The RCEP. Asia’s Equivalent To USMCA and the European Union

- RCEP’s market is 2.5 times larger than that of the EU and USMCA

- Asian free trade will continue to expand North and West

Op/ed by Chris Devonshire-Ellis

The significance of the Regional Comprehensive Economic Partnership (RCEP) agreement has flown somewhat under the radar as concerns its impact upon future global and regional trade. Often referred to as a Free Trade Agreement – which it is – comparisons have tended not however to be made on a global scale, and especially with the United States or Europe. Yet in fact, RCEP is in many ways Asia’s equivalent of these blocs.

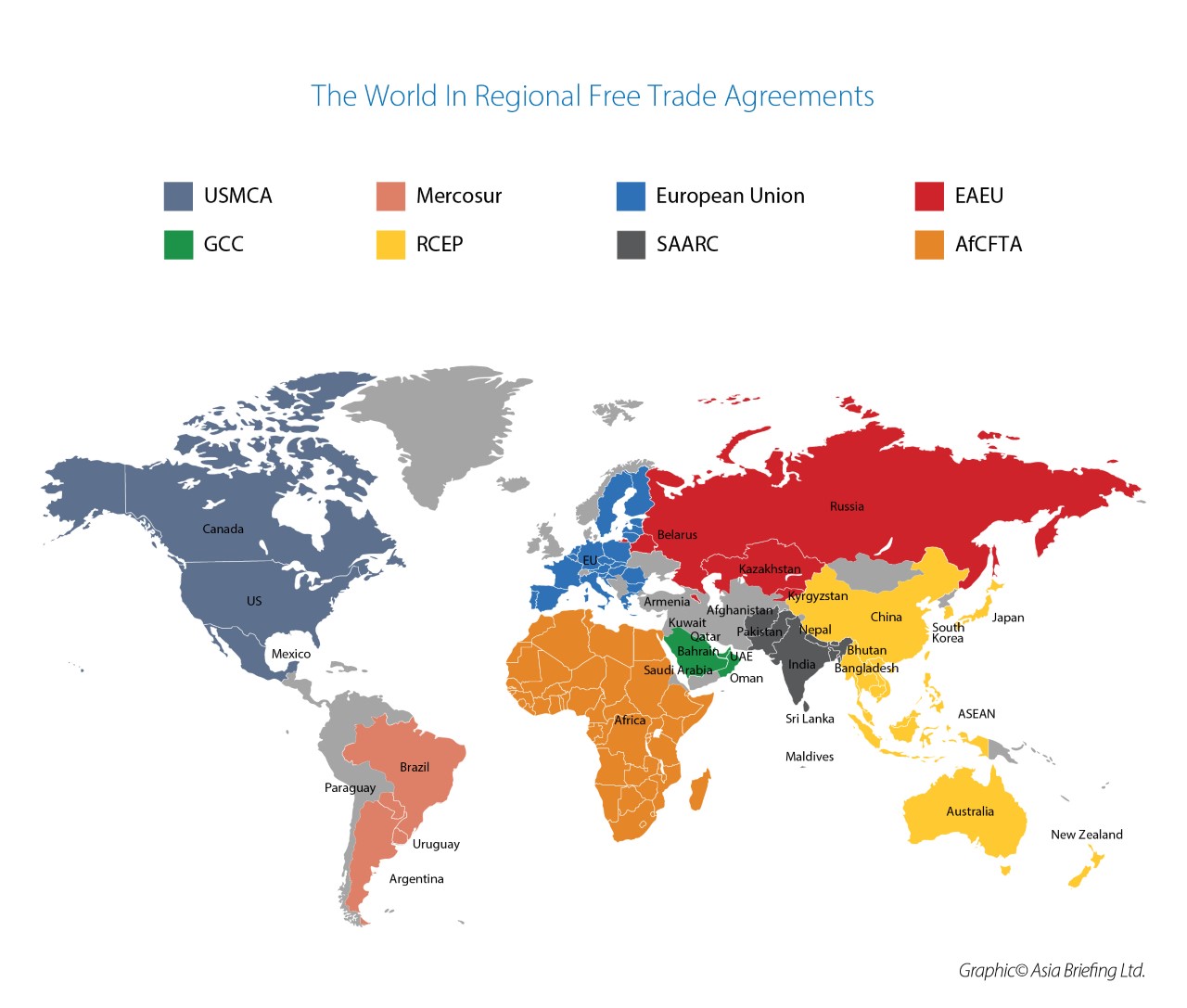

Although the world is divided up into various regional trade blocs, some are more effective than others. South Asia’s SAARC has long been rendered less effective than it ought to be by intra-bloc quarreling over product inclusions, South America’s Mercosur has similar issues, yet on the other hand has agreements with more Latin American countries than are full members. There are additional multi-lateral FTA between blocs themselves, such as the EAEU’s agricultural trade agreement with AfCFTA, and negotiation of deals with China and India. ASEAN exists between the ten nations of South-East Asia (identified here as part of the complete RCEP agreement) with the ASEAN bloc having agreements with India and other countries, and so on. Identifying where these agreements are and intersect would require a complicated map with hundreds of sections.

In this article however we concentrate on the largest by trade volume – and point out the global significance of RCEP by comparing it with the USMCA (NAFTA) and European Union free trade areas.

USMCA

The USMCA (previously known as NAFTA) includes Canada, the United States and Mexico. It originally entered into force in 1994. It has a population of 490 million, a GDP of US$24.8 trillion, with annual per capita income at US$50,700. GDP growth the past three years has averaged 2%.

European Union

The EU began life through the Treaty of Rome in 1958, has a population of 448 million, a GDP of US$17.13 trillion and an annual per capita income at US$38,256. GDP growth the past three years has averaged 2.1%.

RCEP

RCEP was agreed in 2020, with ratification of members still underway. When completed, it will have a population of 2.6 billion, a GDP of US$26.58 trillion and an annual per capita income at US$17,059.

GDP growth the past three years has averaged 6.5%.

As can be seen, while the USMCA, mainly through the wealth of the United States, has the wealthiest consumer population, closely followed by the EU. RCEP however has by far the lowest per capita GDP but displays a wider internal variety of income levels among its members – from a high of US$58,484 (Singapore) to a low of US$1,308 (Cambodia). However, GDP growth amongst the RCEP nations has been three times higher the past three years (factoring in Covid) than in either the USMCA or EU blocs. When this is combined with a total population that is 2.5 times larger than that of the EU and USMCA combined, it becomes obvious to see where the continuing future consumer growth and wealth development will be.

However, the emergence of RCEP also presents global trade and political challenges. While Washington dominates the USMCA, and Berlin to some extent the EU, the RCEP power base will be Beijing, although it will require diplomatic tact in a manner not always recently shown by Chinese diplomats – a point picked up by President Xi Jinping earlier this week when he called for expanding its circle of friends.

While the Western media automatically assumed those comments were directed at Washington and Brussels, they were more likely to have been with a more regional focus in mind – and to Tokyo and New Delhi in particular, neither of whom have particularly close relations with China. Yet Beijing needs them both onside to develop RCEP to its potential – Japan as a member state, while India contemplates inclusion. The door for India participation remains open, even though India dropped out of RCEP in 2019.

RCEP Plus

China though has plans to develop the Asian bloc – a kind of RCEP plus – still further. It has already signed a free trade agreement with the Eurasian Economic Union, which when tariff reductions are agreed will push the Asian bloc in a north-westerly direction and into Central Asia, while the Indian RCEP position remains negotiable. A new, more approachable Beijing could then oversee the development on an Asian region growing west and north to become a continental bloc during the first half of this century. In time, Asia will become a full Free Trade Area backed by a comprehensive protected digital currency with an international (and non-US controlled) financial structure. Whilst the nation states will still be sovereign, the economic development will be transnational and green.

Asia will then stand with two other global regions – North America’s USMCA and the European Union. But new Asia will be the geographically largest, wealthiest, and most innovative.

At its core will be the Chinese domestic economy, by then the world’s largest. With a strong currency, partially backed by gold rather than US debt, it will suck in huge imports mainly from Asia but also North America and Europe.

As mentioned, RCEP is often thought of as a regional East Asian free trade agreement. In actuality, its rise will come to dominate Asian, and significantly impact upon North American, European, and other regional trade blocs, on a global basis. The question for businesses executives globally is: Are you prepared to take advantage of this – or wait until it arrives on your doorstep?

Related Reading

- Heads of State Calls For Acceleration Of Eurasian Economic Union Alignment With China

- Trading Opportunities Available Under the RCEP

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm has 28 offices throughout Asia, and assists foreign investors into the region. For strategic advisory and business intelligence issues please contact the firm at silkroad@dezshira.com or visit www.dezshira.com