China Ignores United States Trade Threats, Energizes Trade Ties With Russia & ASEAN As Alternatives

Washington Doesn’t Seem To Realize China & Global Supply Chains Are Sailing Away

Op/Ed by Chris Devonshire-Ellis

The US-China trade war has dominated the business media for the past two years, however the view from Washington and the Trump administration remains that akin to almost deliberate isolationism. The China-based, US commentators haven’t been much help either in understanding the bigger global picture – fixated upon relations and analysis between Beijing and Washington they have omitted to understand what lies beyond. At the recent St.Petersburg International Economic Forum, at which Presidents Putin and Xi were present, I didn’t notice any Beijing based US analyst in attendance. I expect the same of the upcoming Far Eastern Economic Forum which is being held in Vladivostok in ten days. Putin will be attending, with Indian Prime Minister Narendra Modi as Guest of Honour. A significant presence from ASEAN ministers and trade delegations will also be showing up. But it appears if the United States isn’t involved, the US media and analysts generally have little to no interest. If true, this is a huge mistake.

But while American analysts and business commentators fiddle, and concentrate on Beijing-Washington’s various innuendos and rumors, the trade war continues and is becoming increasingly shrill. But that is not the only part to the equation. With a near 30 year career in China behind me, and a consulting practice the same age stuffed full of North American, European and clients from around the world, we have a differing viewpoint to see the action from. Unfettered by bilateral trade ties, we can cast a longer view of the implications and being on the ground, can see perhaps further and with more clarity. After all, adapting to change is part of my remit as Chairman of our practice and ensuring we are ahead of the game and able to adjust to changes. Those changes are now occurring. Lets look at some of what many analysts are missing:

The Global Supply Chain Is Shifting. And It Doesn’t Appreciate US Uncertainty

A global supply chain means just that, and the US has been a major part in this. However the key word to remember is global. That exists to qualify two angles – first, the all-encompassing of the worlds component t parts manufacturers, who vary from industry to industry but are to be found in each of the 200 or so countries and territories around the world, and secondly the nature of the global market, servicing those same consumers. But those consumers are not just based in the United States, although as at right now, it remains true that the US has the most consumer disposable income. But as McKinsey recently pointed out, by 2030, China’s working-age population will account for 12 cents of every dollar spent in cities worldwide. That’s just ten years away. It also means that China wishes to control more of the global supply chain to ensure it delivers what it needs.

This strategy goes hand in hand with the US-China trade war in that an unwitting Washington has actually presented China with a scenario it wants to happen. Less dependence on US goods, and especially when presented as trade differences dressed up as imbalances. In fact, although the trade war has been dressed up as a US response to the current US-China imbalance (US$378 billion last year) a lot of that was accounted for by US traders and middle men buying low in China and selling high in the US. All of that US profits taxable income will deteriorate as a result.

There is an additional issue. The Global Supply Chain isn’t American. Building such structures is hugely expensive and requires massive amounts of cross-border and international coordination. Global MNC’s around the world need to service their customer bases and preferably without delays or shortages. China, and India are now the worlds largest markets for smartphones, with the United States third. Following them are Russia, Brazil, Indonesia, Japan, Germany and Mexico. Coming up fast are countries such as the Philippines, Vietnam, Turkey, Thailand, Iran, Egypt, Pakistan and Bangladesh. The world’s top four largest Smartphone users (excluding the US) account for 1.4 billion users. The United States accounts for 252 million, less than 20% of the top five total. In short, this means that when such statistics are spread across the Global Supply Chain in most major consumer markets, the United States only accounts for a relatively small slice of the consumer pie. If the US, as it has done, continues to disrupt that supply chain then it will find it moving away from American suppliers and to new homes. This is starting to occur.

China-Russia Trade Developing

The sanctions imposed by the United States and, following the US lead, the European Union on Russia following the take over of Crimea from Ukraine have actually acted as a study of the impact of an economy when subjected to such measures. During that time I have spent a considerable time in Russia as it became apparent that Russia would need to look east to other markets such as China. Although in local consumer terms the sanction imposed some initial consumer inconveniences, this has now passed –Russians now make themselves what the EU used to provide. Russian businesses have also been looking at opportunities overseas, while Beijing has been studying, and to a large part coordinating with Russia over the US sanctions.

This is manifesting itself in two ways, firstly Beijing was pre-warned that Washington was and remains quite able to use the US dollar as a trade weapon, which it did with Russia and has subsequently done with Turkey and Iran. At one point the Russian Ruble was worth less than the Sri Lankan rupee, which is absurd. Recovery from this has seen alternative financing routes being developed; there is a growing trend for bi-lateral trade to be conducted in non-US dollar denominations as a result, while alternative payments systems are currently being developed to circumnavigate any use of the greenback. The BRICS nations – Brazil, Russia, China, India and South Africa – all significant players in the global supply chain – are developing BRICS Pay Similar non-US dollar payment systems are being created elsewhere – including between China and Russia as countries developing and posing a challenge to the United States wish to limit the impact of the potential of future sanctions in any trade dispute. The two countries are also building up significant amounts of Gold Reserves, while Russia has effectively dumped all US Treasures and the entire Eurasian Economic Union is being de-dollarized. The EAEU is a US$5 trillion economy, and trade is expanding. At some point that is going to hurt. Russia also now holds 25% of China’s global RMB reserves.

Having developed a platform to trade in non-US terms, that is now being developed in real terms as China looks to distance itself from US markets, both in terms of buying and selling. Russia is already the worlds largest grain producer and is ramping up production of that and soy to counterbalance China’s previous purchasing from US farmers. China has just announced a pro-Russian Free Trade Zone is to be developed in Heilongjiang, specifically to further develop Russian trade and manufacturing, while the new Chinese Ambassador to Moscow has stated he expects to see Sino-Russian trade double in the next four years. That is entirely possible – China and Russia have signed off a Free Trade Agreement with the Eurasian Economic Union, which while not yet product specific, is currently being negotiated to be so. When that occurs, bilateral trade between China and Russia, long with fellow EAEU members states Armenia, Belarus, Kazakhstan and Kyrgyzstan will show an immediate increase. What are some of the major exports from these countries? Fertilizers, Dairy, Fruits, and Grains. US Farmers may have some difficulty in getting the China market back again.

China-ASEAN Trade Developing

China-ASEAN trade is also being stepped up and new decisions made by Beijing to increase commodity and technical supplies from the region. China’s State Council announced just on Monday that they would establish six new zones, specifically to encourage – which includes tax incentives – regional ASEAN and other border countries companies to supply China with more products. The Russian zone is mentioned above, while the ASEAN influenced ones will be built near the borders of Vietnam, Laos and Myanmar. There are additional reasons for China to do this – it has a comprehensive free trade agreement with ASEAN. In the first six months of this year, ASEAN became China’s second largest trade partner, and sold more goods to China than the United States. China customs data shows that China’s trade with ASEAN rose 10.5 percent to US$288 billion, as China’s trade with the US dropped 9 percent to US$254 billion. ASEAN is fast competing with the United States for the China market, and as the China-US trade war develops, is now supplanting it. Donald Trumps assertation that “We don’t need China” is surely unwelcome news for US producers who have developed trade ties with the country over the past two decades.

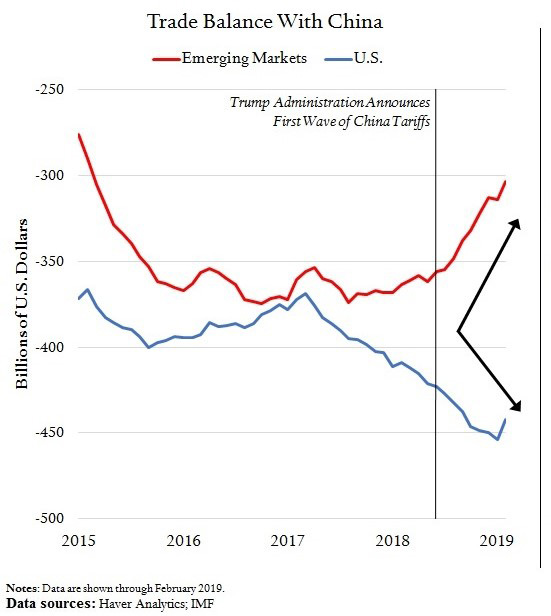

We can see the impact of this in the following graphic. China’s trade with emerging markets such as ASEAN, Russia and the Belt & Road has increase, while China’s trade with the United States has decreased significantly.

In summary, understanding the US-China trade war, and the implications of this requires rather more than an understanding of the political nuances between Beijing and Washington. An entire new Global Supply Chain is being fast tracked, in which the United States is being bypassed and relegated to the role of a Junior Partner, and one whose current behavior has illustrated it can neither be entirely trusted nor entirely relied upon to deliver long standing agreements. As the Global Supply Chain requires exactly that, the role of the US is being diminished. That means that the smart investment dollars need to start looking at countries and regions such as China, India, the ASEAN bloc, African Free Trade Area and Russia – in addition to the Belt & Road nations – for where the new, sustainable supply chain is moving too, and what incentives to do so it will provide.

Evaluating The New Global Supply Chain

Does the country have Double Tax Treaties In Place?

Does it provide Free Trade Areas/Zones and have any Free Trade Agreements?

Is it part of any larger Free Trade Bloc?

Does it have significant borders and developing road/rail/air transport links?

Does it have significant inland and/or maritime ports?

Related Reading

- The US-China Trade War: A Timeline

- China Imposes New Tariffs on US Goods from September 1, ASEAN and BRI Suppliers Now Preferred

- Import-Export Taxes and Duties in China

About Us

Dezan Shira & Associates advises and assists clients with research, legal, tax and compliance issues across China, Asia and the Belt & Road. For assistance please email us at china@dezshira.com or visit us at www.dezshira.com