The BRICS Summit in Xiamen – Getting Egypt, Mexico, Guinea, Tajikistan, and Thailand into OBOR

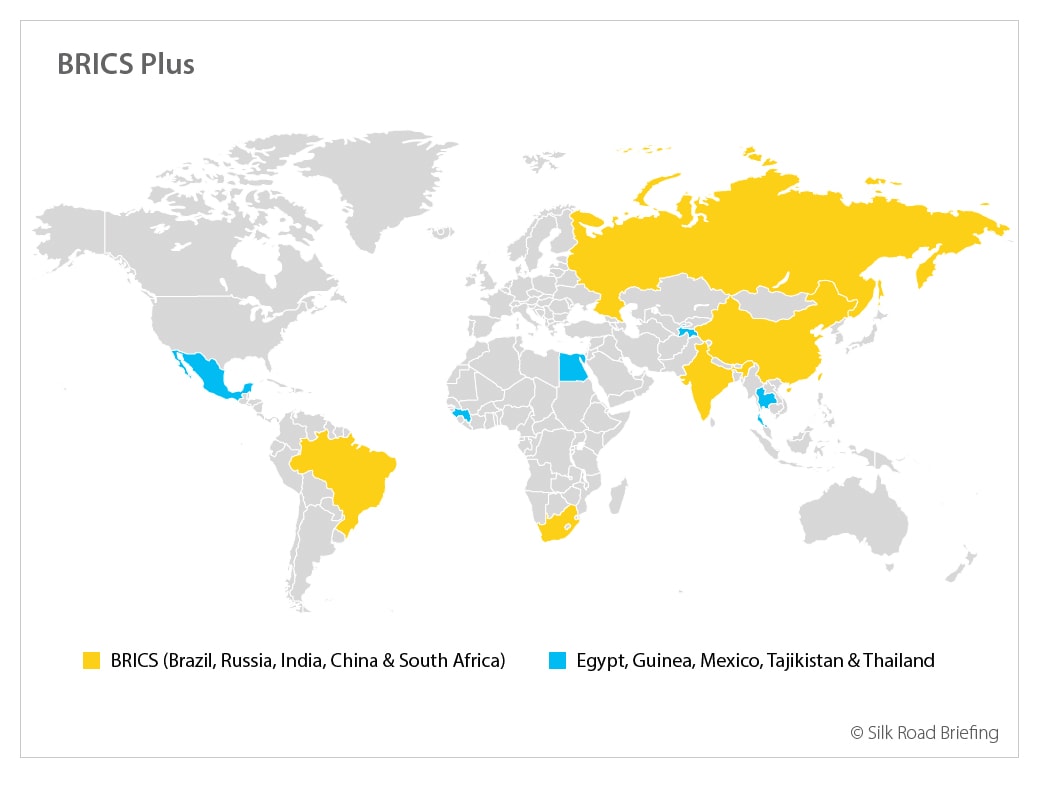

The ninth BRICS summit concluded in Xiamen this week, with the primary members of Brazil, Russia, India, Chin,a and South Africa all taking part. Less reported was the participation of five other nations – Egypt, Guinea, Mexico, Tajikistan, and Thailand, suggesting that each of the original members brought along a guest.

The ninth BRICS summit concluded in Xiamen this week, with the primary members of Brazil, Russia, India, Chin,a and South Africa all taking part. Less reported was the participation of five other nations – Egypt, Guinea, Mexico, Tajikistan, and Thailand, suggesting that each of the original members brought along a guest.

We can take a look at each of these countries’ credentials and their links to the BRICS nations as follows:

Egypt

Population: 96 million

GDP: US$336 billion

GDP Growth: 4.3%

GDP Per Capita: US$3,414

Institutional Organisations: Arab League

The Arab League members also include Algeria, Bahrain, Comoros, Djibouti, Iraq, Jordan, Kuwait, Lebanon, Libya, Mauritania, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Somalia, Sudan, Syria, Tunisia, United Arab Emirates, and Yemen. There are four observer nations: Brazil, Eritrea, India, and Venezuela. Cairo has been the traditional headquarters since 1945.

Egypt is another emerging country with a large population not dissimilar in size to Indonesia, and like Indonesia is also Muslim. A founding member of the Arab League, it has considerable clout within the Middle East and the oil nations, and is a major African producer of oil in its own right. An energy poor China wishes to strike a diplomatic and trade balance between differing Muslim factions, as does Russia, itself a major energy supplier and also with strategic interests in the region. Egypt offers an experienced hand to the BRICS nations in dealing with the complexities of the Arab nations, and the Muslim world in general. It also possesses the Suez Canal, where China has invested billion of dollars in upgrading infrastructure; the Canal is a major thoroughfare for Chinese goods and products to and from Europe.

Guinea

Population: 12.4 million

GDP: US$6.3 billion

GDP Growth: 5.2%

GDP Per Capita: US$508

Institutional Organisations: Economic Union of West African States

ECOWAS also includes Benin, Burkina Faso, Cape Verde, Gambia, Ghana, Guinea-Bissau, Ivory Coast, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leon, and Togo

A lesser-known participant is Guinea, the West African nation. However, it too offers much needed connections and influence with the Economic Union of West African States and is a long term friend of China, being the first sub-Saharan nation to recognize the PRC back in 1946, subsequently hosting then Premier Zhou En-Lai on his first visit to Africa. Both China and South Africa are discussing with Guinea about the development of the Boke Mining region, which has significant deposits of bauxite, used in the aluminium industry. Russian and Chinese companies are among the world’s largest aluminium producers. Guinea also sits atop some of the world’s richest iron ore and bauxite deposits, and has proven reserves of gold and diamonds. Russia just opened up the Eurasian Diamond Exchange in Siberia, and is looking to work with diamond suppliers globally to create an added value hub. Working with poorer nations, such as Guinea makes a lot of sense as Russia positions itself as the new global hub for the worlds diamond market.

Mexico

Population: 128 million

GDP: US$1.04 billion

GDP Growth: 2.3%

GDP Per Capita: US$8,201

Institutional Organisations: Organisation for Economic Co-Operation and Development

The OECD also includes Australia, Austria, Belgium, Canada, Chile, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, South Korea, Latvia, Luxembourg, Netherlands, New Zealand, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, and the United States.

Mexico is also a member of the North American Free Trade Agreement (NAFTA), which has been operational since 1994, and includes Canada and the United States. The current US administration has threatened to pull out of the agreement and to build a wall along with border with Mexico.

Mexico is another interesting partner, with its previous intent of forging better links with Asia stymied by the collapse of the Trans-Pacific Partnership. Both China and Russia are opening up to negotiate for free trade with Mexico at a time when its largest trade partner, the United States, has killed off the TPP, is threatening to pull out of NAFTA, and has commenced building a wall “to keep Mexico out”. There are alternatives to the TPP, both of which are being studied by China and several other Asian and Pacific nations. An introduction to these, which include Mexico, can be found in the article “China Lays Foundations For Free Trade After TPP Failure“. While the Trump administration doesn’t seem keen on Mexico, it should be remembered that the country is a trillion dollar economy, has a large, young, and inexpensive manufacturing worker pool, is a growing consumer market, and is a major global economy. An alignment between Mexico and Asia, rather than North America, when Asia possesses similar development demographics to Mexico may make a lot of free trade sense.

Tajikistan

Population: 9 million

GDP: US$9.24 billion

GDP Growth: 6.9%

GDP Per Capita: US$796

Institutional Organisations: Eurasian Co-Operation Organisation; Shanghai Co-Operation Organisation

Tajikistan’s membership of the Eurasian Co-Operation Organisation (ECO) aligns it with members Afghanistan, Azerbaijan, Iran, Kazakhstan, Kyrgyzstan, Pakistan, Turkey, Turkmenistan, and Uzbekistan, with the concept of mutual free trade and security. However, the ECO has struggled to maintain impetus; its website appears non-functional. The Shanghai Co-Operation Organisation also includes China, India, Kazakhstan, Kyrgyzstan, Pakistan, Russia, and Uzbekistan as well as observer nations Afghanistan, Belarus, Iran, and Mongolia. Bangladesh, Egypt, and Syria have also applied for observer status. Dialogue partners include Armenia, Azerbaijan, Cambodia, Nepal, Sri Lanka, and Turkey, with applicants including Iraq, Israel, Maldives, Ukraine, and Vietnam. ASEAN, the Commonwealth of Independent States, Turkmenistan, and the United Nations are all guest attendees.

Tajikistan’s experience of the Eurasian Co-Operation Organisation appears to have left it more dependent upon the Shanghai Co-Operation Organisation for a regional voice. That the SCO is about to admit Iran, a founding member of the ECO, as a full member of the SCO, and that Turkey, the other founding member of the ECO is a dialogue partner of the same entity probably spells the end for the ECO, and means the SCO has effectively taken over its mantle. In terms of agreeing to a free trade union, one of the original concepts of the ECO, Tajikistan may instead now be looking at the Eurasian Economic Union (EAEU), which includes Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia, and sits effectively between China and Europe. The EAEU has the capability to bring Chinese goods right to the borders of the European Union, and its trade has been increasing. In many ways, the EAEU effectively acts as China’s OBOR Free Trade Area, especially so when its own negotiations with it come to fruition.

Thailand

Population: 69 million

GDP: US$407 billion

GDP Growth: 3.1 %

GDP Per Capita: US$2,586

Institutional Organisations: ASEAN

ASEAN also includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, and Vietnam.

Thailand is well known to China as a member of ASEAN, with whom it has a Free Trade Agreement. China is Thailand’s largest trade partner, worth about US$70 billion, while Thailand also wishes to develop trade ties with Russia, whose Prime Minister Dmitri Medvedev became the first Russian Minister to visit Bangkok in 25 years some eighteen months ago, sparking an interest from Bangkok’s Military Junta in seeking a Free Trade Agreement with the Eurasian Economic Union. That came on the back of Vietnam’s successful FTA with the same, which has resulted in positive trade growth for both parties and Russia – Vietnam investments of some US$10 billion. India, too, has significant trade and investment with Thailand, and a Free Trade Agreement via ASEAN; its current bilateral trade with Thailand is about US$8 billion. China’s interest in Thailand goes deeper still – Beijing is interested in freeing up the bottleneck of shipping via the Straits of Malacca to reach the Indian Ocean and beyond to Europe, and wishes to examine the long held possibility of building the Kra Canal across the Thai isthmus.

As can be seen from the above dynamics, the inclusion of Egypt, Guinea, Mexico, Tajikistan, and Thailand into the BRICS meetings may result in some interesting developments. What at first glance appear a diverse and unrelated collection of nations, upon examination, appear to be rather better aligned to China, Russia, and India’s ambitions in particular, although Brazil and South Africa also provide important support in the Americas and Africa generally. However, it must be recognized that China has more diplomats in its African Embassies than South Africa does.

What is now apparent is that the concept of BRICS is changing and becoming more fluid. Much of the potential between members seems to be aligned with what have previously been One Belt One Road discussions, and expanding it to include other countries may persuade India, which has thus far been OBOR skeptical, to become more involved as it learns and notes the Chinese capacity for organizational development on a global scale.

It remains to be seen how the BRICS will evolve. But the message from Xiamen appears to be clear – co-ordination, expansion, development, and global inclusion into what appears to be following the developing Chinese-Russian axis of OBOR, which focus on commodities, free trade, and new partnerships.

About Us

Chris Devonshire-Ellis is the Founding Partner and Chairman of Dezan Shira & Associates. The firm has 25 years of experience is assisting Governments and MNC’s understand their strategic drive towards emerging markets, providing research, due diligence, legal, tax and operational business advisory services from 28 offices across China, India, ASEAN, Russia and the Silk Road nations. To contact us concerning investment into OBOR please email silkroad@dezshira.com or visit our website at www.dezshira.com

Related Reading:

![]() China-Russia Bilateral Trade is World’s Fastest Growing Opportunity Corridor

China-Russia Bilateral Trade is World’s Fastest Growing Opportunity Corridor

![]() Iran & EAEU Agree On Free Trade; China, India, Mongolia, Pakistan, Singapore, South Korea & Thailand Set To Follow

Iran & EAEU Agree On Free Trade; China, India, Mongolia, Pakistan, Singapore, South Korea & Thailand Set To Follow

China’s New Economic Silk Road

This unique and currently only available study into the proposed Silk Road Economic Belt examines the institutional, financial and infrastructure projects that are currently underway and in the planning stage across the entire region. Covering over 60 countries, this book explores the regional reforms, potential problems, opportunities and longer term impact that the Silk Road will have upon Asia, Africa, the Middle East, Europe and the United States.