China Trains 66,000 Business Executives In Benefits Of RCEP

The US$25 trillion regional free trade agreement is expected to come into effect in five months’ time. Is your Asia based business opportunity prepared?

China’s MOFCOM has been organizing training sessions for over 66,000 Chinese trade representatives and business executives to help them prepare for the upcoming Regional Comprehensive Economic Partnership (RCEP) Free Trade Agreement, according to reports in Chinese media.

Two national online training sessions have already been held to help local governments and businesses in China make effective use of the agreement with others to follow.

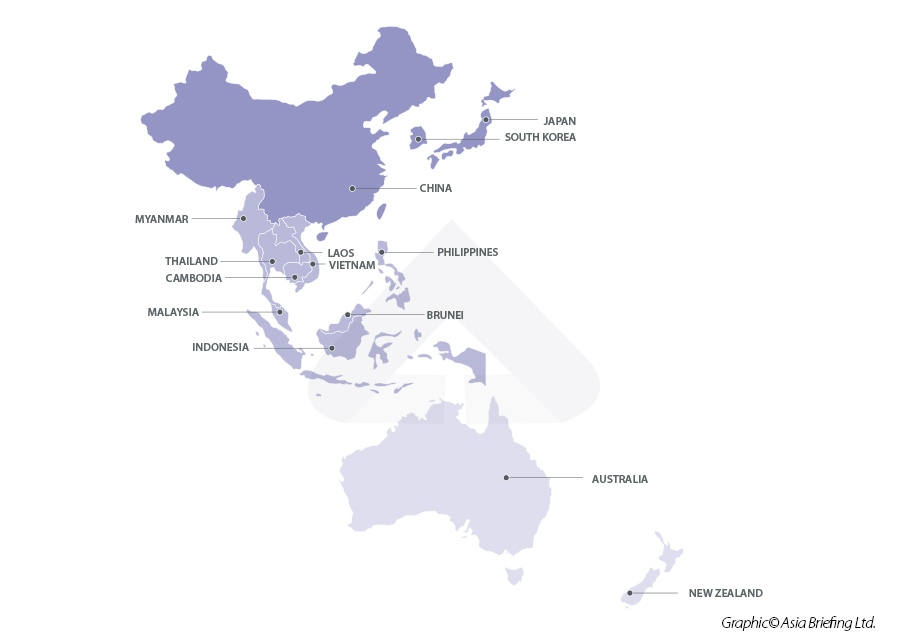

The RCEP free trade agreement includes China, Japan, South Korea, the ASEAN nations of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam together with Australia and New Zealand. The agreement has been finalized but still needs to be ratified by respective regional governments to take effect. China has done so and expects the complete agreement to be in force from January 1, 2022 – five months from now.

Asia Briefing has written extensively about RCEP and the impact it will have on regional and global trade. A selection follows:

- RCEP FTA Signed: What Can Foreign Investors In China Expect?

- Developing Your China Trade With Japan & South Korea Under RCEP

- New Trading Opportunities Available Under The RCEP

- New RCEP FTA Rules Of Origin To Boost Finishing Of Products Investment Into Cambodia, Laos, and Myanmar

- How Does Vietnam Benefit By Joining RECEP?

- RCEP’s Impact On ASEAN’s Supply Chains And Business Environment

How Businesses From Non-RCEP Countries Can Still Benefit From The FTA

While RCEP is a regional trade agreement, it means that there are benefits for international companies too. The RCEP’s sheer size makes it significant. Participating economies account for 29 percent of global GDP and about 30 percent of the world’s population. This equates to a market value of close to US$25 trillion and a total consumer base of about 2.5 billion, of whom an estimated 1 billion are to middle class consumer standards. There are numerous ways in which businesses based in non-RCEP countries can still take advantage:

Establish a trading or manufacturing company in an RCEP member nation

Foreign businesses in other countries can access regional trade agreements by virtue of being locally domiciled. Most of the RCEP nations permit 100% foreign ownership although certain industry sectors may require a local partner. General manufacturing and trading services however can usually be held 100%. Establishing a business in Asia is usually not that expensive, although some thought needs to be put into place as concerns where. Typically, different countries offer certain trade and commodity benefits that others may not have and be stronger in certain industry sectors. Operational costs and productivity rates also vary. Consultants with a solid Asian base will be able to advise. Dezan Shira & Associates, the publishers of this website have offices throughout China and ASEAN, with representation in Japan and South Korea.

Examine your national trade agreements for RCEP connections

Does your country or region have an agreement with an RCEP nation? If so, you can use that to gain RCEP market access. Examples are the EVFTA between the European Union and Vietnam, which came into effect in August last year. That can be used as an RCEP access route for businesses in all EU member countries.

Another is the UKVFTA between the United Kingdom and Vietnam, effective from May this year.

Agreements with Singapore are particularly useful in terms of the RCEP agreement as Singapore is a regional hub, conducts business in English and has excellent pan-RCEP banking and financial infrastructure. Singapore is developing as a massive global e-commerce hub for these reasons.

The UK also has an FTA with Singapore, which came into effect on January 1 this year, as does the United States, which also has an FTA with South Korea and Australia.

Examine your national double tax treaty agreements for RCEP connections

Double Tax Treaties (DTA) do not deal directly with trade but are useful in determining bilateral preferential tax treatments between countries. This is especially pertinent in the services industries. Professionally utilized DTA can reduce profits tax burdens by typically 10% when conducting trade overseas. Does your country have a DTA with any of the RCEP countries? It pays to find out. Using them does require professional assistance however the cost of this is more than offset by the tax savings.

While China has made great efforts to educate its business and trade services sectors in the benefits of RCEP, Western businesses tend to have been left in the dark. However, the intelligence is there to assist and advise. We have provided several links above to help businesses understand the impact of RCEP globally, while our tax and trade professionals can also assist. An initial enquiry costs nothing: please email to asia@dezshira.com for assistance.

Related Reading

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com