After The Coronavirus: The Asian Belt & Road Initiative Economic Recovery 2020-2021

Emerging Central & South Asian Economies May Offer Production Respite For Impacted Western Manufacturers

Op/Ed by Chris Devonshire-Ellis

The Asian Development Bank have released a report on the predicted state of Asian economies during the Covid-19 impact and post Coronavirus. The Asia Development Banks largest five shareholders are the United States (15.6% of total shares), Japan (the same), China (6.4%), India (6.3%), and Australia (5.8%). We have extrapolated the data as concerns China’s Belt & Road Initiative in Asia and provide a breakdown on this sector as follows:

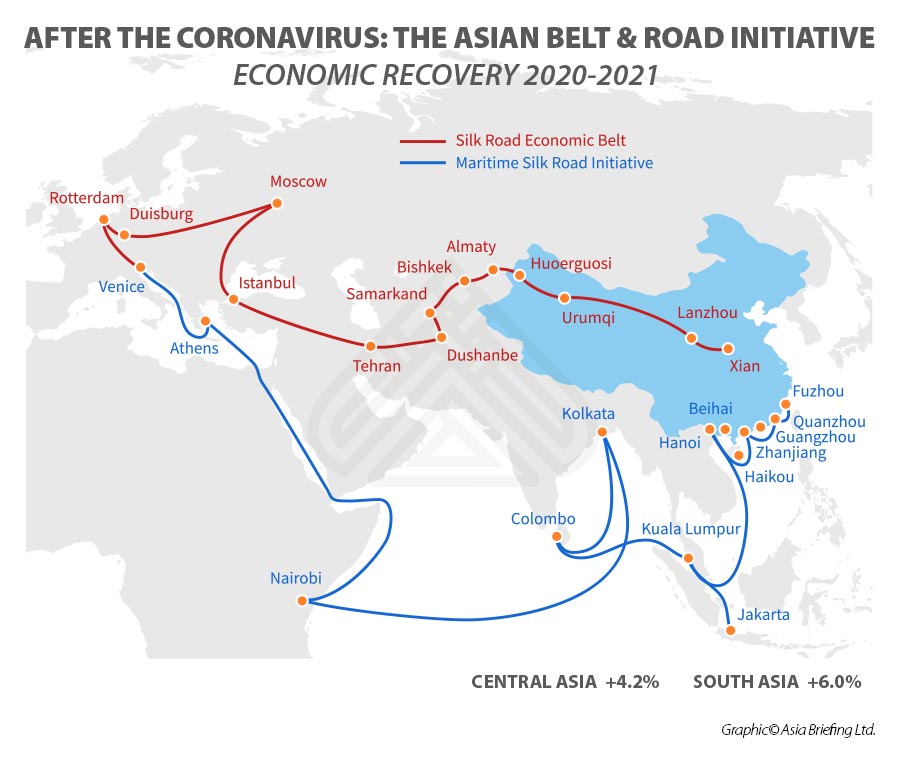

The Road

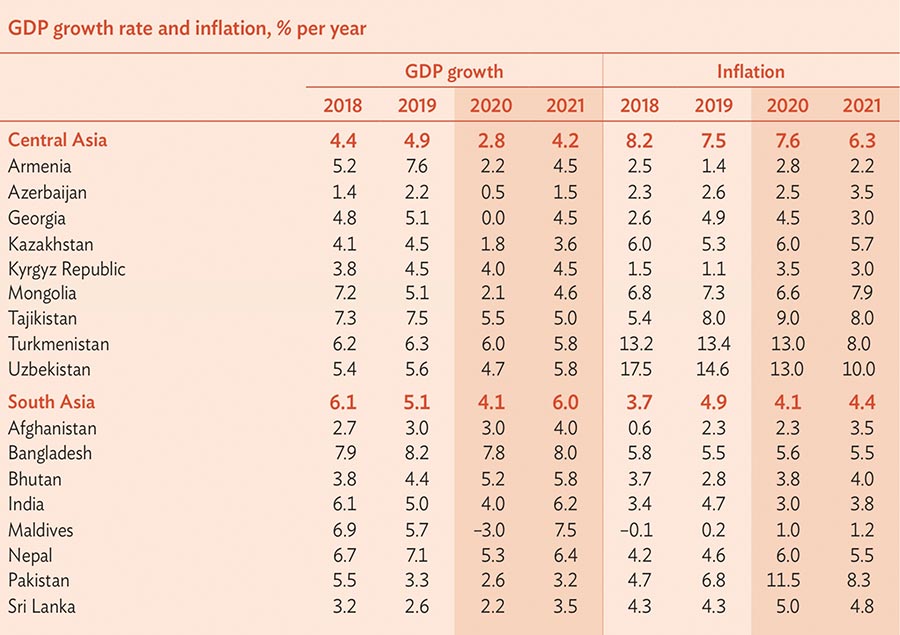

Concerning Central Asia, and the “Road” section of China’s Belt & Road Initiative, ADB predict that Central Asia will decelerate under COVID-19 after steady acceleration in recent years. Growth in the region will drop to 2.8% in 2020 as economies falter worldwide and drag down global commodity prices.

Lower petroleum prices and sluggish production will weaken oil exporters, with growth slowing to 0.5% in Azerbaijan and 1.8% in Kazakhstan, the largest economy in Central Asia, slowed as well as by reduced public investment. Fiscal consolidation and lower remittances from Russia will weaken growth in Tajikistan. Similarly, growth in Mongolia will decline this year as FDI inflow ebbs but will climb next year as mining and investment pick up.

Georgia’s highly tourism- and trade-dependent economy will be particularly vulnerable to COVID-19 as closed borders and monetary tightening grind growth to a halt in 2020. Growth in Armenia, a metal producer notable for its sales to China, will fall sharply this year, however slower mineral exports to the PRC will slow growth less dramatically in Kyrgyzstan and Uzbekistan. Regional inflation at 7.6% this year will be little changed as mixed projections balance out. Monetary tightening is expected to lower inflation in Georgia, Kazakhstan and Uzbekistan in 2021.

The Maritime Belt

South Asia will face a milder slowdown. Regional growth will decelerate to 4.1% in 2020 and then recover to 6.0% in 2021, largely tracking the trend in the dominant Indian economy. GDP performance will remain strong in Bangladesh, which is forecast to grow by 7.8% this year even as global demand pulls back, and continue to accelerate in Bhutan both this year and next as a new 5-year plan strengthens government spending, and despite lower tourist arrivals.

The Maldives and Sri Lanka are less sheltered from global efforts to limit the spread of COVID-19, which are forecast to cause the tourism-dominated economy of Maldives to contract by 3.0% in 2020 before surging back in 2021. Leaving aside external upheaval, growth in Pakistan will slow as agriculture stagnates, notably affecting cotton output, and as stabilization efforts constrain domestic demand. The intended correction of macroeconomic imbalances in Pakistan should restore confidence in the economy and bring later benefits.

Regional inflation will soften to 4.1% in 2020 as food inflation eases in India with improved agriculture. Unusually low inflation will continue in Maldives with subsidies and price controls on basic goods joined by anticipated deterioration in demand. Pakistan, by contrast, will struggle this year with double-digit inflation fueled by escalating food prices, scheduled hikes to utility rates, and domestic currency depreciation.

The full predicted economic scenario for Central Asia, the Caucasus and South Asia can be seen as follows:

For the situation as concerns the ASEAN countries of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam please refer to today’s ASEAN Briefing article Growth In Emerging Asia To Rebound In 2021.

For the situation in China and the manufacturing impact of Covid-19 on the rest of the world, please refer to today’s China Briefing article China To Recover Production In 2021 As US & EU Face Sluggish Covid-19 Rebound.

Overall however the regional position is positive. Central Asian GDP growth is expected to rebound to 4.2% in 2021 after 2020’s decline, with Turkmenistan and Uzbekistan showing higher than normal growth rates. Turkmenistan’s anticipated growth comes on the back of increased Belt & Road influenced trade through to Azerbaijan, while Uzbekistan’s programme of economic reforms and opening up of its economy are also thought likely to stimulate demand.

It is an even better picture in South Asia, where nearly all economies are expected to rebound to pre-Coronavirus levels. There are numerous implications for foreign manufacturers, and especially those in the European Union and United States, whose own economies are predicted to endure significant damage due to the pandemic. Bankruptcies, debt, unemployment and a lack of re-financing capacity are all likely – and expected to impact the EU and United States. Fitch ratings has both entering recession this year (if not already in one) and an immediate move into negative growth. Money supply will inevitably tighten and businesses will start to lose productive staff.

Central and South Asia and China

In emerging Asia, it is a different story. Many of these countries are members of China’s Belt & Road Initiative, with preferential trade terms. Most of them are also involved in significant project financing and infrastructure build. Many of them have Double Tax Treaties with China, including Armenia, Azerbaijan, Kazakhstan, Kyrgyzstan, Mongolia, Tajikistan, Turkmenistan and Uzbekistan in Central Asia, as does the regional powerhouse of Russia. In South Asia, DTA between China and Bangladesh, Maldives, Nepal, Pakistan and Sri Lanka are all in place. All of the ASEAN nations, including Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam have China DTA. This reduces profits taxes and lowers withholding taxes for services when doing business between these countries and China.

In addition to this, China has a Free Trade Agreement with all of the ASEAN nations, and has signed off a non-specific FTA with the Eurasian Economic Union (EAEU). Details on which products are to be included in this are still being negotiated, however the EAEU also includes Armenia, Kazakhstan, Krygyzstan and Russia.

Meanwhile, minimum wages throughout Central and South Asia are also attractive.

| Country | Available Workforce (millions of people) | Minimum Wage (USD) | Individual Income Tax Rates (Percentage of salary) |

|---|---|---|---|

| Afghanistan | 14.5 | 779 | 20 |

| Armenia | 13.8 | 140 | 20-23 |

| Azerbaijan | 5.07 | 146 | 14-25 |

| Bangladesh | 69.7 | 19-95 | 0-30 |

| Bhutan | 0.38 | 58 | 25 |

| Cambodia | 9.23 | 182 | 20 |

| Georgia | 2.01 | 120 | 20 |

| Indonesia | 133.56 | 121-303 | 5-30 |

| Kazakhstan | 9.26 | 78 | 10 |

| Kyrgyzstan | 2.65 | 14 | 10 |

| Laos | 3.80 | 100 | 0-24 |

| Malaysia | 15.28 | 224 | 0-30 |

| Maldives | 0.278 | 242 | 0-15 |

| Mongolia | 1.27 | 155 | 20 |

| Myanmar | 24.74 | 63 | 30-35 |

| Nepal | 10.35 | 129 | 1-36 |

| Pakistan | 1 | 0-35 | 57.2 |

| Philippines | 45.4 | 230 | 0-35 |

| Russia | 76.3 | 195 | 13 |

| Sri Lanka | 8.64 | 71 | 4-24 |

| Tajikistan | 3.4 | 31 | 13 |

| Thailand | 38.91 | 253 | 0-25 |

| Turkmenistan | 2.67 | 156 | 10 |

| Uzbekistan | 15.55 | 35 | 12 |

| Vietnam | 53.7 | 127 | 20-35 |

Low wage overheads, cheap land, improving infrastructure and economies less exposed to debt financing means that should manufacturing, production capability and money supply be limited in the EU and United States, the Central and South Asian alternatives may well be worth considering. Bean counters looking for alternatives in Asia might do well to consider looking further afield for up-coming manufacturing hot spots in order to help kick-start Western economies looking at enduring a sharp, immediate shock. Getting the intelligence in place to begin the process is an advisable step forward.

Related Reading

- How China Added Another 1.4 Billion Low-Cost, Offshore Workers to its Production Capacity

- Corporate Income, Withholding, & VAT Tax Rates In Countries Along China’s Belt & Road Initiative

About Us

Silk Road Briefing is written by Dezan Shira & Associates. The firm provides strategic analysis, legal, tax and operational advisory services across Eurasia and has done since 1992. We maintain 28 offices throughout the region and assist foreign governments and MNC’s develop regional strategies in addition to foreign investment advice for investors throughout Asia. Please contact us at asia@dezshira.com or visit us at www.dezshira.com