months (2017) totaled US$1.13 billion, and China exported US$830 million to Cuba while the island exported US$300 million to China. This means an increase of 56 percent compared to the same period last year.” Chinese Premier Li Keqiang has also said in a meeting in Beijing in November last year with Cuban President Miguel Diaz-Canel that China would invest in Cuba “especially in fields such as new energy, information communication, and biological pharmacy.” Cuba also has a Double-Tax Agreement with Barbados, meaning the two territories could become a major force in Caribbean/Latin American trade with China.

Belt & Road Caribbean And West Indies Nations At A Glance

| Territory | Population (thousands) | GDP (USD, billions) |

|---|---|---|

| Antigua & Barbuda | 101 | 1.17 |

| Barbados | 278 | 5.2 |

| Cuba | 11,200 | 97 |

| Dominica | 73 | 0.48 |

| Dominican Republic | 10,700 | 86.6 |

| Grenada | 107 | 1.8 |

| Guyana | 783 | 3.6 |

| Jamaica | 2,890 | 15 |

| Suriname | 558 | 4.1 |

| Trinidad & Tobago | 1,390 | 22 |

| Total | 28,071,000 | 4412 |

(This puts the population of Caribbean & West Indies members of China’s Belt & Road Initiative as roughly equivalent in size to Australia and with a GDP roughly equivalent to that of Norway or the United Arab Emirates).

Dominica, the smallest of the regional Belt & Road partners, is looking for assistance with protection against global warming and climate change. Dominica’s Foreign Minister Francine Baron, was in Beijing just a few months ago to discuss this with Chinese Foreign Minister Wang Yi, while the country is also in need of infrastructure development and repairs to damage caused by regular Cyclones. About 30% of the labor force is engaged in agriculture, and especially banana crops and processing. Dominica also has an emerging financial services industry, although it has faced criticism over transparency issues. Tourism is a developing industry.

The Dominican Republic has negotiated a US$600 million loan to upgrade power distribution with the China Export-Import Bank. Although no overall value has been placed on the level of Chinese support for the Dominican Republic, Reuters reported earlier this year that this could reach US$3.1bn though a package of investments and low interest loans. Speaking specifically about China’s Belt & Road Initiative, Dominican Republic President Medina said that the country “boasts one of the region’s most well-connected port networks, as well as a highly trained work force in production, transport and logistics.”

The Belt & Road MoU the Dominican Republic signed off with China has been reported by the Caribbean Council as including the construction of a mega-port and power installations in Manzanillo, on the north coast of the country, in addition to:

- The creation of a mechanism for co-operation between the Export-Import Bank of China and the Ministry of Finance of the Dominican Republic which is expected to result in Chinese credits to support trade, investment and economic cooperation.

- Strategic Cooperation between the Ministry of Finance of the Dominican Republic and the China Development Bank. The Bank, the world’s largest development finance institution, provides support for foreign investment, financing cooperation, and long-term lending.

- An agreement on the development of human resources with China’s International Development Cooperation Agency. This is expected to provide technical assistance, training and other forms of support in order to advance strategic initiatives such as the Belt and Road Initiative.

- Support for trade facilitation, economic development and increased cooperation for infrastructure development.

- The establishment of sanitary and phytosanitary measures relating to trade in agricultural products particularly in relation to exports of tobacco leaf and tobacco products as well as rum and cacao.

- Agricultural cooperation expected to lead to Chinese involvement in agriculture and fisheries in the Dominican Republic.

- The establishment of the Joint Commission on Economic, Trade and Investment Cooperation.

- The development of a plan to support education in the years 2018-2023 as well as others on cooperation in sports and baseball.

- An agreement that will see the creation of training programs and university level exchanges on diplomatic and consular training.

- The facilitation of group travel by Chinese tourists to the Dominican Republic which, according to Frank Rainieri of Grupo Puntacana who travelled to China as a part of a large business delegation accompanying the President, will result in the country receiving Chinese middle-class travelers.

- An agreement on civilian aviation covering flights between the two countries.

Dominican President Medina also suggested that in China, Dominican enterprises could find a large consumer market for their tobacco, rum, pineapple, banana, cacao, blue amber and other high-quality Dominican products, and noted that several Chinese companies had either launched factories or set up offices in Santo Domingo in related to energy, telecommunications, mining and light industry. The Chinese Ambassador to the Dominican Republic also suggested that the country could become a promising destination for Chinese tourists.

According to the Dominican Republic’s National Statistics Office in 2017 China exported US$2.5 billion of goods to the Dominican Republic, but imported just US$145 million of goods, of which a significant part was scrap metal.

In Grenada, Foreign Minister Hon. Peter David attended last months Belt and Road Forum, but has not yet agreed any Belt & Road investment or other related projects. David said to China’s Foreign Minister however that “Grenada is a unique gem offering various opportunities, such as infrastructure development including climate-resilient infrastructure, hotel and tourism development, and agricultural trade, and that Grenada is known as the Isle of Spice, with an abundance of nutmeg and other spices, including cinnamon, clove, ginger, turmeric, and cocoa.”

Guyana is on the mainland but due to its proximity to the Caribbean, trade and cultural heritage is considered part of the grouping. The Belt & Road MoU was signed off in July last year and according to Foreign Minister Carl Greenidge apparently contains provisions for cooperation in the areas of policy coordination, facilities connectivity, trade and investment, finance and integration, and the national broadband network. “One of our main priorities at this point in time is to work on the development of infrastructure and that would include assistance with the design, whether it is with roads, harbour and the like, as well as access to funding for the construction of such facilities.” Greenidge said. Leading up to the MoU signing, China has lent aid to Guyana in the past, allowing the country to acquire marine vessels for plying the Essequibo River between Parika and Supenaam, the construction of the Guyana International Conference Centre, and provided millions of dollars in equipment and vehicles for the Guyana Police Force. Discussions are also underway concerning the Linden-Lethem highway, particularly the Kurupukari to Lethem phase as well as the new proposed Demerara Harbour Bridge which could be financed under the Belt & Road Initiative. The route links Guyana to Brazil. Guyana secured funding from the British Government through its UK Caribbean Infrastructure Partnership Fund (UKCIF) programme to complete the design. Brazil and Guyana have discussed drawing down from the Latin-America China Fund to get the project completed.

Jamaica’s addition to the Belt & Road Initiative took place in Beijing at the recent Belt & Road Forum in April. Jamaica has received about US$2.1 billion in funding from China in the past, mostly for infrastructure initiatives including US$400 million went to road construction while US$300 million went to road and bridge rehabilitation in 2013. An additional US$457 million went to the north-south toll road construction, US$327 million was designated for the road network in 2016 and the Southern Coastal Highway Improvement Project received US$326 million in 2017.

Suriname is also on the mainland and borders Guyana. Like Guyana, it is also considered part of the Caribbean through its close proximity, trade and cultural ties with the region. Suriname signed off a Belt & Road MoU in July 2018, with the document promoting “enhanced cooperation in the fields of infrastructure construction, agriculture, forestry, fishing, law enforcement, human resources and public health.” The country has also adopted the Chinese Spring Festival as a national holiday. Suriname will be modernizing the national Johan Pengel Airport with Chinese assistance, while the two countries are working on an air agreement to connect Paramaribo by air to China and the rest of the Caribbean and Latin America. Improving roads and rail networks are also being discussed.

Trinidad & Tobago signed off their Belt & Road MoU in May last year, with Prime Minister Keith Rowley signing off the deal with Chinese Premier Li Keqiang. Later, Chinese Ambassador to Trinidad & Tobago gave a speech at which he stated “Practical cooperation could be strengthened in fields including financing investment, industrial parks, infrastructure, and tourism, reshaping Trinidad and Tobago as the regional center for shipping, logistics and financing.” Four other memorandums of understanding relating to the economy, medicine and health, and human resources have also been signed off under the MoU.

Meanwhile, the Caribbean Community (CARICOM) which includes Anguilla, Antigua & Barbuda, Bahamas, Barbados, Belize, Bermuda, British Virgin Islands, Cayman Islands, Dominica, Grenada, Guyana, Haiti, Jamaica, Monserrat, St. Lucia, St. Kitts & Nevis, St. Vincent & Grenadines, Suriname, Trinidad & Tobago & Turks & Caicos, have formed a China discussion basis in the shape of the Caribbean-China Economic and Trade Forum, the Caribbean-China Consultations process and a new mechanism, a standing meeting in the margins of the United Nations General Assembly. The American Virgin Islands are not part of this grouping.

In addition to this regional group, and rather like the Cooperation of China & Central Eastern Europe (CEEC) grouping that formally gathers together China with both EU and non-EU European nations, China has done the same with the Caribbean together with Latin America. The China-CELAC Forum brings together under a formal banner, China, together with the Community of Latin America and Caribbean States (LAC). These include Antigua & Barbuda, Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, Cuba, Dominica, Dominican Republic, Ecuador, El Salvador, Grenada, Guatemala, Guyana, Jamaica, Haiti, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Paraguay, St. Lucia, St. Kitts & Nevis, St. Vincent & The Grenadines, Suriname, Trinidad & Tobago & Venezuela. The China-Celac Forum serves as a stage for dialogue and agenda-setting between international and regional leaders, and has become a Chinese priority as a push for deeper influence within the region, and by some to reduce the significant influence of the United States on the politics and economics of Latin America. China’s influence on the region has been accelerating fast. The value of trade between Latin America and China increased 22-fold between 2000 and 2013. China is LAC’s second largest source of imports, and the third largest market for LAC exports.

We will feature Latin and Central America in further articles on China’s Belt & Road global reach in the next few days.

On the other side of the coin for the region is the current US position concerning Venezuela. Several Caribbean countries have become dissatisfied with what has been construed as “American arrogance” and have lambasted restructured oil and gas supplies to make them dependent on the United States for energy as opposed to nearby Venezuela. An editorial published last month in the Jamaica Gleaner captures the mood, suggesting that Washington has put them into a state of dependency while not investing any development or infrastructure capital into the region. China, according to the editorial, is seen as riding to the rescue. Such issues and unhappiness with perceived United States meddling in their sovereign affairs is driving these smaller nations to China – which is pro-Venezuela. It has the capability of leading to regional disputes as nearly happened in the case of the United States proposing a coup would take place in Caracas. That was only headed off after intervention from Russia, itself a long time ally, like China, of several of these regional outposts and Cuba especially. This has alarmed Washington, who called a Congressional enquiry into the strategic changes taking place on their doorstep. That document, entitled ‘China’s Engagement with Latin America and the Caribbean’ can be downloaded here

It is clear that China intends to reshape the Caribbean region, and on a larger scale, bring far more influence to the entire South American continent as well. Concerning the Caribbean, it remains a mixed bag, although there are opportunities for commercial fishing and tourism, the distance to mainland China is quite significant. It currently takes two months at sea to travel from Shanghai to Havana, and a minimum of 20 hours to fly the same route. This means that at present, tourism development from China to the Caribbean can be expected to remain the preserve of wealthy Chinese tourists, who are more likely to be familiar with Western style ambience and the colonial culture that remains prevalent in the Caribbean. China has also made Belt & Road Initiative moves in the South Pacific, and these are far closer to the Chinese mainland than the Caribbean.

There may well be opportunities for Barbados and Cuba to combine talents and treaties to assist Chinese companies in offshore trading and insurance, and work together as an access point to South America. The latter remains the primary target for China, and especially Venezuela due to its oil and gas wealth. In Caribbean and West Indies terms, it is too early to say what the impact on tourism and trade will be. Some of the smaller nations featured have in essence been rewarded for switching political allegiances from Taiwan to China. Others will be hoping for infrastructure assistance.

What is occurring though is a huge change in the political dynamics, with China allowing the Caribbean and West Indies nations to share a platform with their Latin America counterparts and jointly develop a future rather different from that previously dominated by European powers, and currently beholden to United States energy policies. There is the chance for conflict with Washington, although probably not in the Caribbean, and to some extent this is already being played out in the current US-China trade and technology disagreements.

That said, studying the potential for handling Chinese customers and trade, as well as opportunities to sell to China should not be ignored. The Caribbean and West Indies are very much part of China’s Belt & Road, and everything from commodities and agricultural and product sales to catering for Chinese tourism as well as the establishment and promotion of financial services to Hong Kong and China should now be considered by this eclectic grouping.

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has considerable expertise in assisting financial services businesses understand and access the China market as well as assisting foreign businesses import, export, and establish operations in China. We maintain 12 offices in mainland China, 1 in Hong Kong, and a further 15 throughout Asia. Please contact us at silkroad@dezshira.com or visit us at www.dezshira.com

Related Reading:

Related Reading:

![]() China’s Belt & Road Initiative In The Pacific Islands

China’s Belt & Road Initiative In The Pacific Islands

![]() Venezuelan President’s Visit to China Indicative of Growing Sino-Latin American Trade and Opportunities

Venezuelan President’s Visit to China Indicative of Growing Sino-Latin American Trade and Opportunities

Dezan Shira & Associates’ Service Brochure

Dezan Shira & Associates’ Service Brochure

Dezan Shira & Associates´ brochure offers a comprehensive overview of the services provided by the firm. With its team of lawyers, tax experts, auditors and consultants, it is Dezan Shira´s mission to guide investors through Asia´s complex regulatory environment and assist with all aspects of establishing, maintaining and growing business operations in the region.