China Manipulates Its Currency, Is Caught Out, So Gold Rises In Value. Who’s Been Buying Gold? China.

Op/Ed by Chris Devonshire-Ellis

Gold Buying Spree Demonstrates China and Russia Have Already Worked Out How To Hedge Against The US

The United States has formally accused China of being “a currency manipulator” in the latest development in the Tariff war between the two countries, in a move that will enrage Beijing, with the United States saying that China’s actions violated its commitment to refrain from competitive devaluation as part of the G20 agreements. The treasury said it expected China to adhere to those commitments and not target China’s exchange rate for competitive purposes.

US law sets out three criteria for identifying manipulation among major trading partners: a material global current account surplus, a significant bilateral trade surplus with the United States, and persistent one-way intervention in foreign exchange markets. After determining a country is a manipulator, the treasury is required to demand special talks aimed at correcting an undervalued currency, with penalties such as exclusion from US government procurement contracts.

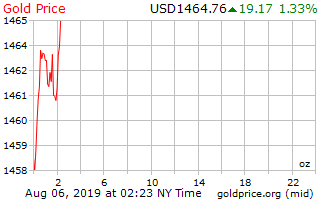

So, there are two issues here. Is China a currency manipulator? Yes, it is. I have first hand (and somewhat notorious) experience of this when several years ago, at a meeting with the then PBOC Chairman Liu Minkang, he mentioned what the rate of the RMB Yuan would be against the Hong Kong dollar in six months time. As the HK dollar is linked to the US dollar, the implication is obvious – predicting the value meant they were controlling it. I reported it at the time only to walk into a complete shitstorm of accusations and denials, both from the US and China, in addition to having the finger pointed at me by international media as a liar and having fabricated the story, especially after the Chinese conveniently denied such a meeting had taken place. Such is life.What China will be annoyed about this time is the loss of face – Trump has actually accused the Chinese Government of lying. In terms of damage, it ratchets up the trade dispute another level and makes it hard for Xi Jinping to climb down. But it appears a move that China might also have anticipated. With the RMB being essentially branded as being artificially high, buyers have dumped it and headed to gold as a safe harbor, with the value of the metal jumping overnight as can be seen in the graphic below.

But who’s been buying up gold recently? China, and Russia. Both have been building up reserves at unprecedented levels, as we reported over on Russia Briefing in the article Russia & China Keep Up Their Gold Buying Spree In Q1 2019. China has purchased 74 tonnes since May, while Chinese firms have also recently been awarded contracts for the construction of a gold smelter and two refineries in Tanzania, Africa’s fourth-largest gold producer. It has also been investing millions into extracting gold deposits in Siberia’s Klyuchevskoye mines. Then there is China’s Silk Road Gold Fund, which has been buying up reserves and deposits around the world.

We discussed that in the following articles:

- China’s Silk Road Gold Fund – The Central Asian Gold Deposits

- China’s Silk Road Gold Fund – The South-East Asian Gold Deposits

- China’s Silk Road Gold Fund – The African & South American Gold Deposits

Meanwhile, the China Gold & Silver Exchange (CGSE) has also increased its footprint by setting up an operations base in Shenzhen while keeping its trading platform in Hong Kong. The new operations include a trading hall, a clearing and settlement office, an assay lab, a logistics office, a bonded warehouse and customs facilities, as well as customer safety deposit boxes. There are additional plans to offer these services to more customers in Southeast Asia, thereby spurring business across the region. China is already the world’s largest producer, mining 473.6 tons in 2016, and has recently announced discovery of its largest deposits, based in Shandong Province, and worth an estimated US$22 billion.

China’s Central Bank currently owns an estimated 1,900 tonnes of gold, just behind the Russians. Combined, the two countries hold an estimated 3,890 tonnes of gold, just behind the United States which holds 4,582 tonnes. Together, it is possible that China and Russia will hold more gold reserves than the US within the next 12 months.Although American economists downplay the value of gold reserves, it would prove an embarrassment to the US Government in terms of perceived US dollar support as the Dollar is based on debt, not assets. Questions are likely to be asked as to exactly how the US dollar is supported at that time. The implications are not lost of some analysts – Crispin Odey, a hedge fund manager at the UK’s Odey Asset Management, has been quoted in Sputnik News as suggesting that “gold is the ‘natural move’ for countries looking to break with the hegemony of the US dollar.” His hedge fund has invested heavily into gold despite being skeptical of the metal in the past. “You have to do what the central banks are doing.”

Brett Arends, of Market Watch has stated “Do China and Russia really need piles of this arcane yellow metal to break the US dollar’s stranglehold on the world’s financial system? Can’t they just issue new currency backed by their economic output, as Europe did when it launched the euro 20 years ago? Maybe, or maybe not. But that seems to be the way they’re betting. We are at a very rare inflection point in history: the passage of economic hegemony. China’s economy has already overtaken America’s by one key measure [national economic output], just as America’s once overtook Britain’s. These periods of transition, throughout history, have been times of instability.”Others have predicted an eventual devaluation of the US dollar itself, an issue I examined in the article Devaluation Of US Dollar Predicted As China & Russia Buy Up Gold Reserves another scenario that will impact upon the current US-China tariff war.

The permutations of why China and Russia have been buying up gold and whether they intend to challenge the integrity of the US dollar at some point remains to be seen. If that is the goal, then the recent boost in value caused by Washington labelling China a currency manipulator will be a nice little bonus for Beijing. But increasingly, it also suggests that both China and Russia have worked out the longer term United States strategy, and in terms of the US-China tariff war, China has been preparing for several years. If that is the case, then this latest development is another sign that bilateral trade between China and the United States is going to be an issue for some considerable time, and that Beijing is well armed for the struggle.

About Us

Silk Road Briefing is produced by Dezan Shira & Associates. The firm provides business intelligence, legal advisory, tax advisory and on-going legal, financial and business operational support to investors throughout China, India, ASEAN and Russia, and has 28 offices throughout the region. We also provide advice for Belt & Road project facilitation. To contact us please email silkroad@dezshira.com or visit us at www.dezshira.com